The net asset value (NAV) of the 21Shares Ripple XRP ETP (AXRP) currently stands at $16.45, with assets under management valued at $50.4 million amid strong investor confidence.

The 21Shares XRP exchange-traded product (ETP) has continued to command investor interest over four years after its inception in April 2019. The Crypto Basic spotlighted the investment vehicle in a report three days ago, aiming to debunk claims surrounding it.

Misconception Around the XRP ETP

Recall that the XRP community came across an XRP ETP on the official Fidelity Investments platform earlier this week. Subsequent reports suggested that the investment product was launched by Fidelity, given its presence on their platform.

However, these reports were inaccurate, as the ETP on the platform was actually the 21Shares Ripple XRP ETP, formerly the Amun XRP ETP. Data confirms that the product has continued to track XRP’s performance since April 2019, being 100% backed by physical XRP.

The product aims to grant investors exposure to XRP in a regulated and secure environment. As a result, it has continued to attract interest from market participants seeking to leverage the potential of the sixth-largest cryptocurrency by market cap.

The Product Data

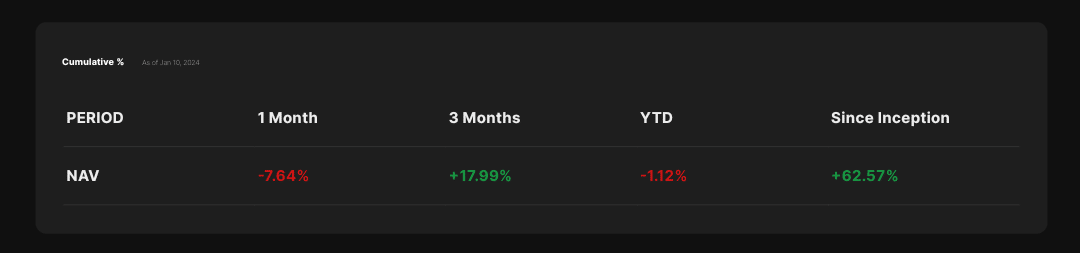

A look at the official 21Shares platform reveals some interesting data connected to the investment product. Notably, its assets under management (AUM), representing the total market value of all the assets it holds, currently stands at $50,431,801 ($50.43 million).

In addition, the number of its outstanding securities is 3,065,000. For the uninitiated, the outstanding securities metric refers to the total number of shares or units of the 21Shares XRP ETP that are currently available or in circulation.

– Advertisement –

While the authorized participants can create or redeem the number of outstanding securities of the ETP, the value of its AUM is influenced by XRP’s price movements. The AUM can also increase or decrease when authorized participants create or redeem shares of the ETP.

Furthermore, the product’s NAV, representing the value of one share of the ETP, currently stands at $16.45. This figure is obtained by dividing the assets under management by the number of outstanding securities.

The 21Shares XRP ETP Outperforms the S&P 500

Interestingly, with the outstanding securities being constant, XRP’s surge in value also directly affects the ETP’s NAV. Data shows that, due to its direct correlation with XRP, the NAV of the product has increased 62% since its inception in 2019.

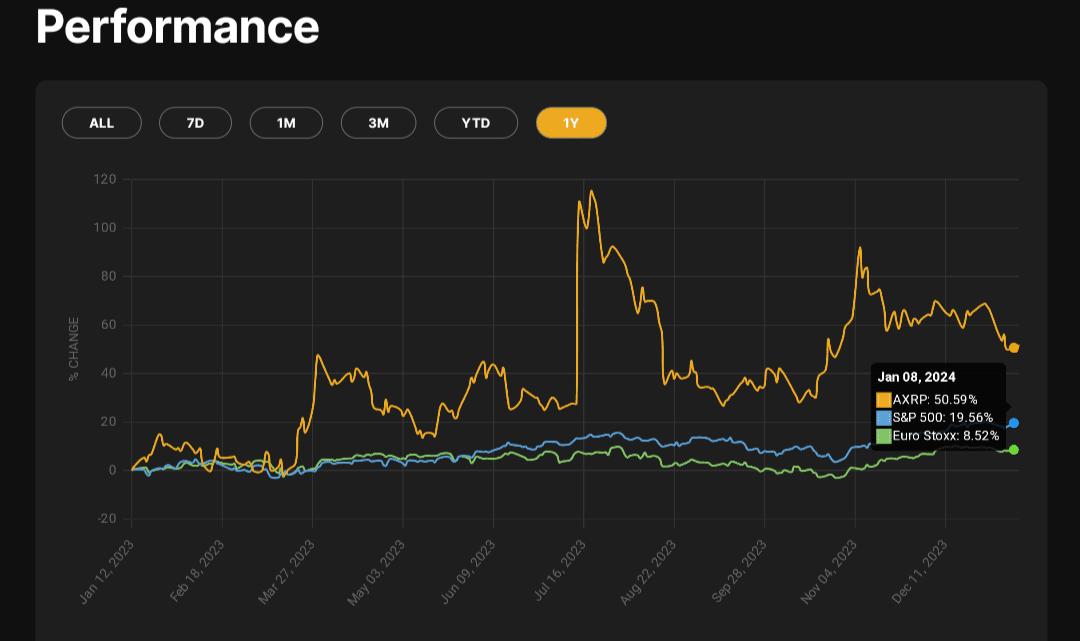

Moreover, data from Jan. 8 confirms that the product has outperformed top conventional indexes such as the S&P 500 and the Euro Stoxx over the past year.

Notably, the S&P 500 has increased 19.56% while the Euro Stoxx is up 8.52% in the last year. However, the 21Shares XRP ETP has rallied 50.59% within the same timeframe.

Amid the success of the ETP, calls have emerged for a U.S. asset manager to turn to an XRP ETF in the country. The asset’s legal clarity also supports this notion. In a CNBC interview this week, Valkyrie’s CIO asserted that the U.S. could see an XRP ETF following the approval of a spot BTC ETF.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2024/01/11/the-nav-of-21shares-xrp-etp-has-increased-62-to-16-45/?utm_source=rss&utm_medium=rss&utm_campaign=the-nav-of-21shares-xrp-etp-has-increased-62-to-16-45