Ripple announced its new partnership with FOMO Pay payments institution that will use its On-Demand Liquidity (ODL) to improve its cross-border treasury flows.

Ripple and partnership with FOMO Pay for On-Demand Liquidity (ODL)

A new partnership for Ripple and its On-Demand Liquidity (ODL) service today involves the Singapore-based payments institution FOMO Pay.

??We’re partnering with FOMO Pay, the Singapore-based payments institution, to improve its cross-border treasury flows using #ODL!

This will allow FOMO Pay to achieve affordable and instant settlement in EUR and USD globally.

Learn more: https://t.co/NFOUvQZgNE— Ripple (@Ripple) July 26, 2022

“We’re partnering with FOMO Pay, the Singapore-based payments institution, to improve its cross-border treasury flows using ODL! This will allow FOMO Pay to achieve affordable and instant settlement in EUR and USD globally”.

Essentially, FOMO Pay will be using Ripple’s crypto-enabled enterprise technology to improve its cross-border treasury flows.

Indeed, by leveraging ODL for treasury payments, FOMO Pay is able to gain 24/7, year-round access to liquidity for EUR and USD, something that previously required a 1-2 day waiting time before funds reached the destination accounts.

Not only that, Ripple’s ODL formula for treasury payments facilitates PSPs (payment service providers) such as FOMO Pay in improving internal corporate cash flows, enabling them to reduce business costs and improve operations.

Ripple and its ODL service leveraging XRP

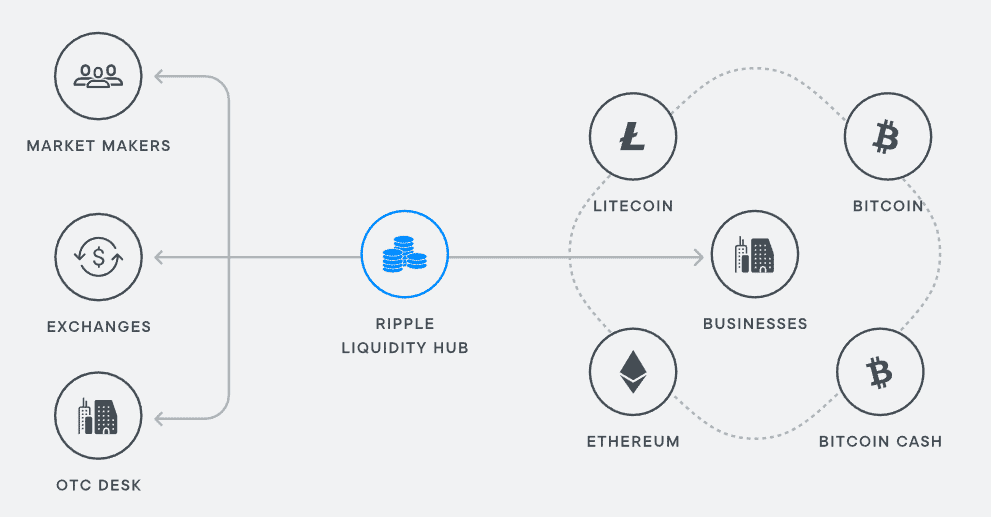

Through its ODL service, Ripple can offer the opportunity for its partners to leverage XRP, the digital asset built for payments, as a bridge between two fiat currencies, enabling instant and low-cost settlement without the need to hold pre-funded capital in a target market.

In this regard, Louis Liu, founder and CEO of FOMO Pay said:

“As one of the leading payment institutions in Singapore, FOMO Pay aims to provide our clients with more efficient and cost-effective payment modes in different currencies. We are excited to partner with Ripple to leverage On-Demand Liquidity for treasury management, which allows us to achieve affordable and instant settlement in EUR and USD globally”.

Brooks Entwistle, SVP and Managing Director of Ripple also released his thoughts on the matter:

“With the Asia Pacific region teeming with opportunities to solve existing silos and inefficiencies with payments, we’re seeing many forward-looking financial institutions clamoring for the next evolution of payment infrastructures – and notably based on crypto and blockchain technologies. This is why we are so excited to launch this crypto-enabled treasury management use case for ODL with innovative customers like FOMO Pay”.

The future of payments

Since its debut in the crypto and banking markets, Ripple, which is based on a DLT rather than a blockchain, would like to become the future of payments.

In this respect, Ripple manages to save a considerable amount of energy, as transaction verification is controlled by a few validator nodes (as opposed to public blockchains, which are trustless instead), incurring negligible network fees.

With this advantage alone compared to Ethereum for example, Ripple’s DLT has been able to establish itself primarily in the cross-border transfer market.

However, as far as assessing the degree of decentralization of the network is concerned, Ripple is certainly standing outside the blockchain and crypto realm.

Source: https://en.cryptonomist.ch/2022/07/26/ripple-to-partner-with-fomo-pay-for-cross-border-treasury-flows/