- Key Point 1

- Key Point 2

- Key Point 3

The “Genius Stablecoin Act: UNCHAINED” places Tether under U.S. jurisdiction, altering its operational landscape.

This legal shift impacts Tether’s operations and may affect the broader crypto market’s regulatory environment.

Tether Faces New Compliance Under U.S. Law

Under the “Genius Stablecoin Act: UNCHAINED,” Tether is now bound by U.S. jurisdiction regardless of its physical location, as reported by ChainCatcher and Zoomer. Legal implications may arise from this jurisdictional change as Tether adapts to increased regulatory scrutiny.

Market participants are analyzing the implications on Tether’s operations and the potential compliance requirements it may face. The enactment of this legislation signifies a broadening scope of U.S. regulatory influence over stablecoins. The news has heightened interests and concerns among investors.

“42% of investors plan to maintain their current investment pace over the next four months, with 27% expecting to increase their activity,” according to the ChainCatcher Team, Research Report Author, ChainCatcher.

Industry experts express caution about the potential impact on Tether. However, there is no official statement from Tether’s team yet. Regulatory compliance and market stability remain top priorities for stakeholders across the crypto space. The market observes Tether’s response to these developments.

Stablecoin Market Dynamics in Light of New Legislation

Did you know? The U.S. government has previously exerted its influence over global financial entities, as seen in its long-standing role in global banking regulations. This move aligns with a historical trend of expanding jurisdictional reach over emerging financial technologies.

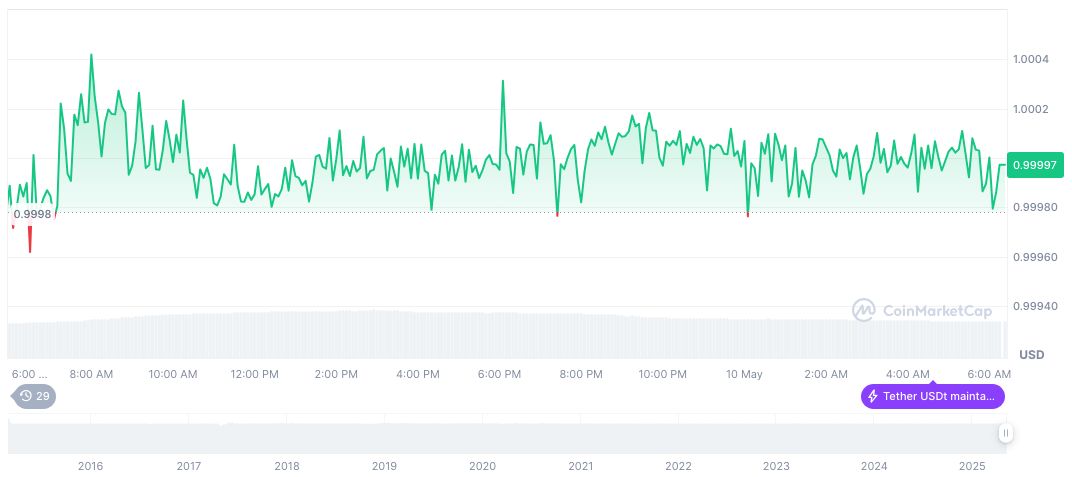

According to CoinMarketCap, Tether (USDT) maintains a stable price of $1.00 amid substantial market activity. With a market cap of formatNumber(149823138651, 2) and a 24-hour trading volume of approximately formatNumber(80289919814, 2), Tether’s impact on the market remains robust, despite a minor 0.04% price drop over the last 24 hours.

The Coincu research team identifies potential regulatory challenges and enhanced compliance demands resulting from the U.S. jurisdictional claim. Historical data suggests stablecoins often influence market stability; thus, policymakers must find a balanced approach to regulation. Observers anticipate further clarifications may drive technological and financial adaptations.

Source: https://coincu.com/336865-us-law-impacts-tether-jurisdiction/