MakerDAO, the governance token behind the fifth most popular stablecoin DAI, is contemplating an increase in its United States Treasury bond investments to $1.25 billion from its previous allocation of $500 million.

According to a proposal released March 6, the move would allow MakerDAO to capitalize on the current yield environment.

Under the new plan, the existing $500 million allocation – consisting of $400 million in Treasury bonds and $100 million in corporate bonds – would significantly increase by $750 million.

MakerDAO intends to achieve this by implementing a six-month U.S. Treasury ladder strategy, which would involve bi-weekly roll-overs.

The latest proposal comes on the heels of several high-profile moves by MakerDAO, including a recent initiative that would permit MKR token holders to borrow DAI.

MakerDAO is reviewing a proposal to extend its existing US treasury bond investments from $500 million to $1.25 billion. pic.twitter.com/DZj72oTJvP

— Maker (@MakerDAO) March 7, 2023

In June 2022, MakerDAO made announcement of a $500 million allocation to Treasury funds. This time, the rationale behind the decision has been explicitly stated as follows:

“ [to] take advantage of the current yield environment, and generate further revenue on Maker’s PSM Assets, in a flexible, liquid, manner that can accommodate material adjustments and upgrades as may be required under prevailing, relevant Maker RWA related policies.”

MakerDAO movements

In other news, MakerDAO — 44% of which is controlled by only 3 wallets – recently voted against a $100 million borrowing proposal by Cogent Bank, with 73% rejecting the bid.

Interestingly, MakerDAO previously approved a similar loan to Huntingdon Valley Bank, suggesting a willingness to work with more traditional financial institutions on the part of the DAI governance token.

The stablecoin market has also seen a boom in the wake of the FTX collapse. After FTX filed for bankruptcy on November 11th, the stablecoin sector’s dominance in the overall cryptocurrency market capitalization rose to 18%, reaching an all-time high, a trend that has continued.

Meanwhile, last month, MakerDAO allocated 5 million DAI to establish a legal defense fund that would address legal defense matters not typically covered by conventional insurance policies, and also introduced Spark Protocol, an Aave rival that will utilize DAI for liquidity and launch a lending product as its initial service.

Additionally, it initiated conversations regarding a proposal that would allow DAI to borrow from MKR tokens, a move that has prompted some to wonder whether this borders too much into the same risky behavior that led to the collapse of UST, the stablecoin backed by Terra Luna.

Critics of Maker’s ‘Endgame’ tokenomics argue that it appears too similar to Terra’s Seigniorage Mechanism, a process that entails producing and eliminating tokens in accordance with market demand.

However, opponents of the plan immediately criticized this mechanism, branding it a probable liquidity exit scam that permits users to depart from the ecosystem through DAI without disposing of their MKR tokens but still maintaining control over the protocol’s governance.

Hmm looks a lot like backing $UST with its governance token $LUNA.

Did @stablekwon secretly infiltrate @MakerDAO? https://t.co/3u6NzOMkPK

— Arthur Hayes (@CryptoHayes) February 24, 2023

Maker doubles down on move

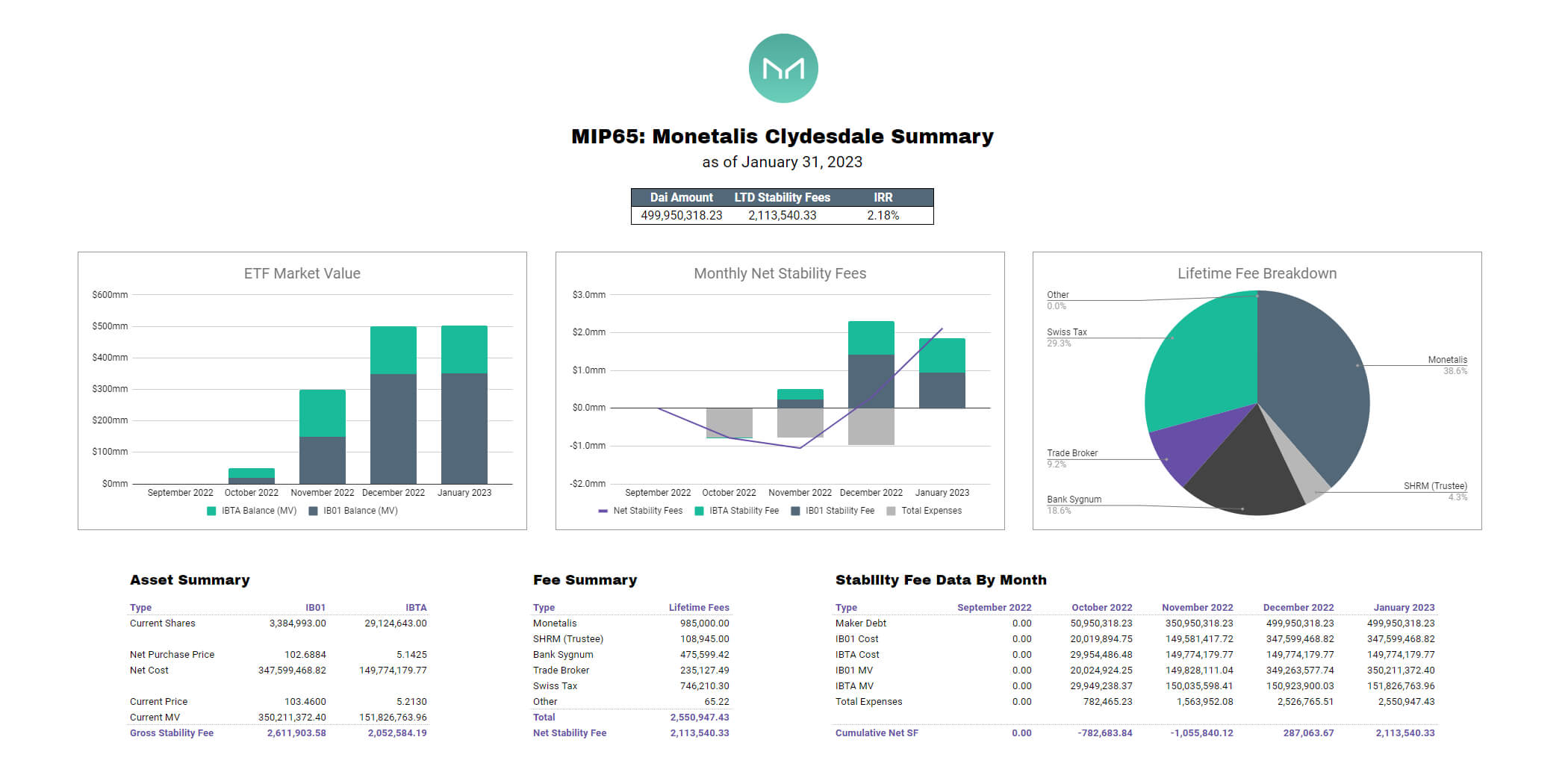

In a tweet, MakerDAO said that by the end of January 2023, “MIP65’s $500 million short-term bond investment strategy has provided ~$2.1 million in lifetime fees to MakerDAO.”

This investment strategy currently represents more than 50% of MakerDAO’s annualized revenues, the Dao added.

As of today, MIP65’s current portfolio is composed of:

• ~$351.4 million of IB01: iShares $ Treasury Bond 0-1 yr UCITS ETF

• ~$150.6 million of IBTA: iShares $ Treasury Bond 1-3 yr UCITS ETF

Source: https://cryptoslate.com/makerdao-faces-criticism-over-tokenomics-plan-amidst-high-stakes-us-treasury-investment-strategy/