Each year, we see that thousands of new crypto protocols are designed in a bid to challenge existing DeFi giants like Uniswap, Aave or Curve. However, merely a few of them succeed.

Capricorn.Finance, an upstart decentralized exchange (DEX) rolled out by Gringotts Labs, saw enormous growth within 2 weeks after being deployed on the Cube Chain Testnet. Before its deployment, the project was seen as the favorite to challenge Uniswap and Pancakeswap, and now it is emerging as a come-from-behind story.

What is Capricorn?

Capricorn is an automated market maker (AMM) based decentralized exchange (DEX) for Cube Blockchain, which is dedicated to building a robust, efficient, and highly-liquid market with governance token CORN. It will offer all Cube Chain users frictionless and efficient high-end trading experiences and sustainable returns.

In many ways, Capricorn.Finance reminds crypto users of Pancakeswap, the BSC-based, third-largest decentralized exchange in crypto world.

Like Pancakeswap, Capricorn adopts an automated market maker (AMM) model, which allows users to trade their CRC-20 tokens against a liquidity pool funded by users who deposit crypto assets and LP token to earn Capricorn’s governance token CORN.

This arrangement was similar to that of most peer-to-peer exchanges which popped up from 2020 to 2022, offering big “yields” to get users to become liquidity providers and the chance to govern the platform. However, many things have furthered Capricorn.Finance’s use cases, such as huge liquidity, better on-chain experiences, high security, and newer products like Garden and Greenhouse.

Market pundits attribute Capricorn’s meteoric growth to the comprehensive support from Ivy Blocks. As of now, Capricorn has secured $300 million in liquidity investments led by Ivy Blocks.

As the independent asset management firm founded by Huobi Global, Ivy Blocks manages billions of dollars in crypto assets and is actively expanding its presence. As one of the favorites of top institutional investors, Ivy Blocks will give comprehensive support for the rising DEX star. For Capricorn, tricky technical or operational problems that plague normal projects are quite easy to resolve, and its true potential has so far been largely untapped.

With CORN being a CRC-20 token used on Cube Chain, one of the most popular blockchain network, Capricorn.Finance allows users to enjoy fast transactions and fees that trump those on BSC, while providing users and stakeholder frictionless and efficient trading experiences and sustainable returns.

Aside from liquidity advantages and a better trading and staking experience, newer products like Garden and Greenhouse have furthered Capricorn.Finance’s use cases.

In Garden, CORN holders could stake CORN to earn other tokens with higher interest than any other DEXs, which is quite attractive for investors. With Greenhouse, the IFO platform set to be launched soon, Capricorn is also expected to be the new transmitting station of Unicorn projects. This will hopefully attract a number of Unicorn projects at the initial stage and result in the most earnings.

In 2021, we saw more than $14 billion lost to cryptocurrency related crimes, as well as many growing projects like Poly Network that suffered heavy losses from such crimes. Crypto asset security was given top priority by most of emerging projects, and Capricorn.Finance has gone above and beyond to be audited by prominent blockchain security firm Armors. Combined with open and safe smart contract, users have been most satisfied with the security offered by Capricorn.

Within two weeks, Capricorn hit it big in both the social media and product sides. As of now, Capricorn has accrued about 80,000 followers on all social media platforms, 34,000 user wallets and 300,000 transactions, and has received over 3,000 bug reports from active users. Evidently Capricorn is being the new favorite among DEX users.

While the overall crypto market is falling into a bearish market sentiment, Capricorn bucked the trend and was chosen by both institutional and regular investors. After Uniswap and Pancake, will Capricorn take over as the next leading DEX? With its official launch on Cube Chain Mainnet coming closer, the market will see what Capricorn is about to bring.

Basic Information

Token: Capricorn Token (CORN)

Chain: Cube Chain (CRC-20)

Initial Supply: 50,000,000

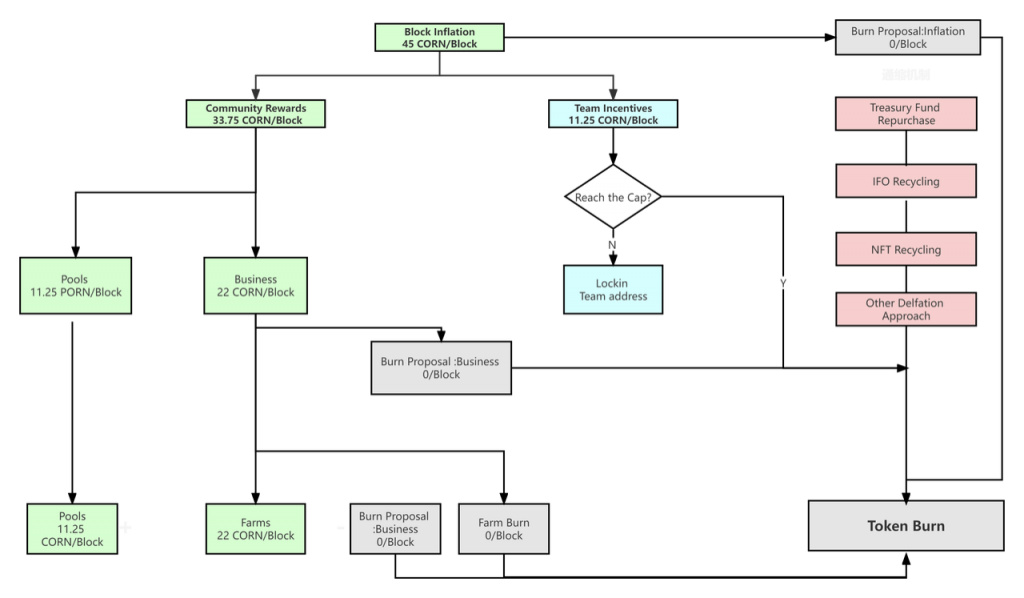

Initial Inflation Rate: 45 CORN / Block

Distributions

- Inflation Minting Distribution

Burn

All recycled tokens go to a specified address and the whole process is transparent. The operations team will regularly burn the recycled tokens and transfer to the black hole address.

Recycling method:

- Treasury Fund Repurchase: 0.03% of the trading fee is kept in a Treasury Address, and the operations team can repurchase the trading fee according to the actual market needs.

- IFO Recycling: In case of future IFO, the collected LP will be disassembled and the CORN part will be recycled.

- NFT recycling: The user pays CORN to establish his own NFT Profile to unlock the Referral Program, Team Battle and other functions.

- Other functions: Reclaim CORN from other services.

Was this writing helpful?

Source: https://coinpedia.org/press-release/how-capricorn-finance-became-the-new-favorite-among-vcs-dex-users/