The asset management firm’s $380 million OnChain U.S. Government Money Fund commands nearly a third of the tokenized Treasuries sector.

Franklin Templeton, the asset management behemoth with over $1.4 trillion in AUM, has launched peer-to-peer transfers for its OnChain U.S. Government Money Fund (BENJI), enabling investors in the fund to transfer their shares to each other.

“Eventually, we hope for assets built on blockchain rails to work seamlessly with the rest of the digital asset ecosystem,” said Roger Bayston, Head of Digital Assets at Franklin Templeton, in a press release.

Launched in 2021, BENJI was the first U.S. mutual fund to use a public blockchain – Stellar – to record transactions and track ownership. Each BENJI token represents a share in the liquid fund, which trades on the Nasdaq exchange under the FOBXX ticker and invests in short-term government securities that currently offer a 5% yield, roughly.

“Allowing fund shares to be transferred peer-to-peer puts Franklin Templeton on the cutting edge of the financial sector where tokenized real-world assets are an industry staple and more open, transparent, and accessible,” Stellar Development Foundation Chief Business Officer Jason Chlipala told The Defiant via email.

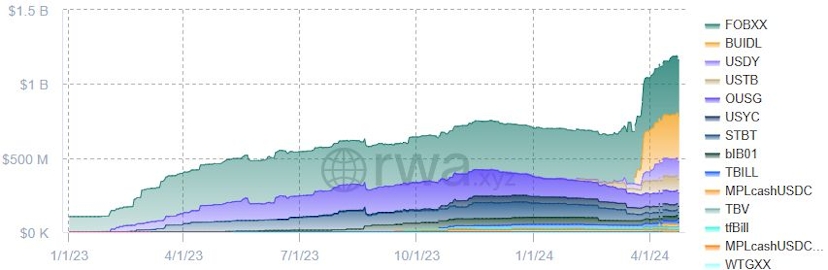

With a market capitalization of $380 million, BENJI leads the tokenized Treasuries sector, but the ongoing real-world asset (RWA) boom has seen it lose some market share to newer competitors like Blackrock’s BUIDL, which has amassed over $300 million of assets since launching on Ethereum just over a month ago. BUIDL cannot be transferred among holders.

Investors can access the fund through Franklin Templeton’s Benji digital assets platform, which requires users to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) formalities.

With U.S. benchmark interest rates at two-decade highs, RWAs have been a prevailing narrative in DeFi for the past year. The tokenized Treasuries sector has grown to nearly $1.2 billion as of April 25 – up 67% since Jan. 1, according to rwa.xyz.

Source: https://thedefiant.io/news/defi/franklin-templeton-enables-p2p-transfers-for-benji-fund