Key Points:

- BlackRock, Fidelity, ProShares, and 21Shares lead, with $1.76B this week alone.

- Last week’s $2.7B inflow propels total assets, trading volume peaks at $43B.

- BlackRock’s IBIT ETF records $1B daily inflow, assets surpass $15B milestone.

Digital asset ETFs/ETPs – crypto funds managed by industry giants like BlackRock, Fidelity, ProShares, and 21Shares have shattered 2021’s yearly inflow record.

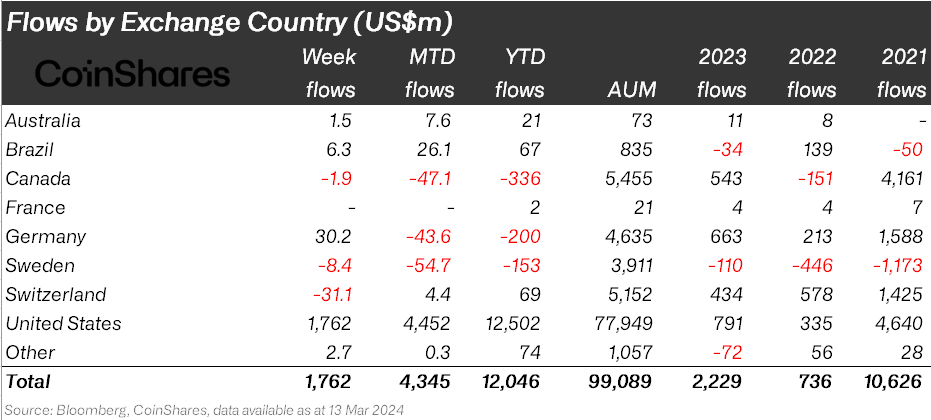

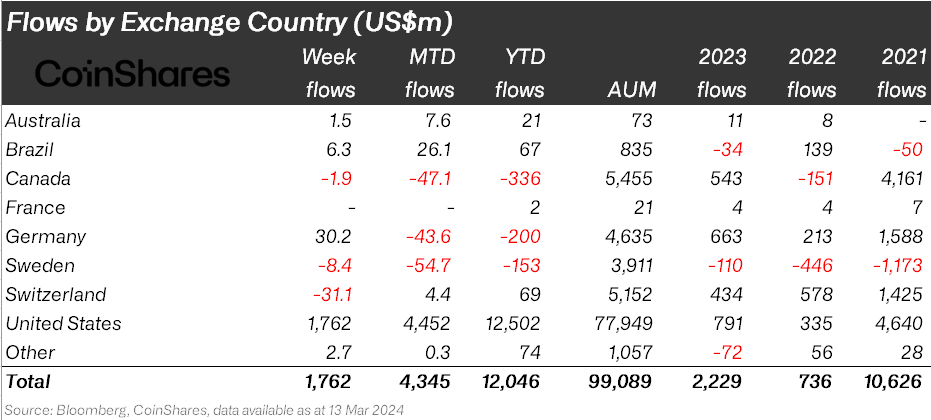

CoinShares reports an astonishing $12 billion worth of global inflows within the first three months of this year, surpassing the entire inflow for 2021.

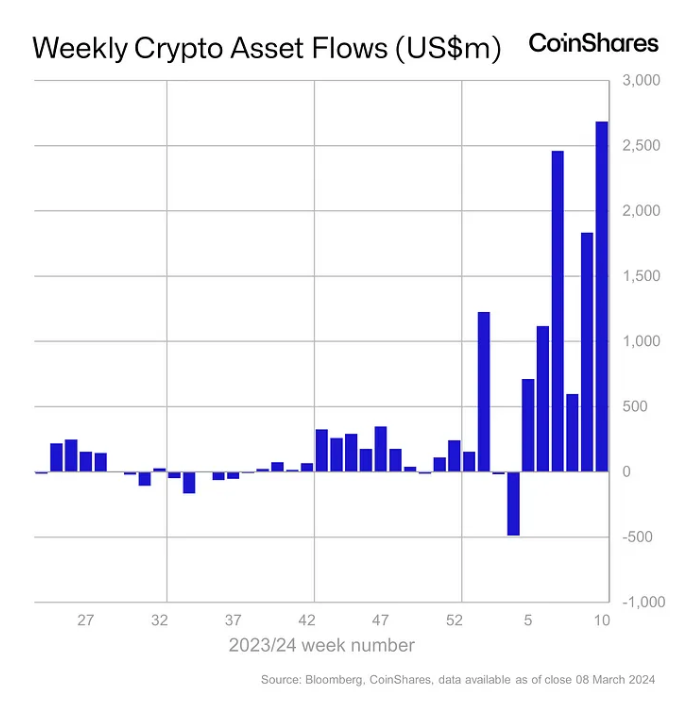

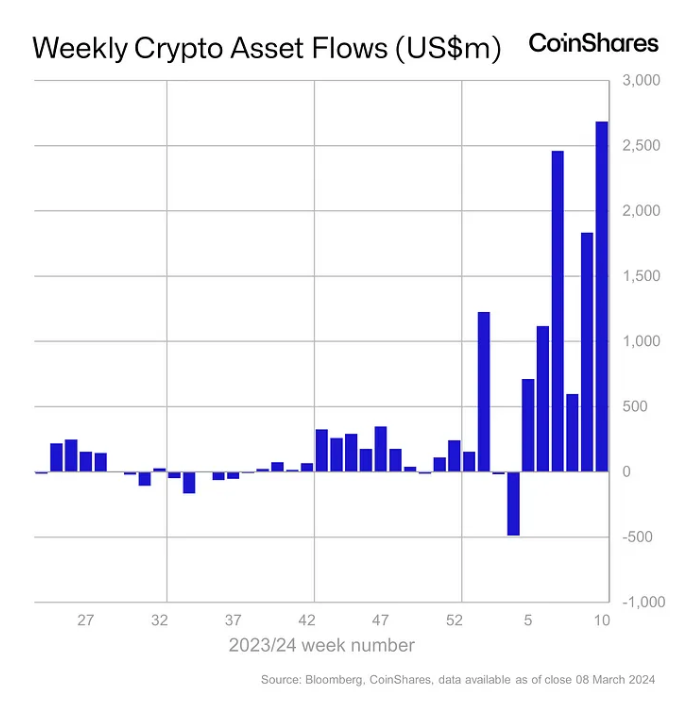

This week’s influx of $1.76 billion into global crypto exchange-traded funds (ETFs) and exchange-traded products (ETPs) marked a pivotal moment, breaking records predominantly influenced by substantial inflows from new spot bitcoin ETFs in the United States.

James Butterfill, CoinShares Head of Research, highlighted the unprecedented success of Digital Assets ETFs/ETPs, noting a staggering year-to-date inflow of $12 billion compared to $10.6 billion for the entire year of 2021.

The crypto investment landscape witnessed a remarkable surge, with last week alone contributing nearly $2.7 billion in inflows, pushing the total for 2024 to $10.3 billion even before this week’s influx. This surge also led to a record-breaking trading volume of $43 billion, almost 50% higher than the previous peak of $30 billion just the week before.

Readmore: Popular Bitcoin ETFs: Exploring the Pros and Cons

Global Crypto Funds Hit $100B AUM Milestone!

Coupled with recent price gains in the crypto market, these inflows have propelled total assets under management at these funds to a historic high, nearing the $100 billion mark.

Notably, U.S.-based crypto investment products dominated this week, accounting for 100% of the inflows, with spot bitcoin ETFs leading the charge. U.S. spot bitcoin ETFs contributed over 88%, or $1.55 billion, of the week’s total inflows. BlackRock’s IBIT ETF, in particular, made a significant impact, registering a daily net inflow record of $1 billion on Tuesday, propelling its assets under management beyond $15 billion for the first time.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 12 times, 12 visit(s) today

Source: https://coincu.com/250670-digital-asset-etfs-etps-have-seen-12-billion/