- Solana saw a bearish shift in the 12-hour market structure

- The liquidation heatmap highlighted how deep the retracement might reach

Solana [SOL] faced some selling pressure at the $118 area over the past week. This saw the market structure shift bearishly as the price action entered a phase of lower highs and lower lows.

AMBCrypto sought to explore where the buyers could attempt to reverse the recent bearish pressure.

In other news, the Total Value Locked (TVL) of Solana reached a high not seen since June 2022. The volume was also high according to data from DefiLlama.

The price action showed a bearish bias

Source: SOL/USDT on TradingView

The higher low at $103.4 was set on the 12th of February. At that point, the market structure was bullish, and SOL reached a new local high at $118.69. Since then, the price has receded.

The OBV also fell alongside it. The buyers were unable to hold on to the support they established midway through February.

The increased selling volume and the market structure shift were also seen on the daily RSI. The momentum indicator fell below neutral 50 to signal a change away from the bullish pressure of the past month.

The Fibonacci retracement levels (pale yellow) showed that the 61.8% level at $94.16 was likely to serve as support in case SOL descends further. Below it, the 78.6% level at $87.49 is also an area of interest for longer-term buyers.

AMBCrypto expects that a retest of either of these levels will be followed by a rally to the 61.8% extension level at $143 in the coming weeks. The psychological $150 level might also be retested.

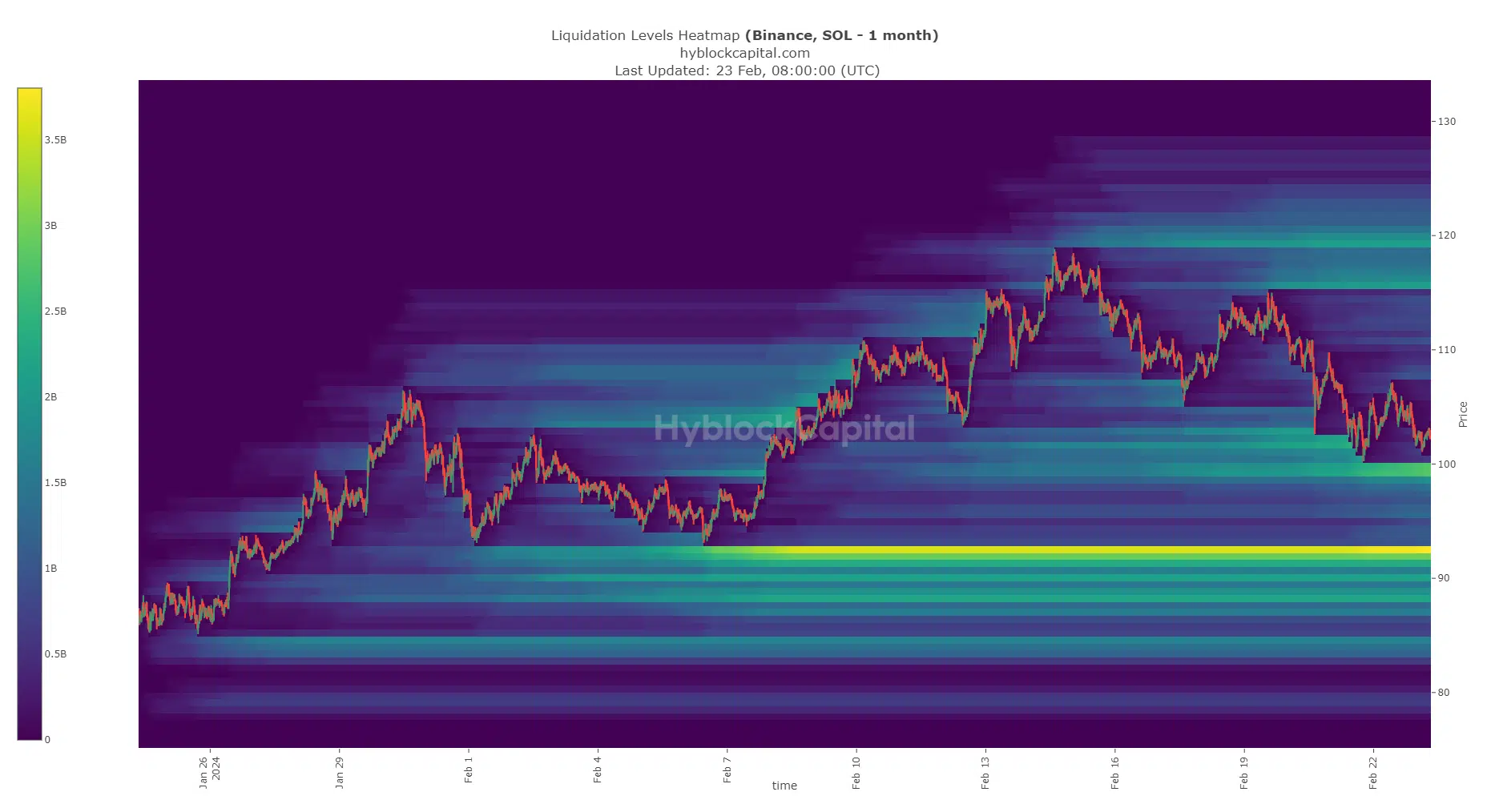

The Solana heatmap supports the idea of a deeper retracement

Source: Hyblock

The $98.6-$100 region was estimated to have $2 billion to $2.6 billion in liquidations. Further south, the $92.5 level was highlighted with liquidations amounting to $3.6 billion. This meant that Solana prices were likely to be attracted toward these regions in the coming days or weeks.

Is your portfolio green? Check the Solana Profit Calculator

A fall to the $87-$92 area appeared unlikely. Yet, traders must be prepared for a move as far south as $88, especially if SOL spirals below the $94 support level.

This would likely offer a good buying opportunity, as the liquidity at the $115-$120 region would be the next target after such a drop.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Source: https://ambcrypto.com/88-or-140-where-will-solana-head-next/