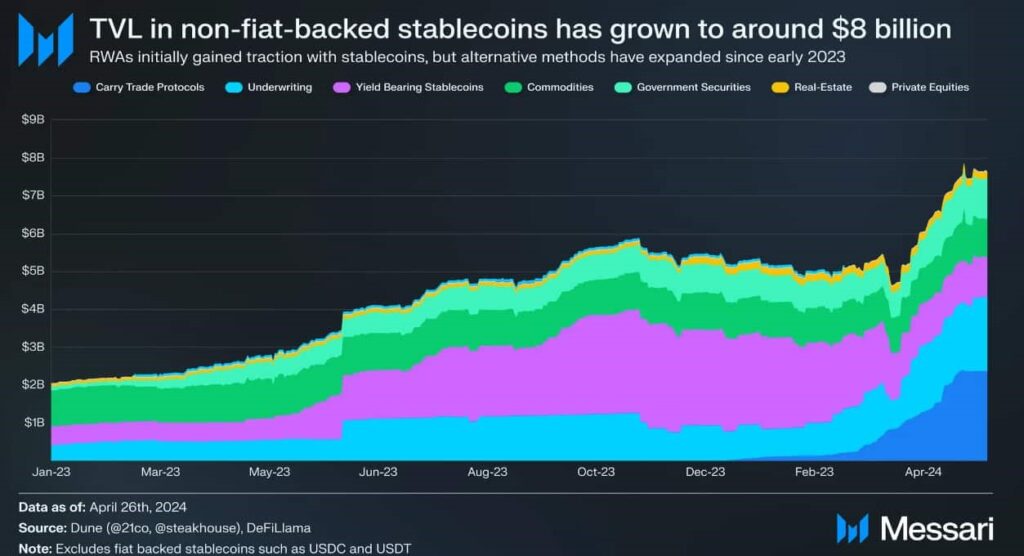

The total value locked (TVL) in Real-World Assets (RWA) has seen explosive growth over the last year, with the TVL surging to $8 billion.

The Real-World Assets sector has experienced substantial growth over the past year, with new protocols emerging that broaden the range of tokenizable assets. This expansion has propelled the TVL from approximately $2 billion at the start of 2023 to nearly $8 billion.

According to a detailed analysis by Messari released in May, stablecoins like USDC and USDT have dominated asset tokenization, representing the bulk of on-chain tokenized assets.

However, the landscape began to shift significantly over the past year with the advent of protocols aimed at broadening the spectrum of tokenized assets. This expansion has been pivotal in increasing the TVL to almost $8 billion now.

Real-world assets growth and demand

RWA protocols offer exposure either to off-chain interest rates or to the price movements of non-interest-bearing assets. They are further categorized by the nature of the investment—either as debt or equity—each carrying distinct risk and return profiles. The clear trend is toward protocols that provide stable and high returns, with debt instruments particularly favored due to their lower volatility and straightforward yield generation.

The decentralized finance (DeFi) analytics platform DeFiLlama supports these findings but reports a slightly lower TVL of $6 billion. Despite the discrepancy, both sources underscore a monumental 700% growth in protocol TVL since the beginning of 2023, painting a picture of rapidly increasing market interest and investment in these types of assets.

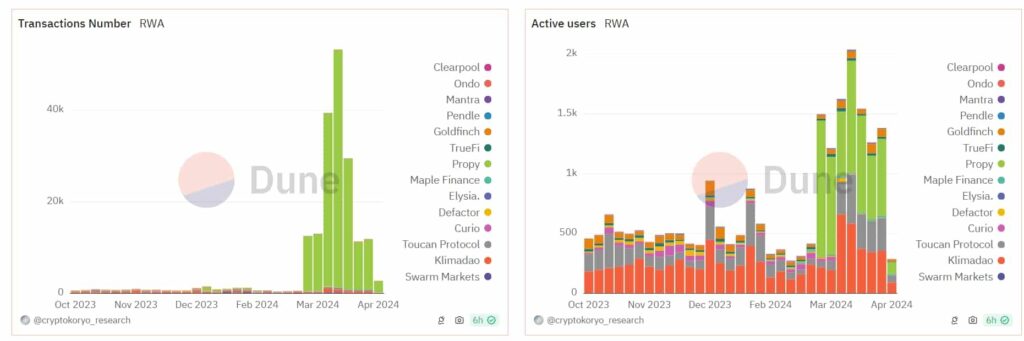

Not only has the total value locked seen impressive growth, but the number of active users on RWA protocols has also risen markedly since February, signaling a boost in popularity among smaller retail investors, according to Dune Analytics. Protocols like the digital carbon market platforms Toucan and KlimaDAO, and the real estate tokenization protocol Propy, have experienced significant user growth.

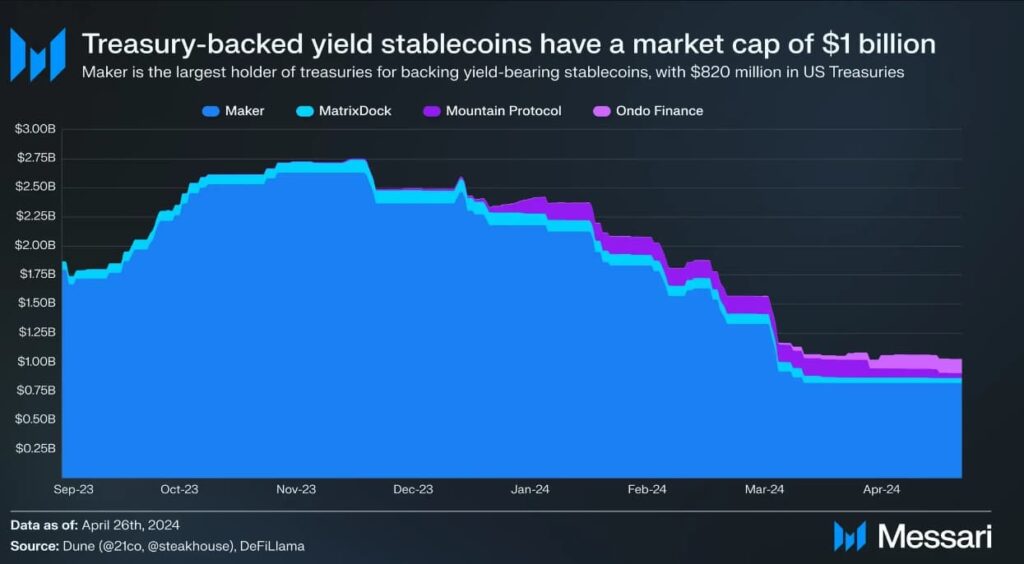

One of the key growth areas within RWA protocols is the focus on yield-bearing assets, designed to bridge the gap between off-chain yields and on-chain users. The divergence between on-chain and off-chain yields, especially noticeable during periods of rising interest rates, has renewed interest in these tokenization models.

Protocols like MakerDAO, which uses U.S. Treasury bills as collateral for its DAI stablecoin, and others such as Ondo and Mountain Protocol, are significant contributors to this segment. These platforms have helped stabilize the yield-bearing stablecoin market, despite it being a smaller part of the RWA ecosystem with just over $1 billion in TVL.

Consumer trends and investments

Despite the diverse offerings within the RWA market, consumer trends show a pronounced preference for yield-bearing assets, which now account for over 90% of the sector’s TVL. This preference is further highlighted by the minimal market traction of non-yield-bearing assets like tokenized gold and real estate, suggesting that the market is skewed towards investments that offer direct returns.

The world’s largest tokenized treasury fund, BlackRock’s Ethereum-based Institutional Digital Liquidity Fund (BUIDL), and Franklin Templeton’s OnChain U.S. Government Money Fund (FOBXX) have made significant contributions to the RWA sector’s expansion. These funds have not only attracted substantial capital but have also set new standards for integrating traditional financial assets with blockchain technology.

As the landscape for tokenized real-world assets continues to mature, the sector’s growth trajectory suggests a strong market shift towards assets that offer tangible yields. This shift is largely driven by the blockchain community’s preference for investments that merge traditional financial stability with the innovative potential of digital assets.

With nearly $8 billion in TVL and rising user engagement, the future of RWA protocols looks promising as they bridge the gap between conventional asset markets and the digital finance realm.

Source: https://finbold.com/tokenized-real-world-assets-nears-8-billion-in-value-as-demand-grows/