The USD/INR exchange rate soared to a record high in 2022 as the Federal Reserve and the Reserve Bank of India (RBI) delivered hawkish interest rate decisions. It rose to a high of 83, which was about 12.5% above the lowest level in 2022. How will the Indian rupee trade in 2023?

Fed and RBI outlook

The USD/INR forex rate rose sharply in 2022 as the US dollar index surged to a highest level in more than two decades. America’s inflation jumped to a 4-decade high of 9.1% as the average gasoline price spiked to $5.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

In response, the Fed decided to deliver a series of rate hikes. In total, the bank increased rates by 450 basis points, pushing them to the highest point in more than 15 years. The most recent rate hike came in December when the Fed increased by 50 basis points. It pointed to more rate hikes in the coming months.

India, on the other hand, had a strong economic growth in 2022. The country benefited from the war in Ukraine as it bought millions of barrels of cheap oil prices. At some point, India and China were buying oil for less than $50 per barrel.

As a result, India’s economic output was significantly better than most countries. While its inflation rose it remained slightly above the target set by the RBI. Indian inflation peaked at about 7.72% in 2022, lower than that of most wealthy countries.

India’s economic outperformance was also seen in the wealth created by its richest individuals. Gautam Adani rose up the ranks to become the third-richest individual in the world as he added $40 billion to his net worth.

Looking ahead, the Fed and RBI will likely maintain a hawkish tone in 2023 in a bid to slow inflation. Nonetheless, theur actions will be relatively less hawkish than in 2022.

USD/INR forecast 2023

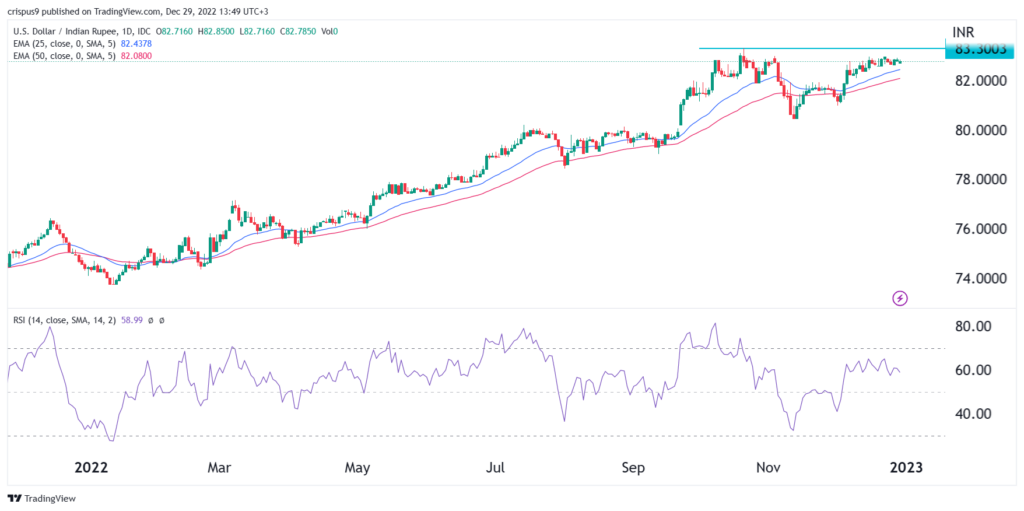

The daily chart shows that the USD to INR forex price rose sharply in 2022 as the Fed and RBI hiked rates. It is now being supported by the 25-day and 50-day moving averages. The pair has also formed a double-top pattern at 83.30.

In price action analysis, this pattern is usually a bearish sign. Therefore, there is a likelihood that the pair will have a bearish breakout in 2023 as sellers target the key support at 80. A move above the resistance at 83.30 will invalidate the bullish view.

Source: https://invezz.com/news/2022/12/29/usd-inr-forecast-2023-rupee-forms-a-double-top-pattern/