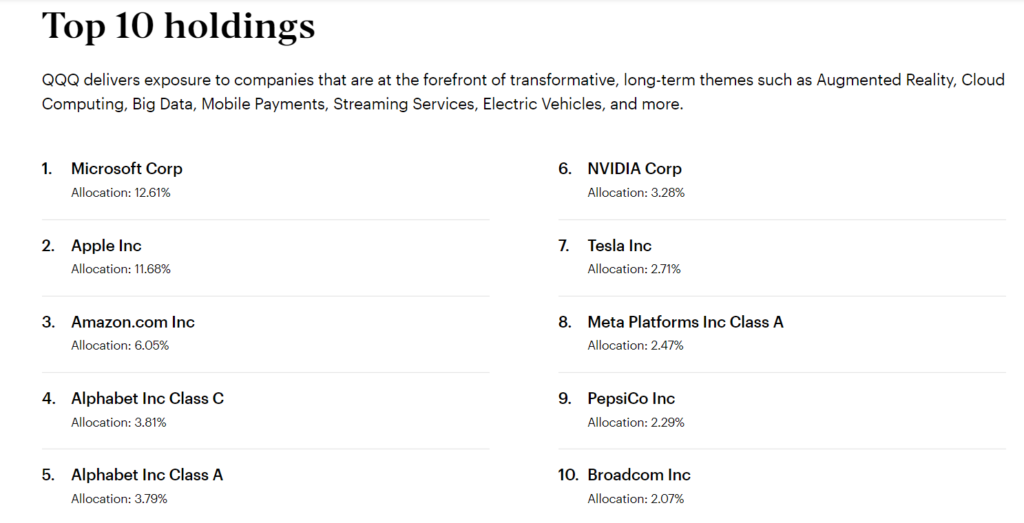

- Investment portfolio changed with Microsoft on top.

- Quarterly dividends distributed on 30 Dec’22.

- Nearly 50% investments are in IT companies.

Since evolution, humankind has found ways to embrace technology. From the stone age to concepts like the metaverse, advancements in the tech sector have left humans awestruck. Pioneer companies like Apple, Meta, and Microsoft have always led the industry. Investing in such companies will certainly mean possible heavy returns in the future.

Invesco QQQ Trust Series 1 (QQQ) is an exchange traded fund launched by Invesco Ltd. The fund is managed by Invesco Capital Management LLC. It invests in stocks of companies operating across energy, real estate, materials, industrials, healthcare, IT, communication, etc.

Recently, its portfolio observed a change with Microsoft (MSFT) having 12.61% share, succeeding Apple (AAPL), now at 11.68%. Moreover, it holds 6.05% of Amazon and 2.47% of Meta. According to the reports, Apple, Meta and Amazon were down by 25%, 65%, and 49%, respectively.

During the last decade, Microsoft has invariably invested in ventures like Azure IoT and Activision Blizzard and edge technologies as a part of its “Intelligent Cloud and Intelligent Edge” strategy. Its alliance with such companies, which may boom as the tech industry and metaverse advances, may yield blissful returns. Microsoft and its alliances are among the first companies to provide an IoT SaaS, IoT Paas and core IoT building blocks to customers.

The prices are moving forward, forming a rising parallel channel with 20-EMA floating above the current price action. Today’s price opened at $263.62, with a trading volume of around $37.8 million. In order to mark a bull trend, the price must find a spot above the current EMA, near $275.5.

The present positive image is formed due to the quarterly distribution of dividends at $0.655 per share on Dec 30. RSI floats in the lower frame showing prices inclining towards sellers as they are booking profits at current trading prices of $266.28. The MACD also diverges for ascending sellers and records rising red histograms.

Conclusion

The Invesco QQQ Trust Series 1, shows a futuristic approach with about 50% holding in IT based companies and other investments in companies like Netflix (NFLX), Alphabet (GOOGL), Amazon (AMZN), etc. with forthcoming development due in metaverse industry, its alliances may help it gain dominance in the market and prove beneficial to the holders. Support zone of $260.68 can be watched to invest in QQQ.

Technical levels

Support levels: $260.68 and $253.83

Resistance levels: $287.87 and $296.78

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Source: https://www.thecoinrepublic.com/2023/01/02/change-in-qqqs-holdings-had-this-effect-on-its-prices/