Berkshire Hathaway stock has shown a little gain in its trading price of June 1st, yesterday, which was almost similar to its recent week price gain. The year-to-date (YTD) price gain was over 4%.

BRK.B Stock Price Analysis

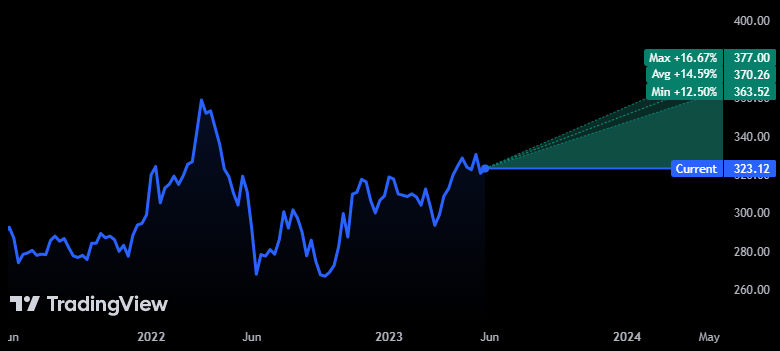

Berkshire Hathaway Inc Class B (NYSE: BRK.B) stock price closed at $323.12 in yesterday’s trading session with little price gain. The surge that the stock has experienced was just 0.64%. The opening price in yesterday’s trading session was $321.42, while the high was at $323.22, and low was noted at $319.53.

As shown in the above price chart, the pre-market price of BRK.B stock is at $324.00, which is showing little surge. As the stock price is trading above its 50-day EMA, it has reached its 20-day moving average. The trading volume in the stock price was just average, while the RSI showed little bullishness.

The analysts have set the price target at $370.26 which is more than 14% up from the recent closing price. The one-year price forecasts that the stock has a maximum estimate at $377.00 while minimum estimate is at $363.52.

Mid-March the stock has experienced quite good trading volume, but due to the bears’ dominance, its price slid down. The recent performance of the stock has nearly mixed reactions from bulls and bears. While the most recent day performance of BRK.B stock has bullish sentiments.

The Fundamentals of Berkshire Hathaway Inc.

Warren Edward Buffett is the CEO of a company that has a market cap of $706.47 Billion. The total revenue of BRK.B for Q1 2023 is $85.39 Billion, and it’s 9.25% higher compared to the previous quarter. The net income of Q1 23 is $35.50 Billion.

BRK.B earnings for the first quarter of 2023 are $3.69 whereas the estimation was $3.58 which accounts for 3.01% surprise. Its revenue for the same period amounts to $85.39 Billion despite the estimated figure of $83.38 Billion. The estimated earnings for the second quarter are $3.72, and revenue is expected to reach $82.27 Billion.

Berkshire Hathaway Inc. New revenue for the last year amounted to $302.09 Billion. The most of which, around $82.38 Billion, came from its highest performing source at the moment, Insurance. Most of the contribution to the revenue figure was made by the U.S. As in the last year, it brought Berkshire Hathaway Inc. New $253.68 Billion.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Source: https://www.thecoinrepublic.com/2023/06/02/brk-b-stock-price-analysis-indicating-the-bullish-outlook/