Alibaba Group Holding Limited (NYSE: BABA) is the world’s leading eCommerce and Internet technology giant, founded on April 4, 1999, with headquarters in Hangzhou, China. Alibaba is to announce its earnings on May 18, 2023. Can it deliver a favorable report to fuel the rally?

Alibaba – Expected Earnings and Financial Analysis

Analysts expect Alibaba to have Earnings Per Share (EPS) of $1.35 and revenue of $30.28 Billion. This is compared to last year, when the EPS was $1.18, and the revenue was $28.35 Billion. The returns increased by 24% over the previous six months, breathing new optimism in the company.

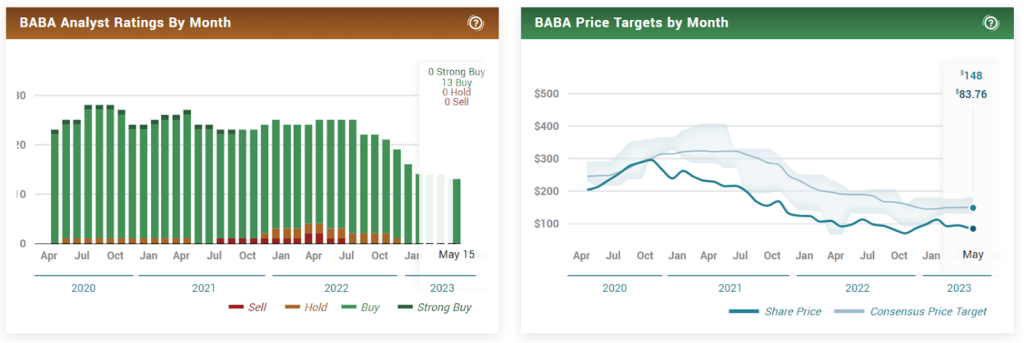

At press time, BABA stock was trading at $85.34, dropping 2.90% in the last 24 hours. Previous close and open were at $87.89 and $86.71, respectively, with an average volume of 23.48 Million shares; the market cap was reported to be $220.817 Billion. Analysts have placed the price target at $147.56 with a 72.9% upside.

Concerning December 2022 data, the revenue was reported to be $864.54 Billion, revenue per share was #326.75, and the quarterly revenue growth was up by 2.10%. The total cash in hand was reported to be $519.21 Billion, and the debt was $191.14 Billion, making the total debt/equity ratio 17.37.

Operating expenses dropped by 5.82% to $60.01 Billion, and net income increased by 65.27% to $46.91. Profit and operating margins hiked by 3.82% and 12.29%, respectively. The returns on assets and equity also hopped by 3.76% and 2.82%, respectively.

BABA’s share price increased by around 50% from its low of $58. As China is opening up and relaxing its Zero-COVID policy, investors are eager to know if the recent gains are sustainable. Currently, the stock remains 70% down from the previous high, and this drop was because the big tech firms in China were facing regulatory scrutiny.

The scenario appears to evaporate, as Alibaba’s treasure chest is experiencing strong cash flows. Their diversified revenue sources in China and cloud potential provide multiple points at certain levels. The e-commerce giant had recently announced investing $1 Billion in the next three years to boost its cloud capabilities.

However, the cloud is a small part of Alibaba’s overall business, but the management prioritizes it for long-term growth and profitability.

Alibaba Group Holdings (NYSE: BABA) – Candle Exploration

The current price bounces from the S1 twice, making it relatively more robust support at $79.52. A downward-sloping trend line and relatively flat EMA do not provide any clear signals. If the price breaks the trend line, it could increase to R1, and the share price shall consolidate between R1 and S1 for some time.

The RSI is at 45.88, indicating equal pressure from bears and bulls. The subsequent earnings would decide further momentum.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Source: https://www.thecoinrepublic.com/2023/05/15/alibaba-baba-stock-next-earnings-in-2-days-can-it-rally/