One thing to start: Amazon has announced a 20-for-1 stock split and a share buyback of up to $10bn, in an effort to boost its stock price in the face of heavy operating costs and concerns over staff retention.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: [email protected]

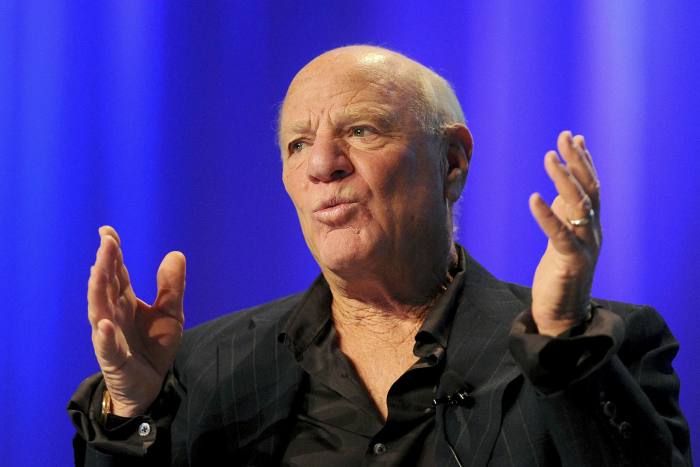

Regulators probe Diller and Geffen’s lucrative Activision bet

Billionaires Barry Diller and David Geffen made great fortunes uncovering talent in Hollywood, music and technology.

Now, their side hustle of sniffing out unannounced corporate takeovers has caught the eye of the Securities and Exchange Commission and Department of Justice.

The duo purchased $108mn of options contracts tied to video game developer Activision on January 14 for about $40 per share, alongside Alexander von Furstenberg, Diller’s stepson from his marriage to Diane von Furstenberg.

Three days later, Microsoft announced a $75bn takeover of Activision for $95 a share, propelling the trio’s options to achieve paper gains of roughly $60mn.

The trades are so good that they’ve become the subject of an insider trading investigation by US regulators, DD’s James Fontanella-Khan and Antoine Gara and the FT’s Stefania Palma report.

JPMorgan Chase, the bank that the trio used to place their bet, reported them to US authorities after the takeover was announced. JPMorgan declined to comment.

Diller told the FT that the trade is clean and was made on the basis of their belief that Activision was undervalued and could eventually be acquired or taken private.

“None of us had any knowledge from any person or any source or anything about a potential acquisition of Activision by Microsoft,” he said.

The three men purchased in-the-money options contracts versus out-of-money contracts that would have been far more profitable, Andrew Verstein, a professor of law at UCLA, told DD.

But they placed a leveraged bet on Activision, which gave them more upside potential than simply buying the stock, as Warren Buffett’s Berkshire Hathaway did in the lead up to the deal.

“It is suspicious when a person buys an aggressive derivatives-based bet in an unannounced merger,” said Verstein. “Most rich people don’t do that.”

Diller told the FT that his lawyers have preserved all documents of their trade “because we were sure somebody would say, ‘well, how could this be such a coincidence?’ It turns out, that’s all it is.”

Diller is a friend of Activision’s chief executive Bobby Kotick and is the founder of media group IAC, which has backed various internet media brands including Tinder and Expedia.

If Diller’s version of events prevails, he and Geffen have pulled off one of the great trades of 2022.

H2O plays Russian roulette

How do you explain to your investors that you just incinerated 40 per cent of their money on a leveraged bet on the Russian rouble?

That’s the unique quandary facing H2O Asset Management, the accident-prone investment firm that still manages nearly €14bn in assets despite its recent scandals.

Regular DD readers will know H2O as a fallen star of European asset management that has lurched from crisis to crisis since the summer of 2019, when the FT revealed that its funds held more than €1bn of bonds linked to controversial financier Lars Windhorst.

H2O’s founders Bruno Crastes and Vincent Chailley make no bones about their penchant for high-risk, high-reward bets. Crastes once even told a crowd of fellow investment professionals that their industry had become “corrupted by all this regulation and all this risk management”.

Even so, DD did a double take when we saw that H2O’s flagship fund had exposure to the Russian rouble through derivatives — equivalent to more than 48 per cent of its €1.9bn in assets — just weeks before Russian tanks crossed the border to invade Ukraine.

The results have been disastrous. And yet, the firm has outlined the unique reasons why it’s clinging on for a rebound.

In a letter to investors last week, H2O said selling the rouble would be a “gift” to buyers including “the Russian government”. (H2O posted an amended version to its website on Monday excluding the word “gift”.)

Then on Tuesday, Chailley explained in a video address to investors that the group’s team expects the currency to rebound because there will be a “negotiation [between Russia and Ukraine] that will start in the coming weeks”.

“Putin knows and said very consistently what he wants to achieve,” he added, before explaining that H2O would adjust the portfolio if there was a further “escalation” in the war.

As a reminder, Putin has said consistently that he wants to “demilitarise and de-Nazify” Ukraine. We’re not sure if Chailley is hoping to profit from this process, because H2O declined to comment on his remarks beyond confirming their accuracy.

In an age of faddish ESG investing, perhaps some may consider such honesty refreshing.

However, we also noticed that H2O’s website explains that it is “currently working on our firm-wide ESG policy”. Clearly there’s more to be done on that front.

The trading scandal that shook Japan Inc

When Japan’s financial regulators raided the offices of the country’s third-largest broker SMBC Nikko last year in a probe into alleged market manipulation, they didn’t stop after going through the files of the company’s traders on the premises.

They went to the bankers’ homes, going through their personal phones and computers, and called in senior staff for questioning.

One June weekend, shortly after multiple interrogation sessions that lasted up to 10 hours, a senior trader died of a brain aneurysm, with Nikko lodging a complaint to the regulators that centred on the stress caused by the investigation. (The FT’s Antoni Slodkowski breaks down the implications on this Twitter thread.)

The probe has since been taken over by the prosecutors who have arrested four executives, including two foreigners, the head of Nikko’s equity business, Trevor Hill and his deputy, Alexandre Avakiants.

At the heart of the allegations against them are trades executed by the firm’s proprietary trading desk to allegedly boost the price of stocks being sold by institutions as large blocks.

The arrests, which have sent shockwaves through Tokyo’s financial community, have drawn attention because of how rare it is for prosecutors to get involved — and arrest the executives — when the company under investigation is a domestic brokerage.

Job moves

Eurazeo has appointed JCDecaux co-chief Jean-Charles Decaux as chair of its supervisory board. The French private investment group also appointed former Société Générale finance chief William Kadouch-Chassaing to its board to replace Philippe Audouin following his retirement and renewed the remainder of its board members for four-year terms.

Freshfields has appointed Howie Farn as a capital markets partner based in Hong Kong. He joins from Kirkland & Ellis.

British Gas owner Centrica appointed Santander’s UK chief executive Nathan Bostock as a non-executive director to its board.

DS Smith has appointed former Unilever chief financial officer Alan Johnson to its board as a non-executive director.

Smart reads

Energy wars Washington’s Russian oil embargo is the most severe move yet in a rapidly escalating global energy showdown between Moscow and the west. This helpful FT explainer maps out the potential global impacts.

Bad education A global group of elite international private schools cater to the future-Davos crowd. But many adhere to a curriculum underpinned by white privilege and systemic racism, Bloomberg reports.

All the Kremlin’s men Russian oligarchs forged powerful connections with western financial and legal systems, from a New York financial adviser that helped them invest in top private equity and hedge funds to UK lawyers who specialise in hiding assets, the New York Times reports.

News round-up

Binance plots M&A spree as regulators scrutinise crypto trading unit (FT)

Pimco stands to lose billions if Russia defaults on its debt (FT)

Citigroup ‘running out of options’ in push to sell Russian bank (FT)

Banks review relationship with telecoms group linked to Mikhail Fridman (FT)

UniCredit warns €7bn at risk in ‘extreme scenario’ of Russia unit being wiped out (FT)

Prudential continues pivot to Hong Kong despite ‘difficult’ conditions (FT)

Shanghai halts trading of key nickel contracts in wake of LME suspension (FT)

ECB pursues flexibility as divisions deepen over Ukraine crisis (FT)

Carlyle to buy Todd Boehly’s CBAM for $787mn (Bloomberg)

Recommended newsletters for you

Scoreboard — Key news and analysis behind the business decisions in sport. Sign up here

The Lex Newsletter — Catch up with a letter from Lex’s centres around the world each Wednesday, and a review of the week’s best commentary every Friday. Sign up here

Source: https://www.ft.com/cms/s/2baa87f1-1fcc-464d-9dfd-f29ab6fb80c3,s01=1.html?ftcamp=traffic/partner/feed_headline/us_yahoo/auddev&yptr=yahoo