- Ethereum stakers impacted positively after the merge.

- Addresses continued to hold their ETH as selling pressure reduced.

According to a 1 March tweet by Messari, the Ethereum [ETH] merge had a huge impact on the state of stakers. Even though the prices of ETH took a hit, staking returns improved from 1% in Q3 to 6% in Q4 of last year.

The Merge vastly improved the economics for stakers.

Real staking returns improved from 1% in Q3 to 6% in Q4 of last year.

The majority of the increase came from a fall in net inflation from 4% to 0%.

FREE @Ethereum Quarterly Report Below 👇 pic.twitter.com/KNBIlIGHDn

— Messari (@MessariCrypto) March 1, 2023

Read Ethereum’s [ETH] Price Prediction 2023-2024

However, the situation of Ethereum stakers could improve due to a new service called the Eigen Layer.

Normally, once ETH is staked, it cannot be used for other functions. This could change with the Eigen Layer. The Eigen Layer is a restaking primitive that allows ETH stakers to secure additional networks, securing multiple services with the same initial capital.

More reasons to stake ETH?

At press time, there were 531,653 validators that had staked their ETH holdings. Even without the added re-staking, the validators on the network were doing pretty well in terms of revenue, which increased by 34.22% over the last month. According to Staking Rewards, the overall revenue generated by stakers reached a value of $2.02 billion at press time.

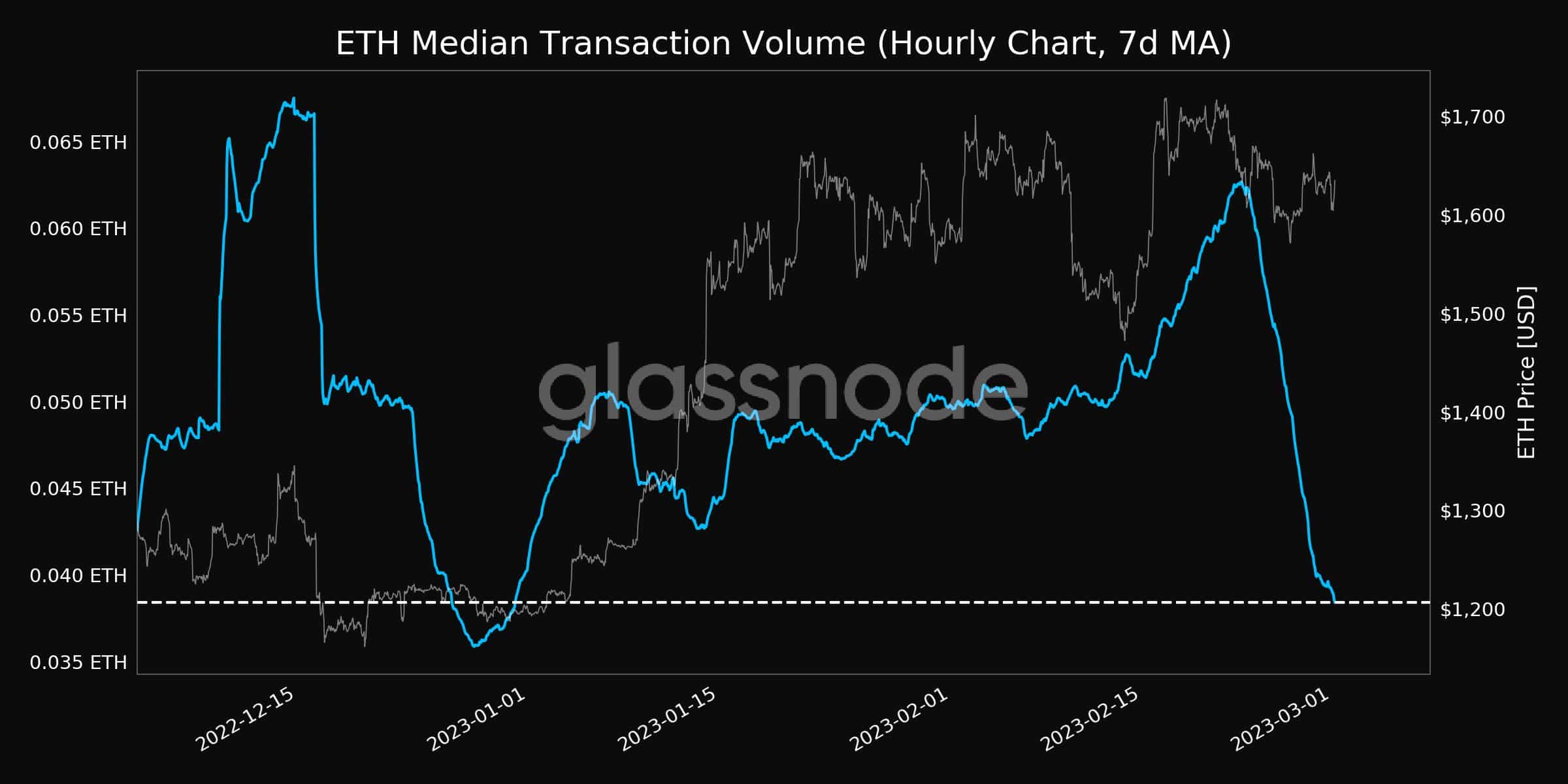

Along with stakers, the number of addresses on the Ethereum network increased. According to Glassnode, the number of non-zero addresses on Ethereum reached an all-time high of 94.83 million addresses. However, despite this, Ethereum’s overall transaction volume declined significantly.

This indicated that many of the new addresses holding Ethereum were not selling their ETH.

One reason for the same would be the network’s low MVRV ratio. According to Santiment, ETH’s MVRV ratio was only slightly positive. This suggested that most holders of Ethereum wouldn’t be making huge profits if they sold their ETH at press time.

Is your portfolio green? Check out the Ethereum Profit Calculator

The long/short difference declined too, suggesting that the number of short-term holders fell. The continuation of this trajectory could lead to an increase in the selling pressure on Ethereum in the future.

Source: https://ambcrypto.com/ethereum-eth-will-this-development-turn-hodlers-into-stakers/