- The proposed agreements may shift economic dynamics, initiating market adjustments potentially favorable to the cryptocurrency sector.

- Market reactions are watching action closely, particularly in the cryptocurrency arena.

- These policies could lift investment sentiments if economic conditions respond favorably.

The proposed agreements may shift economic dynamics, initiating market adjustments potentially favorable to the cryptocurrency sector. Executives like Vice President Vance emphasize positive expectations, though precise deal details remain undisclosed.

Market reactions are watching action closely, particularly in the cryptocurrency arena, where Bitcoin saw significant shifts tied to trade news. Analysts from JPMorgan suggest these policies could lift investment sentiments if economic conditions respond favorably.

Bitcoin Surge Reflects Positive Market Sentiment

Did you know? The suspension of tariffs earlier by Trump once spiked Bitcoin 7% in a single day.

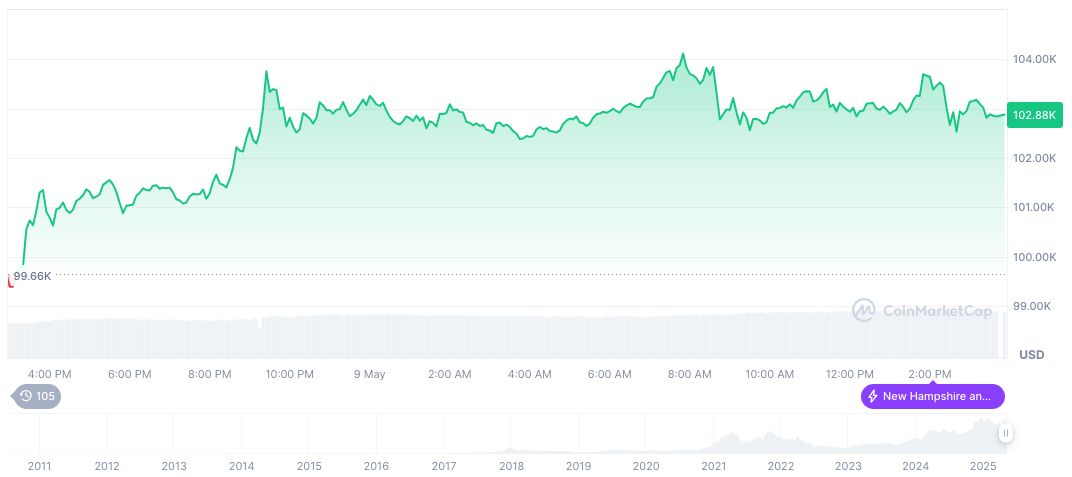

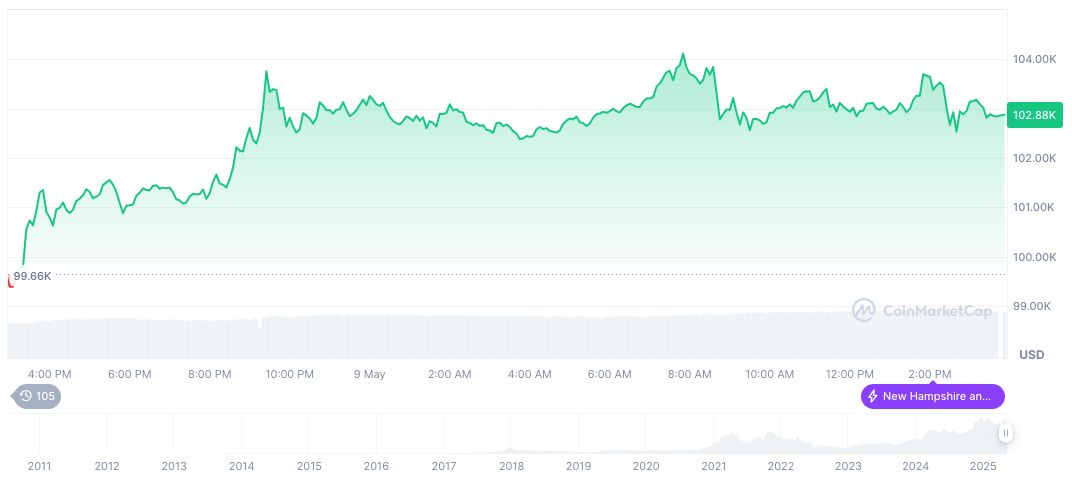

According to CoinMarketCap, Bitcoin (BTC) is priced at $103,774.44, with a market cap of $2.06 trillion. It holds a 62.44% dominance. The 24-hour trading volume decreased by 33.63%, while recent price fluctuations show notable changes over the last 60 days, with a 27.34% rise.

Insights from the Coincu research team indicate potential economic shifts owing to new trade policies, which could enhance risk asset attractiveness among investors. Rate cut signals from the Federal Reserve may also influence broader market dynamics significantly.

Bitcoin Surge Reflects Positive Market Sentiment

Did you know? The suspension of tariffs earlier by Trump once spiked Bitcoin 7% in a single day.

According to CoinMarketCap, Bitcoin (BTC) is priced at $103,774.44, with a market cap of $2.06 trillion. It holds a 62.44% dominance. The 24-hour trading volume decreased by 33.63%, while recent price fluctuations show notable changes over the last 60 days, with a 27.34% rise.

Insights from the Coincu research team indicate potential economic shifts owing to new trade policies, which could enhance risk asset attractiveness among investors. Rate cut signals from the Federal Reserve may also influence broader market dynamics significantly.

Source: https://coincu.com/336791-trump-trade-agreements-crypto-impact-2/