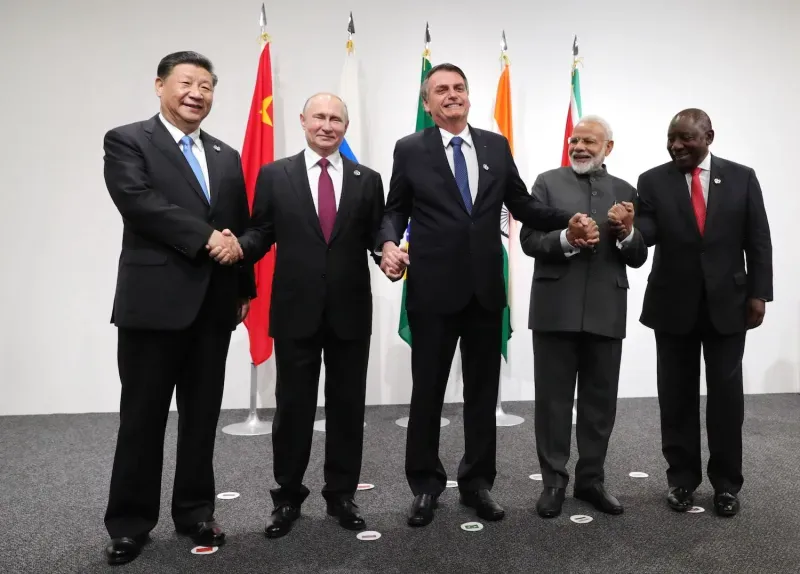

The BRICS bloc, comprised of Brazil, Russia, India, China, and South Africa, is laying the groundwork for a blockchain-based payment system.

This initiative is seen as a direct challenge to the US dollar’s hegemony in international transactions.

BRICs Flocks to Blockchain

According to Kremlin aide Yury Ushakov in an interview with TASS, the creation of an independent BRICS payment system leveraging digital technologies and blockchain is a pivotal goal.

“The main thing is to make sure it is convenient for governments, common people, and businesses, as well as cost-effective and free of politics,” Ushakov emphasized.

This announcement comes at a time when the BRICS countries are actively seeking to diminish their reliance on the US dollar.

Read more: Deploying Blockchain Infrastructure: Challenges and Solutions

The leaders have committed to increasing settlements in national currencies and strengthening correspondent banking networks to ensure secure international transactions.

“Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar,” Ushakov revealed.

This comment underlines the group’s dedication to diversifying away from the dollar.

A New Digital Paradigm

The interest in joining the BRICS economic group has surged. Nearly three dozen countries have now expressed their intention to become members.

This growing enthusiasm, as South African Foreign Minister Naledi Pandor points out, significantly expands BRICS’s global footprint and influence, showcasing a united front against the current US-dominated financial system.

Moreover, Russia’s digital ruble initiative represents a significant stride toward financial independence and resilience against Western sanctions. The digital ruble is designed to facilitate cross-border settlements and bolster Russia’s global financial position.

Read more: What Is the Dollar Milkshake Theory?

This development, alongside the collaborative efforts within BRICS to adopt similar digital currency solutions. This marks a significant turning point in the global economic order.

By leveraging blockchain technology and digital currencies, BRICS may pave the way for a new paradigm in global finance.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

Source: https://beincrypto.com/brics-blockchain-payments-challenge-us-dollar/