The collapse of Terra LUNA/UST, Celsius, Voyager Digital, Three Arrows Capital and the most recent FTX saga has made 2022 a tough and volatile year for many in the industry.

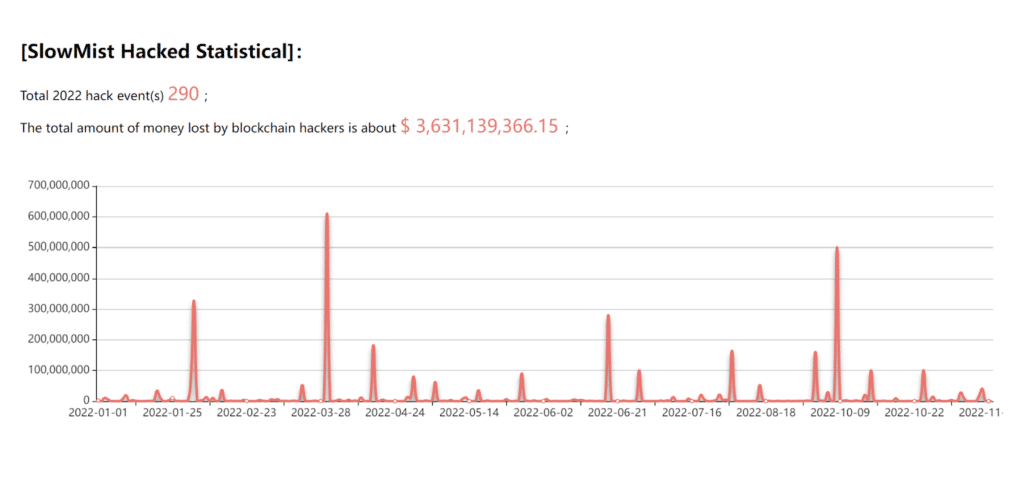

According to CoinMarketCap, the total crypto market capitalization has dropped to $821 billion as of the end of November, while on-chain crime has also increased in frequency and sophistication as the industry grows. As of Nov. 22, 2022, there had been 290 security incidents with a total loss of over $3.6 billion, as documented by SlowMist Hacked (an archive of blockchain-related incidents).

Regulations have been at the core of the ongoing discussion over how to reduce crypto crime. Effectively regulating the market, protecting retail users, providing stability to some of the systemic challenges — these are some of the most pressing issues to be addressed.

On the flip side, this year has also brought regulators and the general public closer to crypto and blockchain trends. As a result, crypto-related policies are also becoming more transparent, which will ultimately contribute to the overall growth of the blockchain trends.

Besides regulations, what are the areas the industry should focus on in 2023?

An Increased Focus on Security Audits

October 2022 alone has seen over 20 attacks on Web 3 crypto coins, related projects and trading platforms. Most of these were attacks and exploitations due to security flaws in the projects’ code.

Many cross-chain bridges have been launched with 0 fees and fast transactions in order to quickly onboard users and projects to the ecosystem — all done at the expense of disregarding security as the most vital consideration.

Cross-chain bridges have a high level of liquidity yet little decentralization, and the majority of the authority resides in multi-signature wallets: once hackers gain access to signatures, they exert complete control.

Additionally, while it’s rare for cross-chain bridges to undergo security audits, the communities provide little in terms of security monitoring. As a result, cross-chain bridges often become a popular target for hackers.

With the raise in security-related incidents, we anticipate that more projects will recognize the value of auditing going forward. Based on the deep knowledge and expertise that SlowMist has accumulated in blockchain security, we believe that it is essential for projects to undergo a comprehensive security audit of the front/back-end and the contract, together with other methods such as using bug bounties to improve the project’s security throughout its ongoing operation and development.

A Multi-Chain Future With Increased Interoperability

2021 started the expansion of multiple Layer 1s with Solana, Avalanche and others, and 2022 saw the continuity of this trend with Aptos and Sui attracting significant investor funding and media attention.

Although the Ethereum Merge from PoW to PoS hasn’t brought significant improvement to its transaction cost or speed, this theme of scalability will continue among other L1s. Various Layer 2 projects have also been developed to reduce the network layer load, increasing its efficiency. Scalable rollup platforms, such as Arbitrum, will continue to garner interest as a medium to long-term solution to the Ethereum network congestion issue.

The impossible trilemma in blockchain — security, scalability and speed — cannot be achieved simultaneously, which means that there are now multiple L1s addressing various user demands.

Consequently, we expect further development of cross-chain solutions, where EVM and non-EVM compatible chains are connected to achieve interoperability and compatibility.

These developments should give the community the opportunity to find the balance between a swift cross-chain bridge, sufficient liquidity and a secure user interaction experience.

Anti-Money Laundering and On-Chain Tracking Analysis

The importance of on-chain crime tracking is also more prominent. On-chain data can benefit blockchain trends analytics and anti-money laundering investigations immensely, and we’re already starting to see a multitude of on-chain tracking and analysis platforms and tools.

Through the data aggregation of these tracking tools, users can discover information such as the location of their funds and determine whether their assets are connected to stolen funds.

In the near future, tracking tools will continue to develop and add more capability to anti-money laundering investigations.

More Emphasis on Backing Up Your Keys

Even with all of the various self-custody wallet products available now, the loss of private keys and seed phrases has continued to be a very common reason behind many cases of crypto theft.

To address this issue, backups such as multi-party computation (MPC) have gained a place in the spotlight in recent months as a viable solution to the single-point backup problem.

With MPC, when a private key is initially generated, it can then be divided into multiple shards and distributed to a group of individuals. Using this specific method, the original private key can then be restored when necessary. In the near future, we anticipate that there will be an open-source solution that conforms to industry standards on this topic.

Zero-Knowledge Proofs: Scalability and Privacy

Zero-knowledge technology is a subfield of cryptography that can solve privacy and scalability issues for numerous Layer 1 blockchain projects.

Although it is not a new technical term, it hasn’t been a hot topic until recent months, and zero-knowledge proofs may be one of the most significant Web 3 and blockchain solutions in the coming years.

DAOs: Will Their Use Cases Expand?

In 2022, DAOs became one of the hottest topics in crypto, even though the majority of DAO organizations and their creation tools are exclusive to the Ethereum ecosystem and less developed on other L1s.

How DAOs can overcome incentive challenges, implement cross-chain asset management and interaction capabilities and expand use cases will be the key for the next phase of its development.

NFT Markets Move Multi-Chain

Previously, the Ethereum ecosystem was the one processing the vast majority of NFT transactions.

In the years to come, it’s possible that NFT transactions will increasingly be conducted on different chains, so projects that help facilitate such transactions will be in high demand.

The gaming industry is a promising new frontier for NFT applications, with a rising number of new players and developers in NFT related games in 2023.

One thing we know for sure: blockchain trends will be the driving force of many of the developments worldwide. We are looking forward to a compliant blockchain and Web 3 cryptocurrency world, a world of expanded capacity with a multi-chain balance, mature technology and an ecologically stable ecosystem.

Source: https://en.cryptonomist.ch/2023/03/11/blockchain-development-trends/