Bitcoin Halving, What Is It?

Bitcoin halving is an event in which, for every new block mined, it reduces by half the reward paid to miners. Therefore, the rate at which new coins are put into circulation. It happens about once every four years. The last halving took place in 2020 when the block reward was cut from 6.25 to 3.125 Bitcoins. The next one is expected in April of this year where the reward will decline again to 1.5625 Bitcoins.

Through this process, the supply total is kept at 21 million. It is then carefully observed by buyers as it can affect Bitcoin’s economics and market value. As of March 2024, a total of 19.65 million Bitcoins have been mined, 98.7 % of the total supply.

The world’s financial market players have been anxious as the fourth halving of Bitcoin is on the way. This event is vital as it will determine the future value of Bitcoin and the way investors see it. Based on the analysis of the trends of the past and the present state of the markets, the evidence demonstrates that the applicability of making a wise investment decision towards the crypto-industry is a must.

Historical Performance Post-Halving

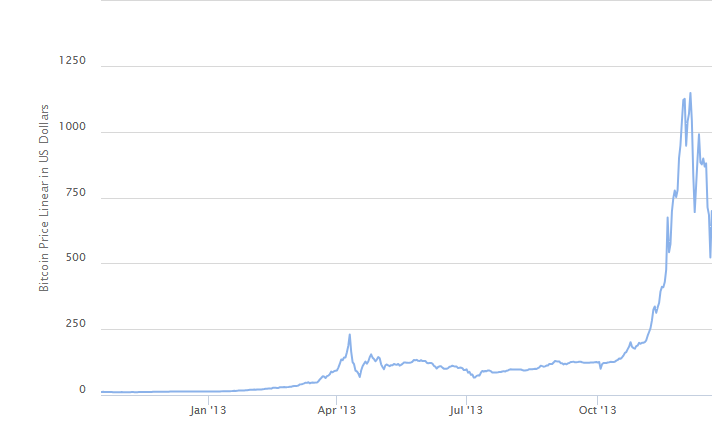

Bitcoin’s price chart which came after the halving has very useful data. It is helpful for predicting future prices and reactions of the market. During late November 2012 when Bitcoin halved, its growth was over 9500% in one year (from $12 to $1,160).

Likewise, the second halving of July 2016 was followed by a noticeable change in the price of Bitcoin. It skyrocketed 4100% over the next year and a half (from $470 to almost $20,000). According to the two aforementioned events, Bitcoin halving is the principal cause of the price trend changes. It significantly impacts the fourth halving projection of the investors.

Consumer Views and Investment Mindset

The April 2024 halving event anticipation has already influenced the market sentiments and market expectations due to multiple elements. The launch of the spot Bitcoin ETFs and the fact that institutional players are getting involved with the market demand even more attention. Another factor is global events such as US elections and increases and decreases in interest rates. They can create uncertainty with the future direction of Bitcoin price.

Even despite this, there is still faith that Bitcoin possesses the ability to remain a store of value. It can be a hedge against inflation in the long term.

Careful research and selection of reliable crypto resources, such as exchanges and custodians is vital, given the digital assets’ complexities. That’s a part of the successful approach to investment in cryptocurrencies. Besides that, regulatory developments and macroeconomic factors should be considered by the investors. Thus, they can forecast the fluctuations of the Bitcoin price in the near future.

To Wrap It Up

The fourth Bitcoin halving marks an essential milestone for those wishing to take part in the growing cryptocurrency industry. By analyzing past bеhavior outcomes or еconomic forеcasts and supply dеmand projеctions, invеstors may makе a dеlibеratе dеcision to dеal with thеsе opportunitiеs or thrеats.

Our journey into the realm of digital assets wouldn’t be complete without wisely assessing the risk factors and choosing the ideal mix to reap profit from the Bitcoin halving and beyond.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com and all its authors do not, and will not endorse any information on any company or individual on this page. Readers are encouraged to do their research and take any actions based on their findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com and all its authors do not and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

Sam Chess is an utterly focused person looking for the minute details having potential to make a big difference. He is a writer and proofreader with a zeal to understand the cryptocurrency market. Additionally, he can be found trying to figure out the biggest mystery in the industry, Satoshi Nakamoto.

Contact :linkedin

Source: https://www.thecoinrepublic.com/2024/04/23/understanding-bitcoins-fourth-halving-valuable-insights-for-investors/