In a recent report on technologies for making cross-border payments in the best possible way, the European Central Bank (ECB) talked about Bitcoin (BTC), though in a negative way.

By contrast, the ECB believes stablecoins and Central Bank Digital Currencies (CBDC) can be viable means of payment.

In search of the holy grail: Bitcoin and stablecoins under the eye of the ECB

A few days ago, the European Central Bank released a 59-page report on the search for the “Holy Grail of cross-border payments”, a paper written by Ulrich Bindseil, who is the ECB’s Director General of Market Infrastructure and Payments, and George Pantelopoulos, Lecturer in Economics at Newcastle University.

The paper explores several solutions for how to make cross-border payments more efficient. The best one must meet four characteristics, according to the ECB:

- It must be immediate;

- It must be cheap;

- It must be universal and easy to use anywhere in the world;

- It must be settled in a secure settlement medium, such as central bank money.

In addition, the report explains that a more modern and up-to-date solution should also be an open system: one example given, while questionable, is that interbank payments involve several vendors, unlike in the use of a stablecoin that is issued by a single counterparty.

And, of course, the Holy Grail must in no way compromise monetary sovereignty.

In pursuit of this so-called Holy Grail for centuries (the report even refers to the Middle Ages), also a priority goal of the G20 since 2020, the report outlines how Bitcoin, stablecoins and state digital currencies work in order to understand whether they are suitable technologies.

Indeed, at a time when globalization is booming, as is digitization, the ECB is increasingly concerned with finding faster and cheaper means of making cross-border payments.

According to an ECB forecast, the solution to these problems will be found within the next decade.

“The holy grail of cross-border payments can be found within the next ten years”, the paper explains.

The history of the search for the perfect payment method

A long excursus is devoted to the attempts in history to find the perfect method of making cross-border payments.

The first financial instrument used for this purpose was the promissory note, which originated in the Arab world at the beginning of the Islamic era. It is a written order from the issuer ordering a counterparty to remit an amount, either immediately or by a predetermined date. If the drawee failed to pay, the drawer would have the right to seek compensation in court.

Then, in the mid-19th century, electronic transfers of direct deposits through correspondent banking arrangements began, brought about by the laying of the first transatlantic cable.

However, the problem of security and lack of automation remained, and this prompted 239 banks from 15 countries to form the Society for Worldwide Interbank Financial Telecommunication (SWIFT) to create a common messaging standard.

SWIFT, however, does not solve all the problems associated with a huge constant flow of cross-border payments.

The multinational strategy consulting firm McKinsey estimated in 2018 that a financial institution facilitating a cross-border payment receives an average of as much as $20 in fees from a single transaction, while a 2021 study by Oliver Wyman and JP Morgan explained that global costs stand at about $120 billion each year.

And the costs increase due to KYC and AML procedures, as well as being tied to the time zone of the financial institutions involved.

In any case, banks remain the point of reference for these payments (albeit expensive and slow, by the ECB’s own admission), so an alternative solution must be found.

Bitcoin rejected as the perfect payment method

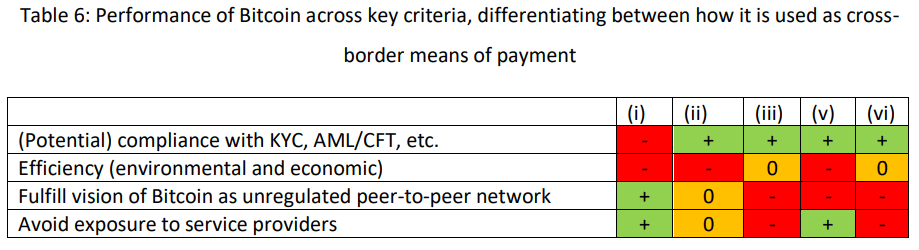

The document – starting in particular on page 25 – explains that Bitcoin cannot be considered as an alternative to payment methods, but is nevertheless discussed for at least 10 pages to explain why:

“The FSB does not even consider unbacked crypto-assets such as Bitcoin as a suitable means of cross-border payments”.

Citing Bitcoin’s whitepaper and various examples of BTC being used as a payment method, for example in El Salvador, in each case the queen of cryptocurrencies is almost labeled as a religious cult. The report goes so far as to say:

“There are also many reports about Bitcoin supporter’s quasi-religious belief that Bitcoin is actually “a new messiah”.

The report also mentions the Lighting Network, recognizing it as a solution to have fast and low-cost transactions, but the problem for the ECB seems to still be Proof of Work (PoW) which is called expensive and also useless. In addition, BTC is called unsuitable for payments because of its high volatility and low scalability.

In another part of the report, the ECB goes so far as to state that Bitcoin is attractive to users only because it is poorly regulated.

In this regard it explains:

“Much of its perceived appeal for cross-border payments stems from the fact that it has (so far) escaped equal regulatory treatment in terms of compliance […]. This has led to widespread use of Bitcoin for criminal purposes”.

Fintech explained by the ECB

From page 17 it starts talking about payment methods made by fintech companies such as Revolut or Wise or even MoneyTransfer or Western Union that are labeled as “closed-loop solutions” and very expensive, as fees can range from 0.74 to as much as 4.12 euros.

PayPal is also criticized:

“It has so far not been very ambitious in terms of offering cheap cross-border retail payment services”.

ECB in favor of stablecoins

The document, as mentioned, does not only talk about Bitcoin, but also about stablecoins and CBDCs, the so-called state cryptocurrencies, mentioning also Facebook’s Libra/Diem.

With regard to stablecoins, it is pointed out that they have attractive qualities for possible use, but for reasons of financial stability, the focus for the ECB should be on secured stablecoins only and, therefore, pegged 1-to-1 with a fiat currency (in fact, the DAI stablecoin is immediately removed from the picture, since it is algorithmic):

“Because of their flexibility and their non-ideological search for an efficient global means of payment, stablecoins have the potential to provide an efficient means of cross-border payment for several reasons”.

In any case, stablecoins are also not considered truly suitable for this purpose given that they would be controlled by BigTech companies and monetary sovereignty could be breached.

So, with stablecoins also crossed off the list of solutions, the only thing left are CBDCs, but in the report, it is explained that we are still in the early days and there are many issues still to be resolved in this regard, such as the fact that they have to become commonplace and that everyone has to be able to use them.

Source: https://en.cryptonomist.ch/2022/08/05/ecb-sees-bitcoin-expensive-system/