Recent data confirms that the spot BTC ETF products are commanding considerable interest in the U.S., as the products approach a combined $10 billion trade volume in 3 days.

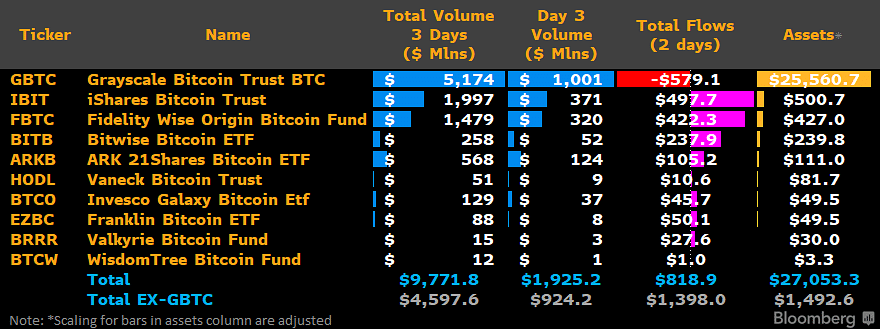

James Seyffart, a prominent Bloomberg ETF analyst, called attention to this development in a recent post on X. According to Seyffart’s disclosure, the combined volume of these products hit $9.771 billion on the third day of trading.

Recall that these products commanded $4.3 billion on the first day of trading. The recent data indicates that the ETFs have attracted an extra $5.471 billion in volume over the past two days of trading on the open market.

Grayscale Leads the Spot BTC ETF Race

Interestingly, day three witnessed a considerable surge in volume despite the recent correction recorded in the Bitcoin (BTC) and broader crypto markets. Notably, data from a table shared by Seyffart confirms the dominance of the Grayscale Bitcoin Trust (GBTC) in the market.

Of the $9.771 billion total volume, GBTC accounts for $5.174 billion, representing 53% of the volume. In addition, GBTC recorded a massive $1 billion in trade volume on the third day.

Despite the impressive metrics, GBTC has seen $579 million in outflows over the last two days. Recall that Grayscale has continued to move BTC across wallets in recent times. GBTC is the only ETF on the list with a negative netflow.

However, the investment product contains the largest assets under management (AUM) in the ETF market, totaling $25.56 billion. GBTC’s massive AUM is largely attributed to its earlier existence as a Bitcoin trust before Grayscale transformed it to an ETF.

– Advertisement –

BlackRock and Others Follow

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) is second on the list in terms of trade volume. IBIT boasts a total of $1.997 billion over the past three days of trading, with $371 million in volume on the third day. This figure represents a 63% decline from the $1.01 billion volume on the first day.

Fidelity Wise Origin Bitcoin Fund (FBTC) sits right under BlackRock’s IBIT, with $1.479 billion in total volume. FBTC has recorded a net inflow of $422 million over the past two days, and valuing it at $427 million as of press time.

Despite having a lower AUM than the Bitwise Bitcoin ETF (BITB), the Ark 21Shares Bitcoin ETF (ARKB) has commanded a greater trade volume over the past three days.

The ARKB has commanded a volume of $528 million with an AUM of $111 million. Recall that Ark Invest CEO Cathie Wood asserted that not all ETFs would survive the race.

In terms of flows, BlackRock’s IBIT has witnessed the largest inflows in the last two days, amounting to $497.7 million. Data from BitMEX Research shows that IBIT recorded $214 million inflows on the third day alone. Ark Invest’s ARKB saw $123 million inflows on the third day.

Despite the massive inflows, BitMEX Research noted that the substantial outflows witnessed by Grayscale’s GBTC resulted in a net outflow of $41 million overall on the third day. However, BitMEX confirmed that the data is not conclusive at the time, and could be inaccurate.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2024/01/17/spot-btc-etf-products-approach-10-billion-volume-in-3-days/?utm_source=rss&utm_medium=rss&utm_campaign=spot-btc-etf-products-approach-10-billion-volume-in-3-days