Peter Schiff advises Bitcoin holders to “abandon ship” before it hits bottom.

Peter Schiff is against Bitcoin again

Economist Peter Schiff, famous for being a lifelong Bitcoin hater, has advised investors to let go of BTC before it can cause serious losses to their wallets.

It is known to the entire community by now that Schiff does not see eye to eye with the queen of crypto, and this time he is back on the attack with one of his classic tweets:

Markets rarely give investors much time to buy the bottom. #Bitcoin has been trading near $20K for the past 12 days. More likely $20k will prove to be a false bottom, giving suckers plenty of time to climb aboard a sinking ship. Better to abandon ship before the bottom drops out.

— Peter Schiff (@PeterSchiff) September 6, 2022

In the tweet, the economist clearly describes Bitcoin as a sinking ship that is giving too much time to “naive investors” to get on board.

In fact, according to his analysis and also based on what is happening now in the market, it appears that the $20,000 threshold has been a false support.

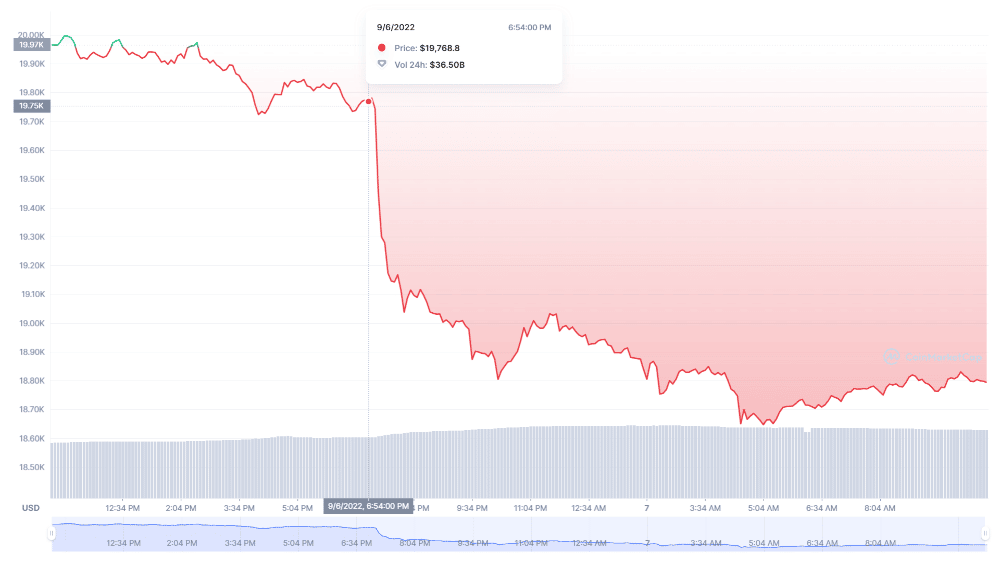

It is curious to see the reaction of the price of BTC a few hours after Peter Schiff’s words, which were shared publicly through his official Twitter account.

As can be seen from the chart, the abrupt descent of the value began towards late afternoon, around 7 PM (CET) precisely.

Studies regarding sentiment analysis show that there is a positive correlation between influential events, such as the words of a widely followed figure, and the price of crypto in particular.

In this case, the relationship is present and it is close, but one would have to dig deeper to see if this was the cause, or if it was a natural market downturn.

The opposite view and thinking of Michael Saylor

As is well known, the market is filled with opposing views, and that is what creates the market, because without it, it would have no reason to exist. There are those who are willing to buy at a certain price and those who, at the same time, are willing to sell at the same value. In this way, the needs of the two counterparts are met and thus a buying and selling agreement is born.

The market, however, is not limited only to this and numerical data. In fact, as numerous studies on investor psychology show, every action hides an infinite variety of emotions, which influence and are reflected in the individual’s decisions.

Everyone reasons with his or her own head, based on ideals and beliefs assimilated from early childhood. Everything contributes to the creation of different lines of thought, and this is a factor that can be observed in every sphere and reality.

In the specific case of Bitcoin, there are those who have always hated it, such as Peter Schiff, and those, on the other hand, who have been great supporters from the beginning, contributing to its development and spread, just like Michael Saylor.

Saylor’s past

In reality, not exactly from the very beginning. In fact, in December 2013, Michael Saylor wrote on Twitter that Bitcoin’s days were numbered, comparing it to the same fate as online gambling.

#Bitcoin days are numbered. It seems like just a matter of time before it suffers the same fate as online gambling.

— Michael Saylor⚡️ (@saylor) December 19, 2013

It took little to realize the true potential of the number one crypto, fully embracing it from that point forward.

It is enough to mention that the company of which he was the former CEO, MicroStrategy, is the company holding the highest share of Bitcoin in the world. In fact, its portfolio has as many as 130,000 BTC, currently worth $2.4 billion.

To his misfortune, about a week ago, he was sued for tax fraud. Apparently, he allegedly paid income taxes in Florida instead of in Washington, which, according to investigators, is the city where he lives most of the time. Surely, the avid Bitcoin supporter was looking for some tax relief.

Returning to the talk of opposing views, just yesterday, Michael Saylor referred to Bitcoin as the World Bank, sharing his thoughts in a tweet:

#Bitcoin is the World Bank.

— Michael Saylor⚡️ (@saylor) September 6, 2022

Peter Schiff’s latest events

Surely, Peter Schiff will disagree with this last statement. Then again, he firmly believes that everyone should forget about Bitcoin and stop buying it.

For now, Schiff is grappling with the authorities in Puerto Rico, which, about two months ago, shut down one of its banks on suspicion of tax evasion and money laundering.

For this very reason, the Office of the Commissioner of Financial Institutions in Puerto Rico, ordered Euro Pacific Bank to suspend all operations for lack of capital levels and inadequate compliance controls.

Source: https://en.cryptonomist.ch/2022/09/07/peter-schiff-back-attack-against-bitcoin/