The cryptocurrency market is currently experiencing a whirlwind of events that have the potential to shape its future. Two prominent players, Fidelity and BlackRock, are seeking approval for Bitcoin Exchange-Traded Funds (ETFs), which could bring newfound legitimacy and institutional investment to the crypto space. However, amidst this development, the specter of rising interest rates looms, posing challenges to cryptocurrencies without strong fundamentals. In this article, we will delve into the potential impact of Fidelity BTC ETF, and rising interest rates, and highlight the advantages of the CONG token as a secure investment option in the face of these market dynamics. The project has managed to raise USD 8 million and recently reached over 10,000 holders.

Fidelity and BlackRock Bitcoin ETFs: Paving the Way for Institutional Investment

The recent efforts by Fidelity and BlackRock to launch Bitcoin ETFs have sent ripples of excitement throughout the crypto community. An ETF provides a regulated and accessible investment vehicle for institutional and retail investors, offering exposure to Bitcoin without the need for direct ownership or custodial concerns. If approved, these ETFs could be a game-changer, opening the floodgates for institutional capital and bringing increased liquidity and stability to the crypto market.

Fidelity, a renowned asset management firm, has a track record of embracing digital assets, having established a dedicated cryptocurrency division. Their proposed Bitcoin ETF aims to leverage Fidelity’s expertise and reputation to provide investors with a secure and regulated means of accessing the digital asset market. Similarly, BlackRock, the world’s largest asset manager, has expressed interest in entering the cryptocurrency space through a Bitcoin ETF. Such involvement from industry giants like Fidelity and BlackRock holds the potential to attract significant institutional investment, further solidifying cryptocurrencies’ position as a legitimate asset class.

Rising Interest Rates: A Potential Challenge for Cryptocurrencies

While the prospects of Bitcoin ETFs and institutional investment are exciting, it is crucial to consider the broader market environment. One such factor that demands attention is the prospect of rising interest rates. Central banks worldwide have been signalling a shift towards tighter monetary policies to combat inflationary pressures. Higher interest rates can have a profound impact on the crypto market, particularly for cryptocurrencies without strong fundamentals.

Cryptocurrencies without a robust underlying framework or a clear use case may suffer as rising interest rates drive investors towards traditional assets that offer more stable returns. During periods of economic uncertainty, investors often seek refuge in assets backed by tangible value and established markets. As a result, cryptocurrencies that lack solid fundamentals may experience significant price volatility and decline in value.

CONG Token: The Best Defense Against Rising Interest Rates

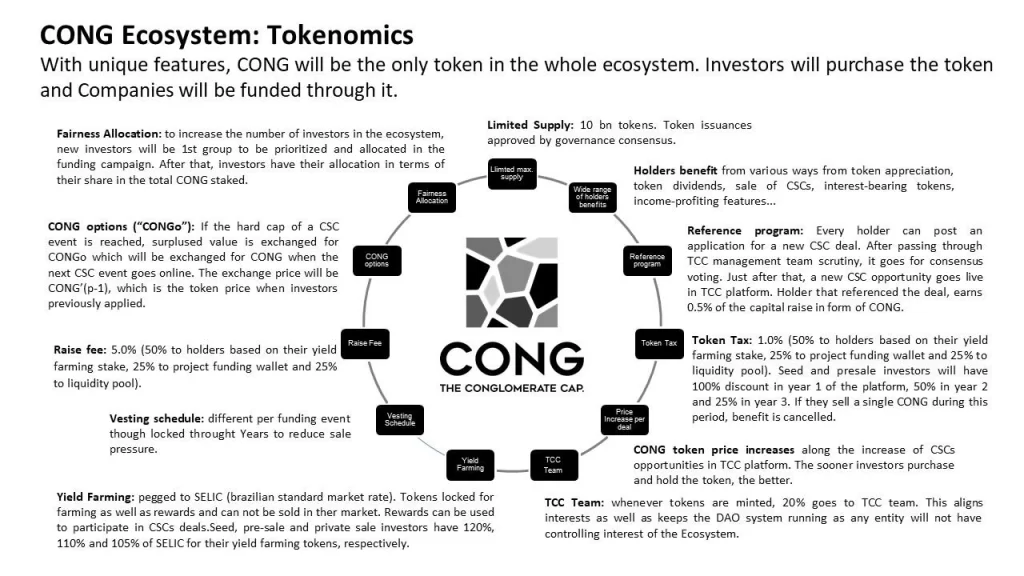

In the face of rising interest rates and the potential challenges they pose to the crypto market, the CONG token stands out as an ideal investment option. CONG, an abbreviation for “Crypto Nexus for Growth,” offers a unique blend of features that position it as a secure and reliable investment during times of economic turbulence.

One of the key strengths of the CONG token lies in its robust underlying fundamentals. Unlike many other cryptocurrencies, CONG operates on a decentralized blockchain platform that prioritizes security, scalability, and sustainability. The token’s developers have taken a meticulous approach to building a comprehensive ecosystem that fosters growth and innovation within the crypto community.

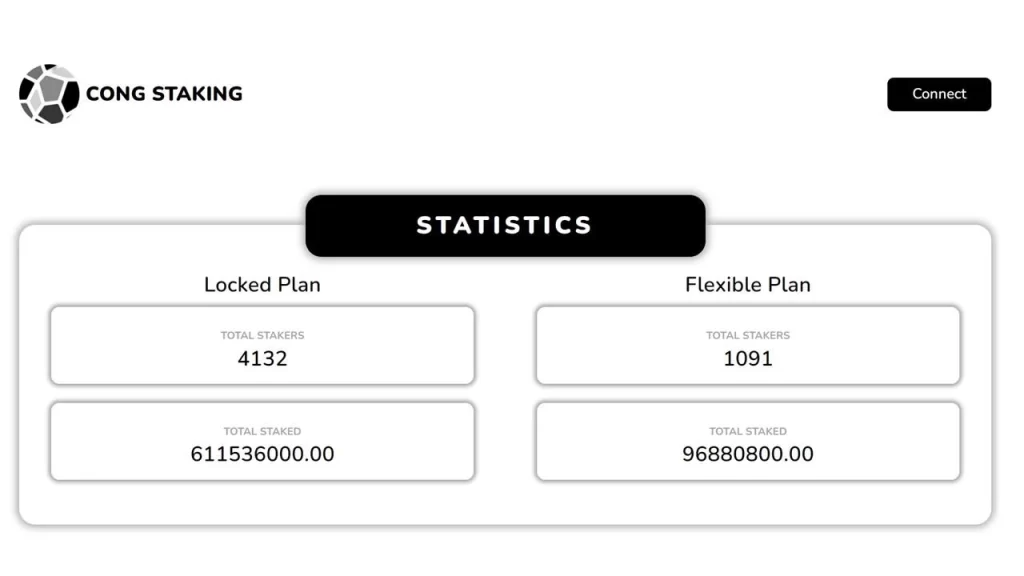

Moreover, CONG offers investors a tangible use case through its innovative staking and lending programs. Staking CONG allows token holders to earn passive income by participating in the network’s consensus mechanism and securing the blockchain. Investors can choose among six staking types, with APYs up to 59% plus compounding.

BUY CONG TOKEN NOW

Additionally, CONG’s lending program enables investors to generate further returns by providing liquidity to the platform. These features make CONG not only an investment opportunity but also a means of actively participating in the token’s ecosystem.

The CONG token stands out from other tokens in the crypto market due to its unique investment strategy and focus on real-world assets across different sectors. Unlike many cryptocurrencies that are solely based on speculative trading or rely heavily on the performance of the overall crypto market, CONG takes a different approach by investing in tangible assets with intrinsic value. This diversification across various sectors, such as real estate, infrastructure, and commodities, allows the CONG token to be less correlated with the performance of other tokens, making it an attractive option for investors seeking to mitigate risk and establish a more stable and balanced portfolio. By bridging the gap between the digital and physical worlds, CONG provides a secure and uncorrelated investment opportunity within the crypto space.

Furthermore, CONG’s commitment to sustainability aligns with the growing environmental concerns associated with traditional cryptocurrencies. By employing an energy-efficient consensus mechanism and adopting eco-friendly practices, CONG sets itself apart as a responsible and conscientious investment option in a world increasingly focused on sustainability.

CONG Token: A Comprehensive Security Framework

In addition to its underlying fundamentals, the token prioritizes security to protect investors against the challenges posed by rising interest rates. The token’s developers have implemented advanced security measures to ensure the integrity and confidentiality of user transactions and data. Through the use of cutting-edge encryption protocols and multi-factor authentication, CONG provides a secure environment for investors to transact and store their assets.

In addition to that, CONG leverages decentralized finance (DeFi) principles to enhance security. By eliminating intermediaries and enabling direct peer-to-peer transactions, it reduces the risk of hacking or unauthorized access often associated with centralized systems. This decentralized nature not only enhances security but also provides transparency and immutability to the entire ecosystem.

Conclusion

As the crypto world experiences seismic shifts with the potential introduction of Fidelity and BlackRock Bitcoin ETFs, the looming specter of rising interest rates poses challenges to cryptocurrencies without strong fundamentals. In this landscape, the CONG token emerges as a secure and reliable investment option. With its robust underlying framework, tangible use case, commitment to sustainability, and comprehensive security measures, CONG stands poised to weather the storm of rising interest rates and provide investors with a secure haven within the crypto market.

BUY CONG TOKEN NOW

Source: https://coinpedia.org/press-release/the-crypto-world-shakes-fidelity-btc-etf-rising-interest-rates-and-the-cong-token/