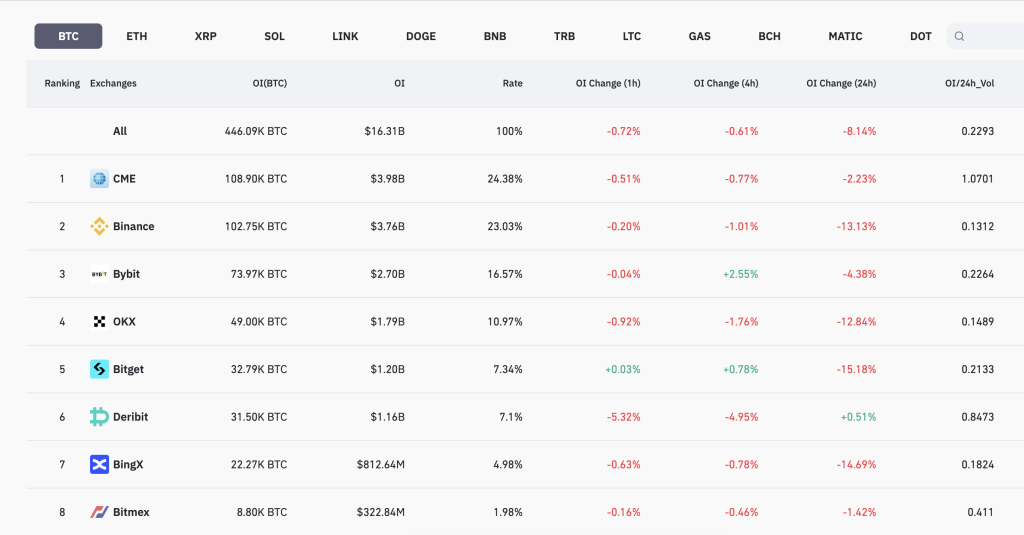

In a major twist, the Chicago Mercantile Exchange (CME) has become the top dog in Bitcoin futures, outpacing Binance for the first time ever. CME now holds a whopping 111,100 BTC in futures, making this a historic moment for the exchange.

Here are the details you’re looking for.

CME‘s Big Win

In the last 24 hours, CME saw a remarkable 4.17% jump in its BTC futures positions. Coinglass reports that CME’s notional open interest (OI) went from $3.57 billion to $4.08 billion, pushing it to the top of the Bitcoin futures exchange. This is a big leap from its second-place spot just a few weeks ago.

It’s not just about numbers – CME hit another milestone by going beyond 111,100 BTC in open interest for its cash-settled futures contracts for the first time. Plus, CME now commands 25% of the Bitcoin futures market, showing its dominance.

Dethroning Binance

In a historic move, CME has taken the crown from Binance, a major player in the crypto exchange world. Just a week ago, Coinpedia highlighted Binance’s lead with a notional open interest of $3.85 billion, 8% more than CME. But things flipped, and now Binance is in second place at $3.77 billion, a 10% drop compared to CME.

Read More: Bitcoin Futures Open Interest Surge: Volatility Incoming?

The big question on everyone’s mind is, what caused CME’s sudden success? Some think it’s because more big institutions are investing in it, signaling a shift in how things work in the crypto futures scene.

This isn’t just a win for CME; it’s a turning point that shakes up the world of cryptocurrency. Meanwhile, the market is still digesting the news.

Source: https://coinpedia.org/news/cme-makes-history-takes-the-lead-over-binance-in-btc-futures-contracts/