The Chicago Board Options Exchange (Cboe) has made a bold move by filing a request with the Securities and Exchange Commission (SEC) for the acceleration of multiple Bitcoin spot ETF (Exchange-Traded Fund) applications. It is anticipated that the exchange is preparing to list ETFs by tomorrow.

Cboe Files For ‘Request For Acceleration’

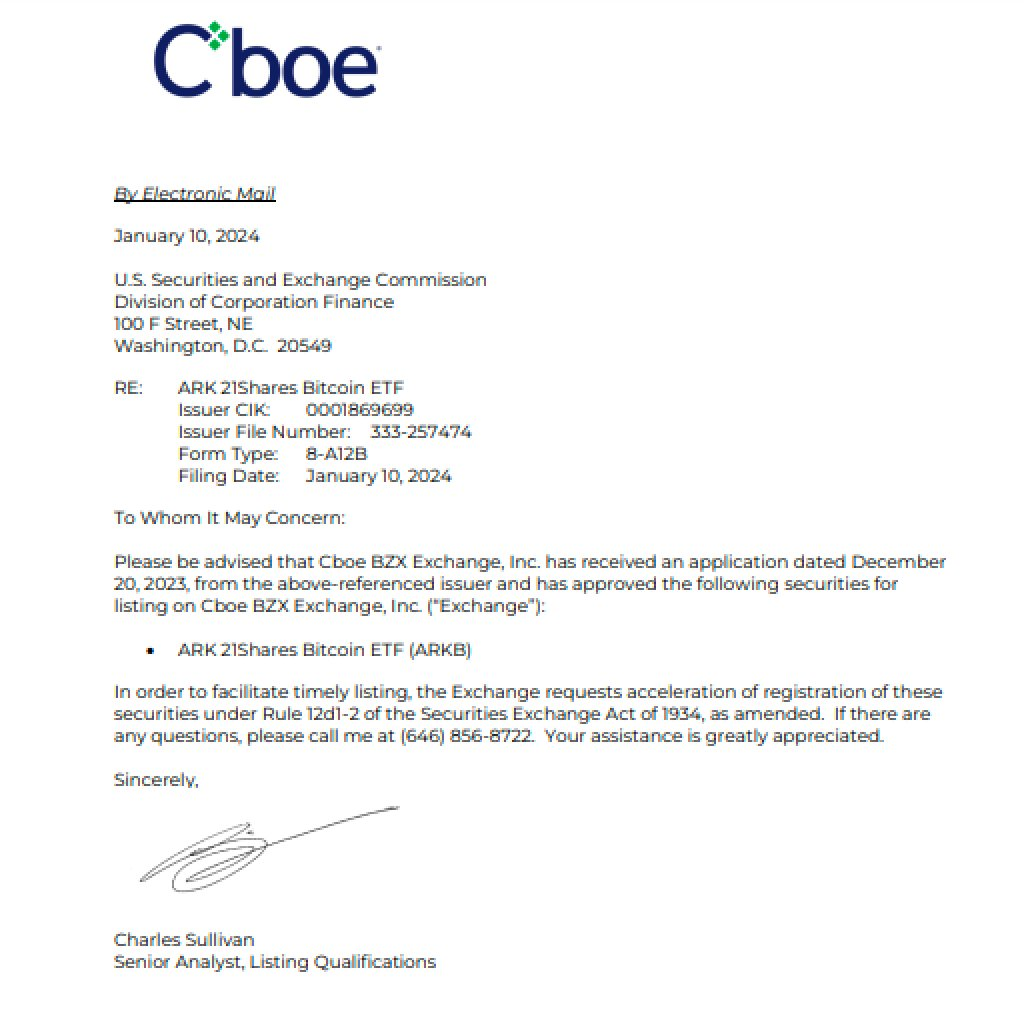

The Cboe BZX exchange submitted requests to the Securities and Exchange Commission (SEC), seeking to accelerate the approval process for several proposed spot bitcoin ETFs. These include the Invesco Galaxy Bitcoin ETF, Fidelity Wise Origin Bitcoin Fund, VanEck Bitcoin Trust, Franklin Bitcoin ETF, and the ARK 21Shares Bitcoin ETF.

The exchange’s requests show the need for “acceleration of registration” under Rule 12d1-2 of the Securities Exchange Act of 1934, as amended, to ensure timely listing of these securities, as mentioned in one of the letters.

Although Cboe has approved these applications to list securities on its exchange, this step does not guarantee SEC approval. Bloomberg analyst Eric Balchunas pointed out that this move appears to be a “request for acceleration,” which is essentially the final phase before S-1 effectiveness.

The crypto market has been eagerly anticipating the regulator’s decision on these numerous proposed funds, possibly as soon as today.

Bloomberg Intelligence analyst James Seyffart, commenting on the development, described it as essentially a request for immediate listing. “I was expecting this after the market closed today, so it’s a bit early but still within expectations. This represents a very late stage in the approval process,” Seyffart noted in a post on X.

Here’s When Approval Might Come

On January 9, there was increased anticipation regarding the SEC’s decision on a spot Bitcoin ETF. However, an unexpected thing occurred when the SEC’s official X (formerly Twitter) account posted a message granting full approval for the ETF.

This post quickly stirred confusion as SEC chair Gary Gensler soon declared the account had been “compromised,” disavowing the announcement of any decision on the investment vehicle.

There’s debate over whether the tweet was an authentic announcement prematurely leaked by a hacker, or if it was a fabricated statement intended to shake the crypto market. However, the X safety team revealed on the same day that the SEC’s account lacked two-factor authentication. The episode has also drawn the attention of several U.S. lawmakers, who are urging the commission to provide a detailed report on the incident.

Bloomberg reports that the SEC is poised to greenlight its inaugural spot Bitcoin ETF between 6-8 pm New Jersey time.

Source: https://coinpedia.org/news/cboe-seeks-quick-sec-action-for-spot-bitcoin-etfs-as-it-confirms-listing-certificates-of-multiple-applications/