- BTC recovered over 3.5% of its value in the last 24 hours

- Selling pressure on Bitcoin rose, despite the recent price hike

The past week was somewhat of a bloodbath for Bitcoin [BTC] as its value dropped below $56,000 on the charts. The FUD around the cryptocurrency fueled speculations, with many expecting BTC to fall even further down.

However, the market trend changed over the last 24 hours. In fact, some would argue that Bitcoin is finally taking its first steps towards $100k now.

Bitcoin eyeing $100k?

Bitcoin finally got rid of the bears as its daily chart turned green. According to CoinMarketCap, at the time of writing, BTC was up by more than 3.5% in just 24 hours. It was trading at $59,623.01, with a market capitalization of over $1.17 trillion.

Meanwhile, Titan on Crypto, a popular crypto-analyst, recently shared a tweet highlighting an interesting development. As per the tweet, the last price correction might have been the last deviation from BTC’s road towards $100k. This seemed to be the case as well as historically, whenever such deviations have happened, BTC’s price has gained bullish momentum soon after.

To be precise, similar episodes happened in March 2023, June 2023, and January 2024.

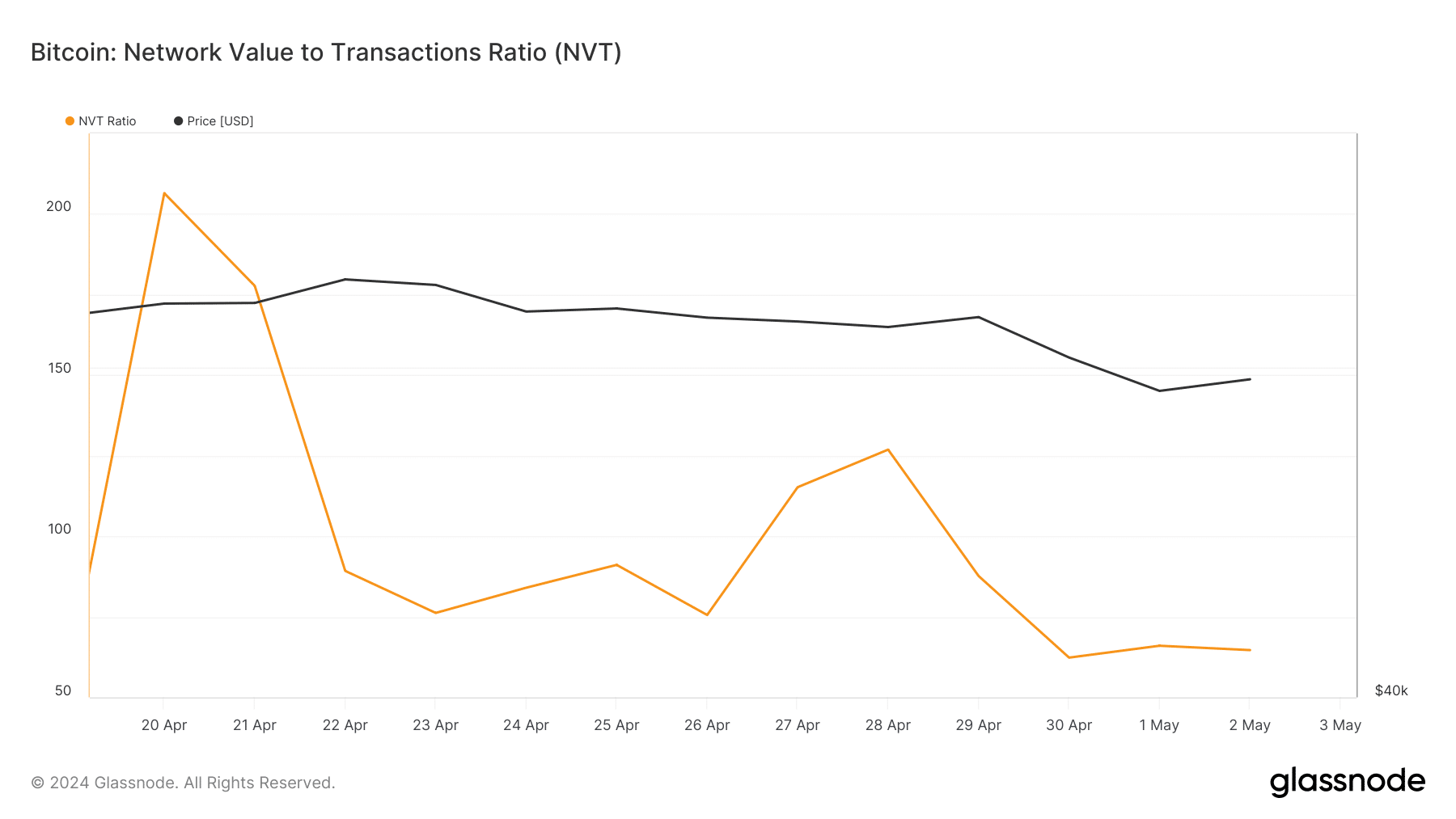

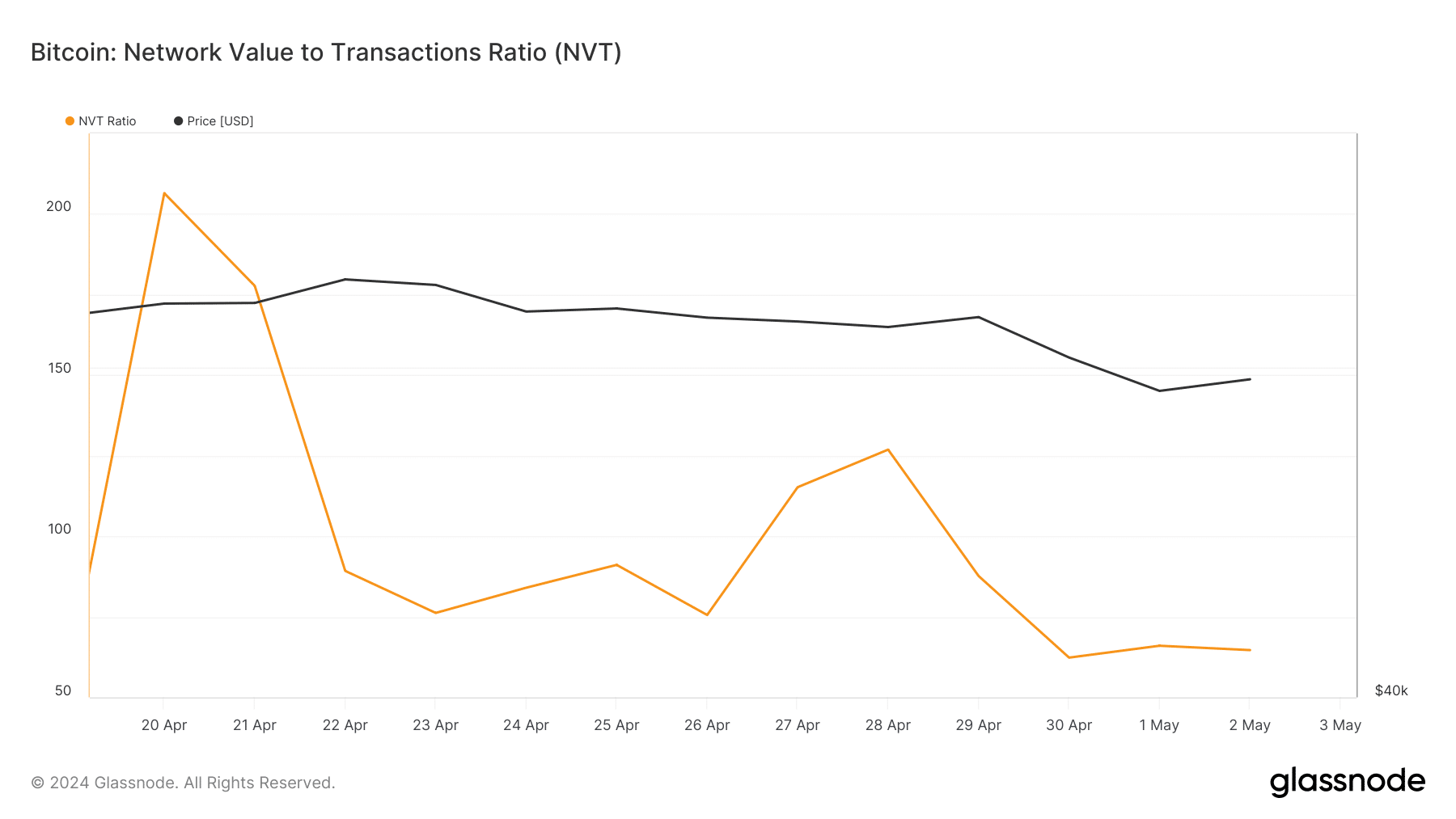

The possibility of BTC touching $100k in the coming weeks is high now, especially since the coin’s network-to-value (NVT) ratio dropped – A sign that the coin may be undervalued.

Source: Glassnode

Are investors buying Bitcoin?

Since the chances of a bull rally seem to be high, this might be the right opportunity for investors to accumulate BTC.

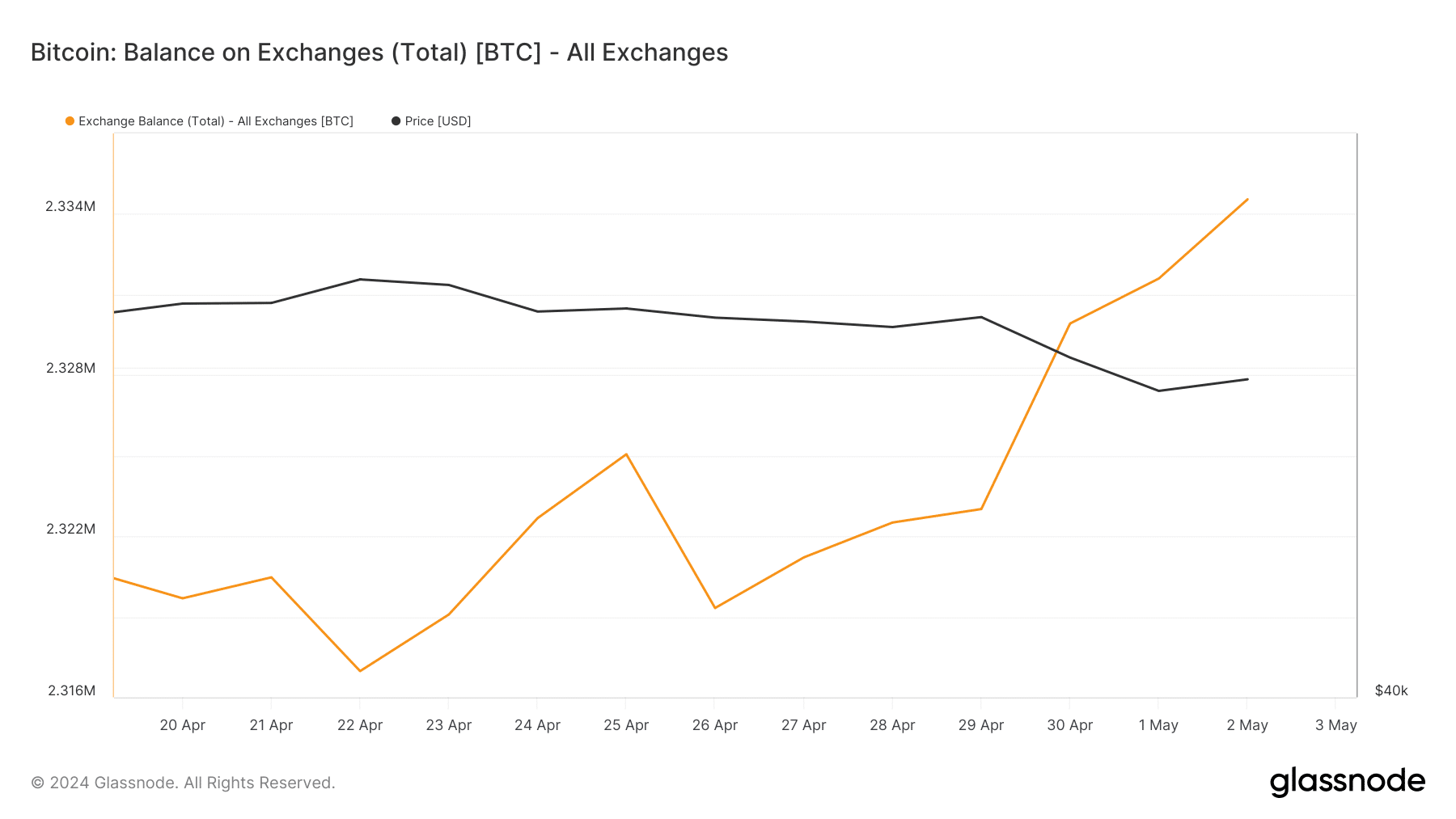

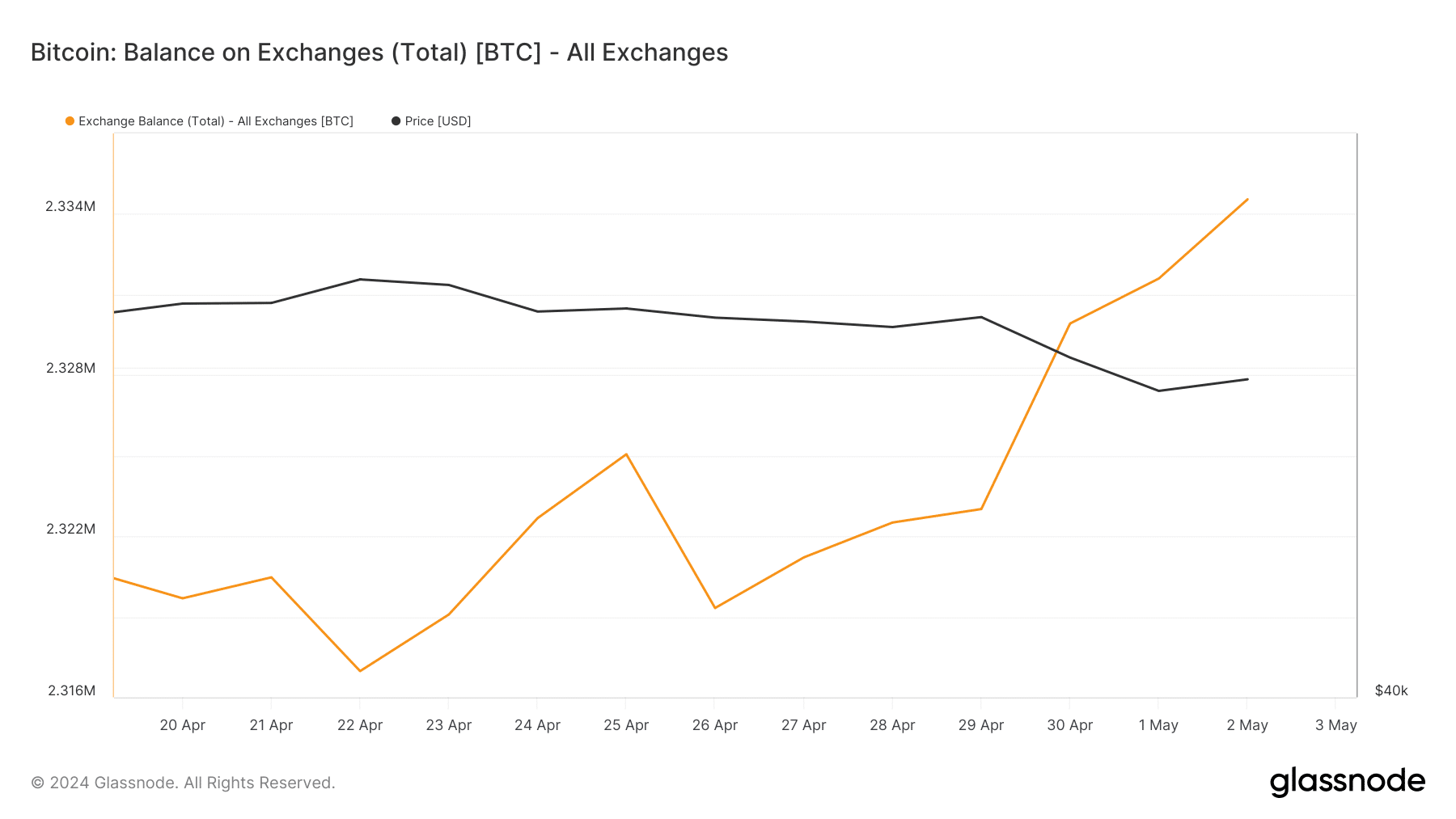

Therefore, AMBCrypto checked Bitcoin’s metrics to see whether buying pressure was high. We found that BTC’s exchange balance registered a sharp upward trend. At press time, BTC’s exchange balance stood at 2.33 billion BTC.

Source: Glassnode

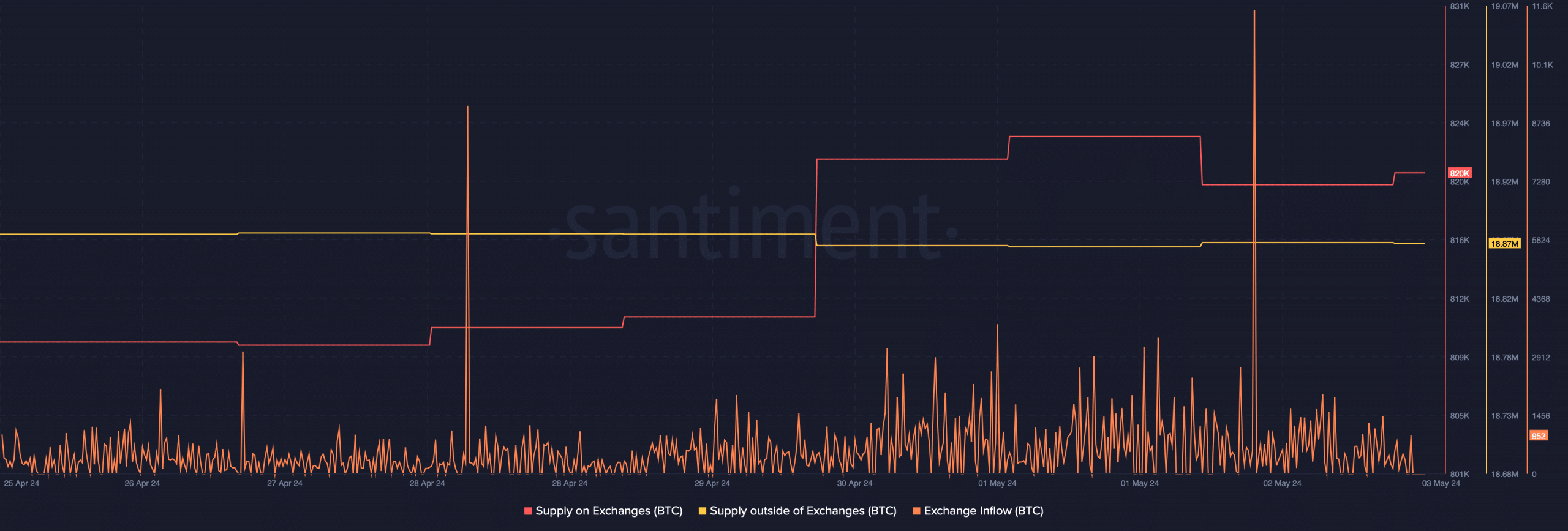

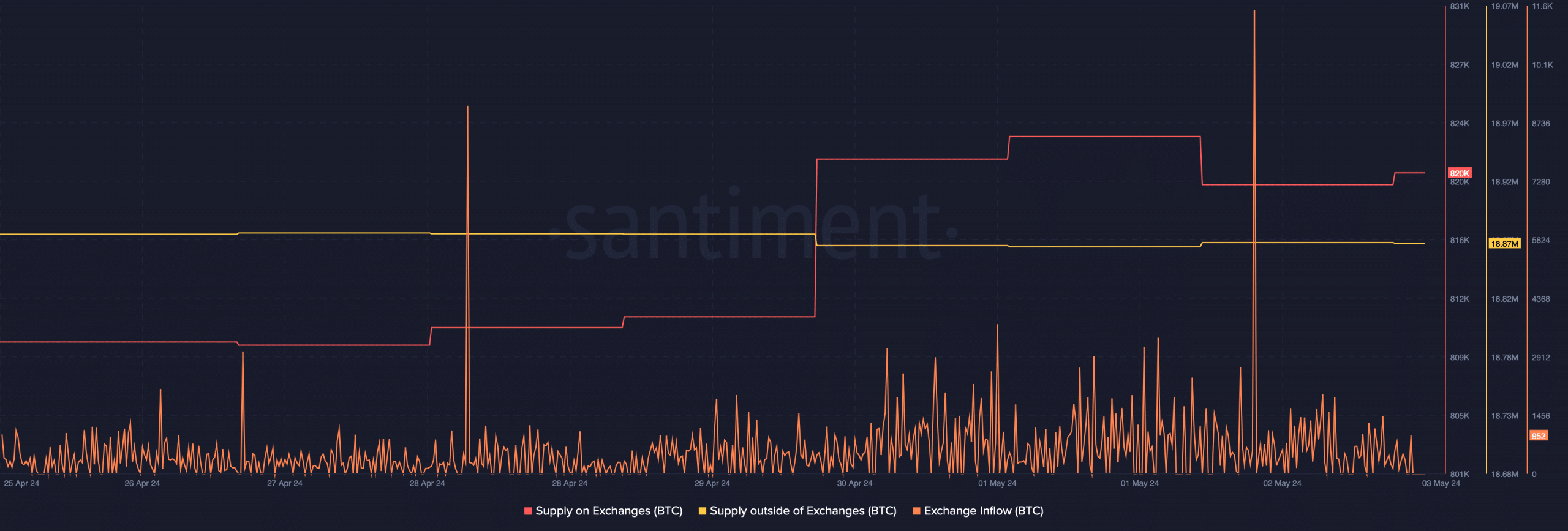

This indicated that investors have been selling BTC. On top of that, BTC’s supply on exchanges rose last week, while its supply outside of exchanges dropped.

The fact that selling pressure on BTC was high was further proven by its exchange inflow, which spiked multiple times in the last seven days.

Source: Santiment

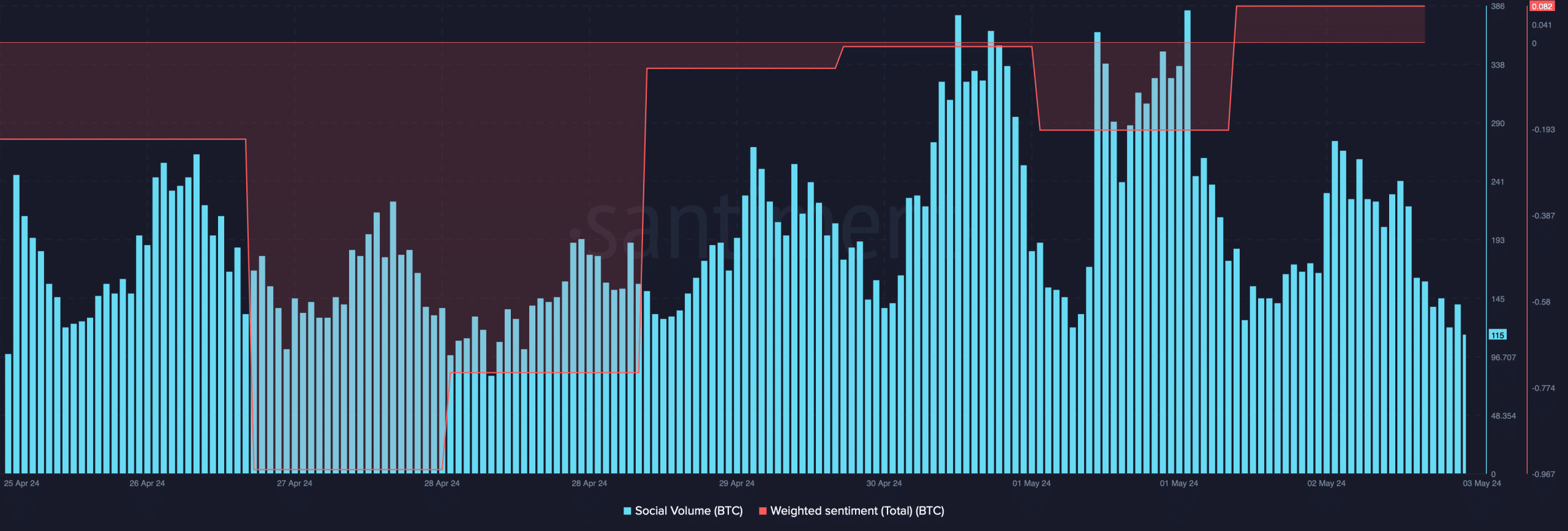

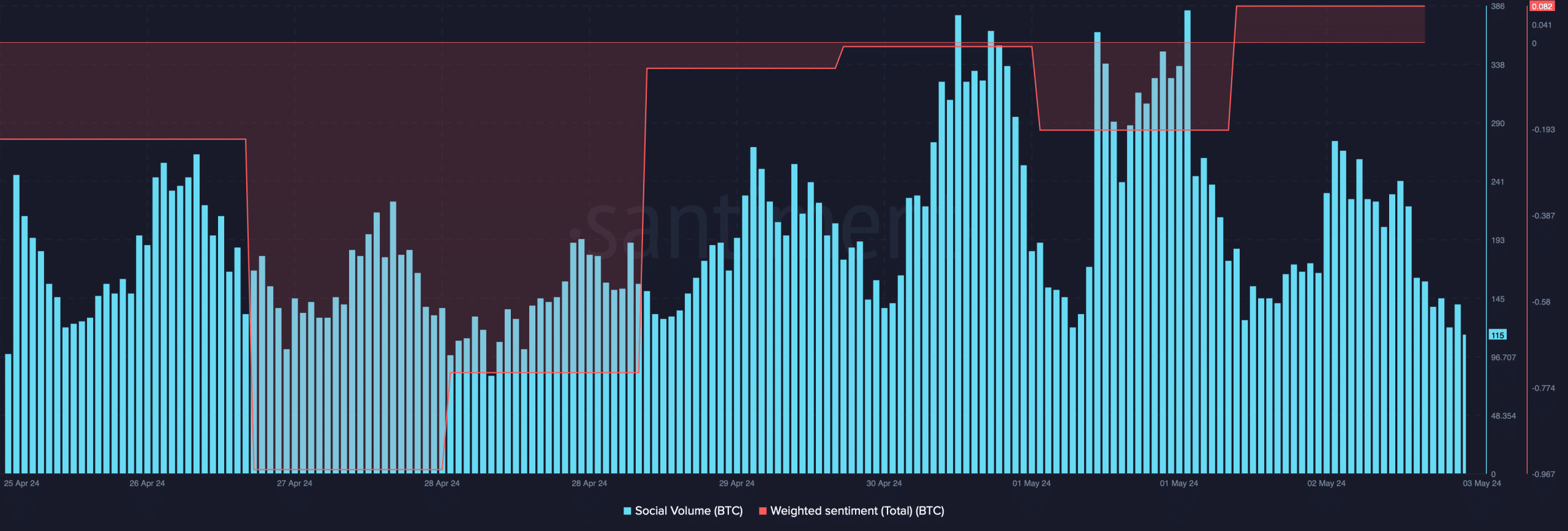

Here, it is interesting to note that the hike in selling pressure didn’t have a negative impact on market sentiment. AMBCrypto’s analysis of Santiment’s data revealed that BTC’s weighted sentiment hiked, suggesting the dominance of bullish sentiment.

Read Bitcoin’s [BTC] Price Prediction 2024–25

Finally, its social volume also remained high, reflecting the king of crypto’s popularity in the crypto space.

Whether investors’ confidence will be enough for BTC to stick to its road to $100k will be an enticing episode to keep an eye on.

Source: Santiment

Source: https://ambcrypto.com/bitcoin-price-prediction-should-you-buy-and-is-100k-still-on-the-cards/