Join Our Telegram channel to stay up to date on breaking news coverage

The current state of the cryptocurrency market has put investors at a standstill, thanks to unexpected price movement in a majority of assets across the domain. There has also been much speculation around Bitcoin’s price and the likelihood of it crossing the $24,500 mark again.

The previous day, the price of Bitcoin had increased by more than 7%, briefly trading above $25,000 and reaching a record high of $25,262 before reverting to around $24,000.

The frontrunner crypto has not seen this price range since August 2022. So, has the price of Bitcoin reached its peak already or will it keep rising? This article will examine the current performance of the digital asset and make future predictions.

Due to Hong Kong’s cryptocurrency initiatives, Bitcoin reaches a new 8-month high

A sharp rise in the value of cryptocurrencies was recorded today, mainly due to positive news coming out of Hong Kong. The Asian financial hub has declared that it will accept investors and digital assets in order to establish itself as a significant cryptocurrency hub in the future.

As of this June, any Hong Kong resident, including entities from the Chinese Mainland, will be able to buy, sell, and trade cryptocurrencies without restrictions.

Prices rose by 9% in a single day as a result of the announcement’s positive market reaction. Hong Kong’s decision to accept digital assets suggests that money from China can now easily flow back into the cryptocurrency markets, despite the country’s ban on the personal use of cryptocurrencies.

Changes were made as a result of Paul Chan, Hong Kong’s Financial Secretary, declaring in January that the city wants to develop a strong regulatory framework for cryptocurrencies.

Bitcoin Price Is Currently Holding At $24,500

Bitcoin’s price is currently about $24,643 and its 24-hour trading volume is above $37 billion. Since yesterday, Bitcoin has increased by about 11%. With a $475 billion live market cap, it is presently ranked first on every website.

Technically speaking, Bitcoin just crossed over $24,300, which represented a huge double top resistance level. The chance of a positive trend continuation in Bitcoin has strengthened as a result of the recent closing bars above this level. Regarding the latest levels of resistance for Bitcoin, they are $25,450 and $26,000.

When there is a bearish breach of the $24,300 level, the BTC price may fall toward the $22,500 level, which is maintained by an ascending channel.

BTC has established an upward channel, and the RSI, as well as MACD indicators, are both in the buying range, so there is a good possibility that it will keep trading bullishly over $24,300.

US Macroeconomic Research Supports Bitcoin Bulls

CPI or Consumer Price Index is an established source of market and cryptocurrency volatility, and this year was no different. It has, however, evidently contributed to the rise of bulls, at least for the top crypto at the moment. As more information on its effect on crypto is yet to come out, the question today is whether the ongoing bullish phase will stick around and further fuel the most recent phase of Bitcoin’s remarkable return in 2023.

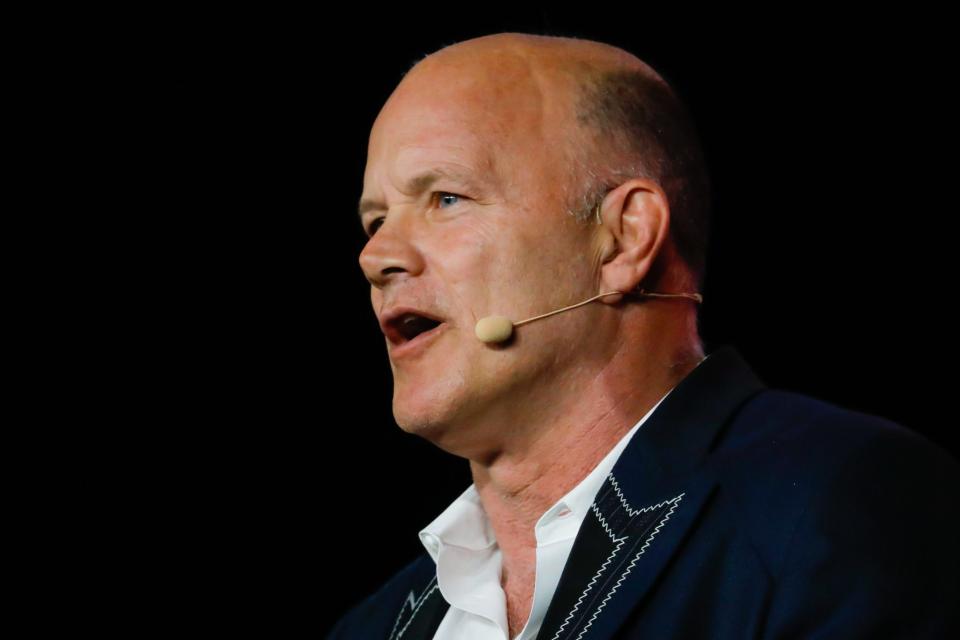

Mike Novogratz, the founder, and CEO of Galaxy Digital has stated his expectation that Bitcoin will hit $30,000 by the end of March. On February 15, Novogratz discussed the price movement and client enthusiasm together at a Bank of America conference. He claimed that rising FOMO is preparing to make his prediction a reality.

With a 12% increase in the last 24 hours, Bitcoin’s highest daily gain in more than a month, the cryptocurrency just has to rise another 21.5% from its present levels to accomplish Novogratz’s goal.

The well-known VC still sees the commodity reaching that level, but not in the next five years, having previously forecast that the price of Bitcoin will reach $500,000 per token in 2024.

To Encourage the Use of Digital Assets, El Salvador Established a “Bitcoin Embassy” in Texas.

The first country to accept Bitcoin as legal cash was El Salvador, and since then, it has done more to promote the usage of digital assets. The government intends to promote the acceptance of cryptocurrencies by opening a “Bitcoin consulate” in Texas.

Milena Mayorga, the US ambassador to El Salvador, tweeted about this development on February 17. This proposal comes after Switzerland took a similar step to encourage the usage of digital assets last year. El Salvador intends to further its initiatives to encourage the use of Bitcoins internationally by establishing a “Bitcoin consulate” in Texas.

The plan was made public following a tweet from Milena Mayorga, the country’s US ambassador. This action comes after a related push by Switzerland to promote the usage of cryptocurrencies last year.

Conclusion

The price of Bitcoin reached a recent all-time high of more than $24,500 on February 18 before falling as a result of more selling pressure. If Bitcoin’s latest high is broken, it is likely that the token will continue on its upward trajectory.

In the last 24 hours, the Bitcoin price has surged by more than 4%, indicating that perhaps the bulls are back and staying put. The technical indicator is poised to cross the upper channel boundary if they keep increasing purchasing pressure.

Read More:

Fight Out (FGHT) – Newest Move to Earn Project

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Live Now

- Earn Free Crypto & Meet Fitness Goals

- LBank Labs Project

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Join Our Telegram channel to stay up to date on breaking news coverage

Source: https://insidebitcoins.com/news/bitcoin-price-holding-at-24500-is-last-junes-high-the-next-target