Quick Take

Bitcoin recently reached a year-to-date high of approximately $65,500 during European trading hours.

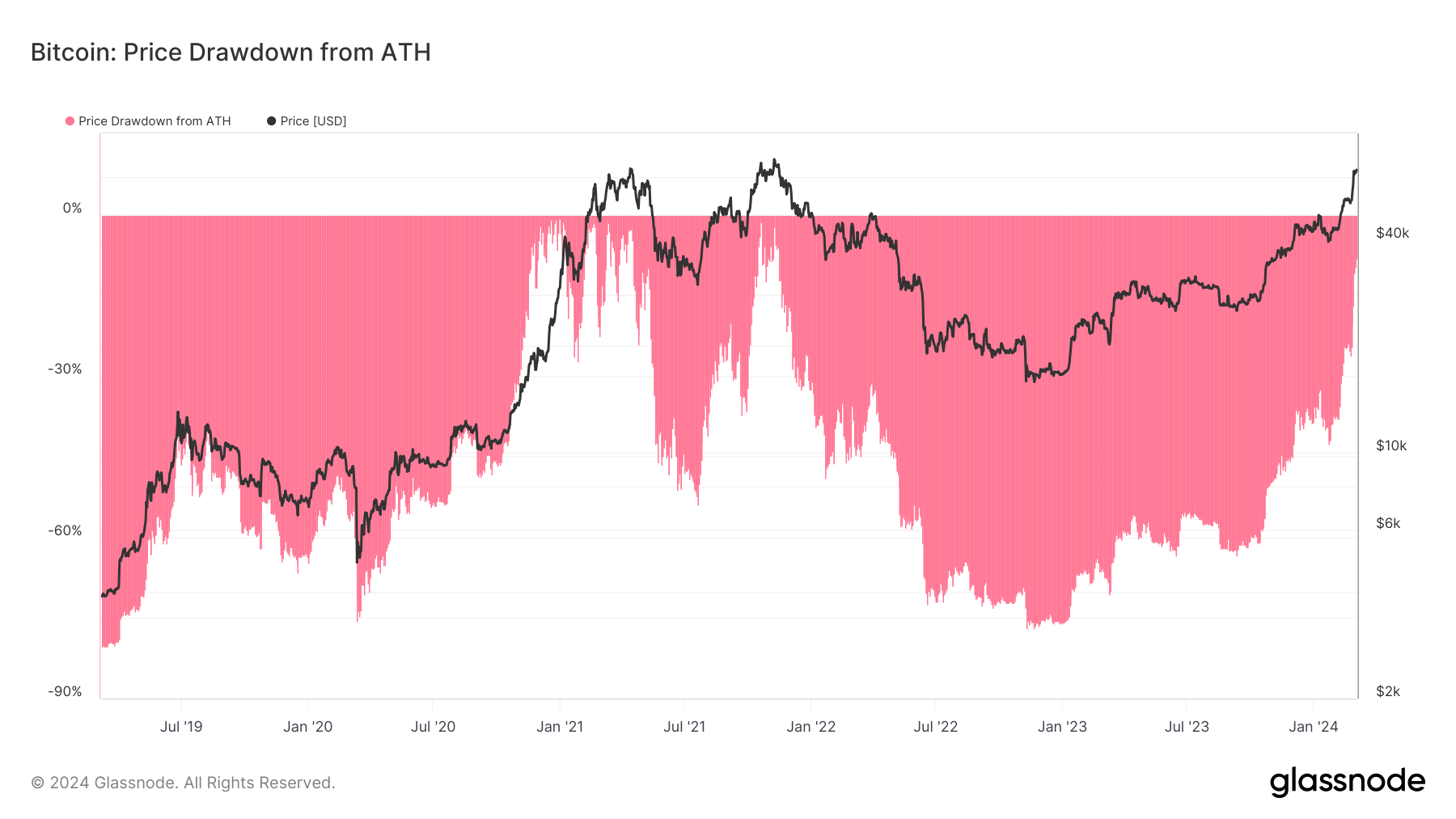

This resurgence brings Bitcoin within 8% of its all-time fiat value high of around $69,000, reached back in November 2021 (around 844 days ago). However, the journey upward has not been devoid of turbulence.

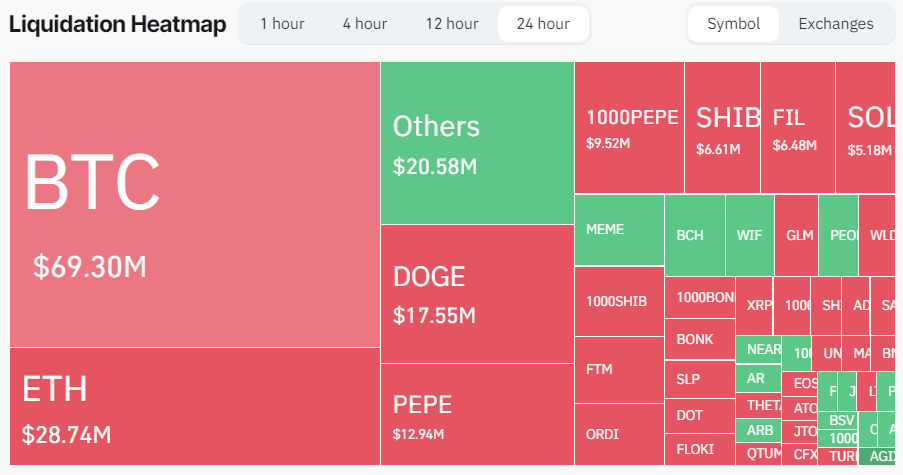

Recent data from Coinglass reveals that the digital asset ecosystem has suffered approximately $230 million in liquidations in the past 24 hours, with Bitcoin accounting for roughly $70 million, mainly driven by short positions equalling roughly $50 million.

It’s noteworthy to mention that Bitcoin has experienced a significant appreciation of approximately 44% year to date. In terms of nominal fiat value, this signifies a rise from $44,000 to a commendable $65,000.

Interestingly, Bitcoin’s rise comes before a “halving” event, a significant occurrence that has historically never been preceded by a Bitcoin all-time high.

The post Bitcoin passes $65,000 as liquidations surge and halving approaches appeared first on CryptoSlate.

Source: https://cryptoslate.com/insights/bitcoin-passes-65000-as-liquidations-surge-and-halving-approaches/