Bitcoin Analysis

Bitcoin’s price closed back above an important inflection point on Monday [$19,891] and concluded its daily session $+78.8.

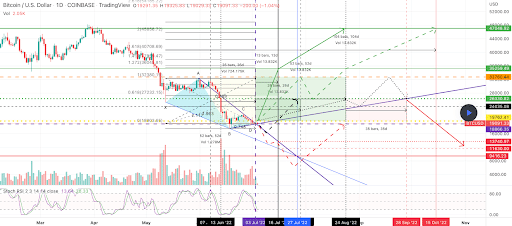

The first chart we’re analyzing for Tuesday is the BTC/USD 1D chart below from otwa2113. BTC’s price is trading between the 0 fibonacci level [$18,903.65] and 0.618 [$27,232.15] at the time of writing.

The targets for bullish BTC traders to the upside are 0.618, 1 [$32,380.15], and 1.272 [$36,041.81].

From the bearish perspective, they’re aiming to push BTC’s price below the 0 fib level with a secondary target of $13,740.97.

Bitcoin’s Moving Averages: 5-Day [$19,573.97], 20-Day [$22,552.32], 50-Day [$28,459.32], 100-Day [$35,074.06], 200-Day [$43,048.77], Year to Date [$36,515.48].

The Fear and Greed Index is 19 Extreme Fear and is +5 from Monday’s reading of 14 Extreme Fear.

BTC’s 24 hour price range is $19,050-$20,343 and its 7 day price range is $18,817-$21,108. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $33,668.

The average price of BTC for the last 30 days is $23,187.4 and its -34.5% over the same duration.

Bitcoin’s price [+4.74%] closed its daily candle worth $20,224 on Monday and in green figures for a second consecutive day.

Ethereum Analysis

Ether also marked-up in price on Monday and concluded its daily session +$77.21.

The second chart we’re looking at for Tuesday is the ETH/USD 4HR chart below by EthanTW. ETH’s price looks to potentially be forming a Head & Shoulders pattern on the 4HR timescale.

Ether’s price is trading between the 0.382 fib level [$1,080.98] and 0 [$1,115.00], at the time of writing.

The overhead targets for Ether bulls are the 0 fib level followed by the $1,400-$1,500 level.

The target to the downside for Ether bears are 0.382, 0.5 [$1,070.47], and 0.618 [$1,059.97].

Ether’s Moving Averages: 5-Day [$1,081.76], 20-Day [$1,258.82], 50-Day [$1,838.15], 100-Day [$2,398.14], 200-Day [$3,064.58], Year to Date [$2,544.79].

ETH’s 24 hour price range is $1,045.57-$1,160.9 and its 7 day price range is $1,010-$1,229. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $2,195.73.

The average price of ETH for the last 30 days is $1,300.57 and its -39.51% for the same time frame.

Ether’s price [+7.19%] closed its daily candle on Monday worth $1,151.27 and in green figures for a third straight day.

Dogecoin Analysis

Dogecoin’s price followed the macro crypto market higher as well during its daily session on Monday and Doge concluded its day +$0.0023.

The third chart we’re looking at for Tuesday is the DOGE/USD 1W chart below from EdgarTigranyan. Dogecoin’s price is trading between 0.00% [$0.0519] and 23.60% [$0.1202], at the time of writing.

Dogecoin bulls are looking overhead to break the 23.60% fib level followed by 38.20% [$0.162] and 50.00% [$0.196].

Bearish traders have targets to the downside of the 0 fib level with a secondary target of [$0.04].

Dogecoin’s Moving Averages: 5-Day [$0.066], 20-Day [$0.066], 50-Day [$0.086], 100-Day [$0.110], 200-Day [$0.155], Year to Date [$0.120].

Doge’s price is -72.7% against The U.S. Dollar for the last 12 months, -51.05% against BTC, and -42.62% against ETH over the same duration.

Dogecoin’s 24 hour price range is $0.065-$0.069 and its 7 day price range is $0.062-$0.072. Doge’s 52 week price range is $0.049-$0.351.

Dogecoin’s price on this date last year was $0.231.

The average price of DOGE over the last 30 days is $0.067 and its -16.65% over the same timespan.

Dogecoin’s price [+3.17%] closed its daily candle on Monday worth $0.0693 and in green figures for a fourth consecutive day.

Source: https://en.cryptonomist.ch/2022/07/05/bitcoin-crypto-market-higher-monday/