Key Points:

- Bitcoin halving 2024 introduces groundbreaking changes in onchain activity and market structure.

- Continued adoption of Bitcoin ETFs proves pivotal in mitigating sell pressure during and post-halving.

- The advent of ordinal inscriptions injects new life into onchain activity, shaping Bitcoin’s future dynamics.

Bitcoin halving 2024 approaches its next halving event around April 2024, the cryptocurrency landscape is set for a fundamental shift.

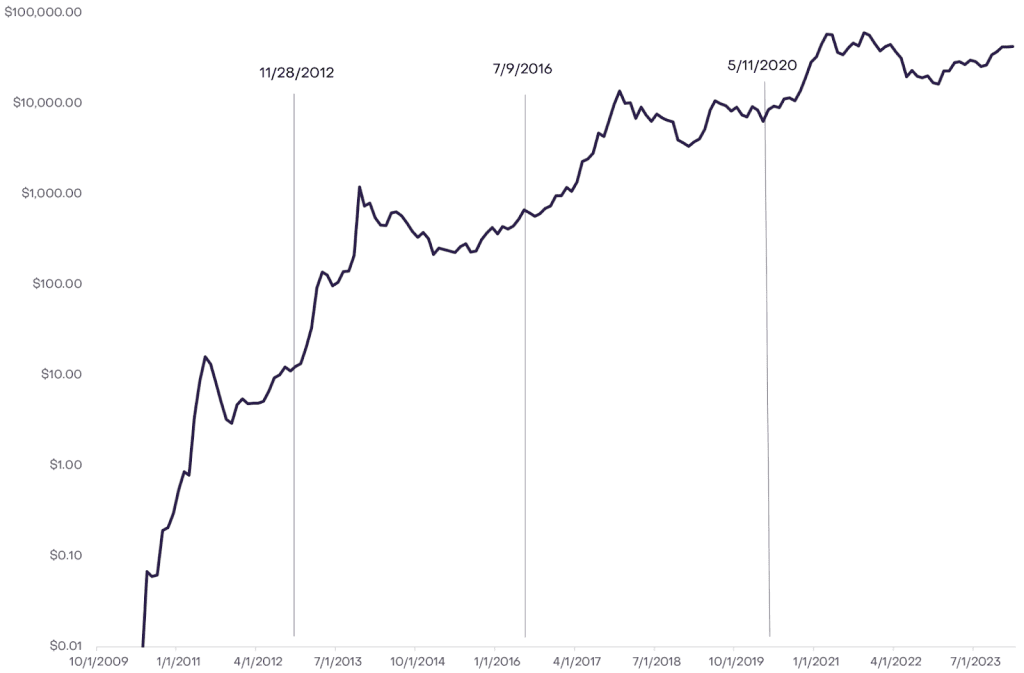

Unlike previous halvings, this upcoming milestone is accompanied by significant developments in onchain activity and positive market structure updates.

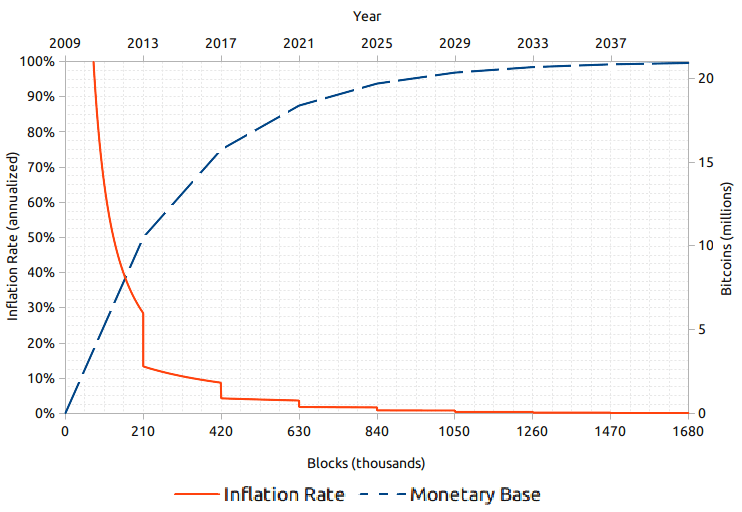

The halving, occurring approximately every four years, involves reducing the rate at which new bitcoins are created by half. This event is hard-coded into Bitcoin’s protocol and plays a crucial role in managing its overall supply. The impending halving in 2024 is expected to bring unique changes to the cryptocurrency ecosystem.

Unraveling Transformations in April 2024

Key among these changes is the surge in fundamental onchain activity. Onchain metrics, which encompass transactions and other activities recorded on the blockchain, indicate a robust and growing engagement with the Bitcoin network. This increased onchain activity signifies a growing user base and heightened interest in utilizing Bitcoin for various purposes beyond mere speculation.

Positive market structure updates further differentiate this halving from its predecessors. The market’s structure, including factors like liquidity, order book dynamics, and institutional involvement, has evolved favorably. These positive changes contribute to a more stable and resilient market environment as Bitcoin readies itself for the upcoming supply adjustment.

ETF Surge and Onchain Revitalization: Navigating Bitcoin’s Evolutionary Path

The continued adoption of Bitcoin ETFs is identified as a potential mitigator of sell pressure during and after the halving. As institutional and retail investors increasingly turn to Bitcoin ETFs, these investment vehicles serve as a conduit for absorbing selling activity. This trend aligns with the broader acceptance of Bitcoin as a legitimate asset class.

A noteworthy development contributing to the vitality of onchain activity is the introduction of ordinal inscriptions. These unique digital markings on the blockchain have injected a renewed sense of dynamism into the Bitcoin ecosystem. The precise impact and utility of ordinal inscriptions are still unfolding, but they hold the potential to further enhance the functionalities and possibilities within the Bitcoin network.

As Bitcoin enthusiasts and investors anticipate the halving in April 2024, the convergence of these factors—fundamental onchain activity, positive market structure updates, ETF adoption, and ordinal inscriptions—paint a picture of a transformative event that extends beyond the traditional narrative associated with halvings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 14 times, 1 visit(s) today

Source: https://coincu.com/247078-bitcoin-halving-2024-unique-fundamentals-and-etf-surge-impact-market-dynamics/