As Bitcoin and altcoins approach the end of 2023, the BTC price is at $43,000.

CoinShares, which publishes its weekly cryptocurrency report every week, did not publish its weekly report this week due to the Christmas holiday.

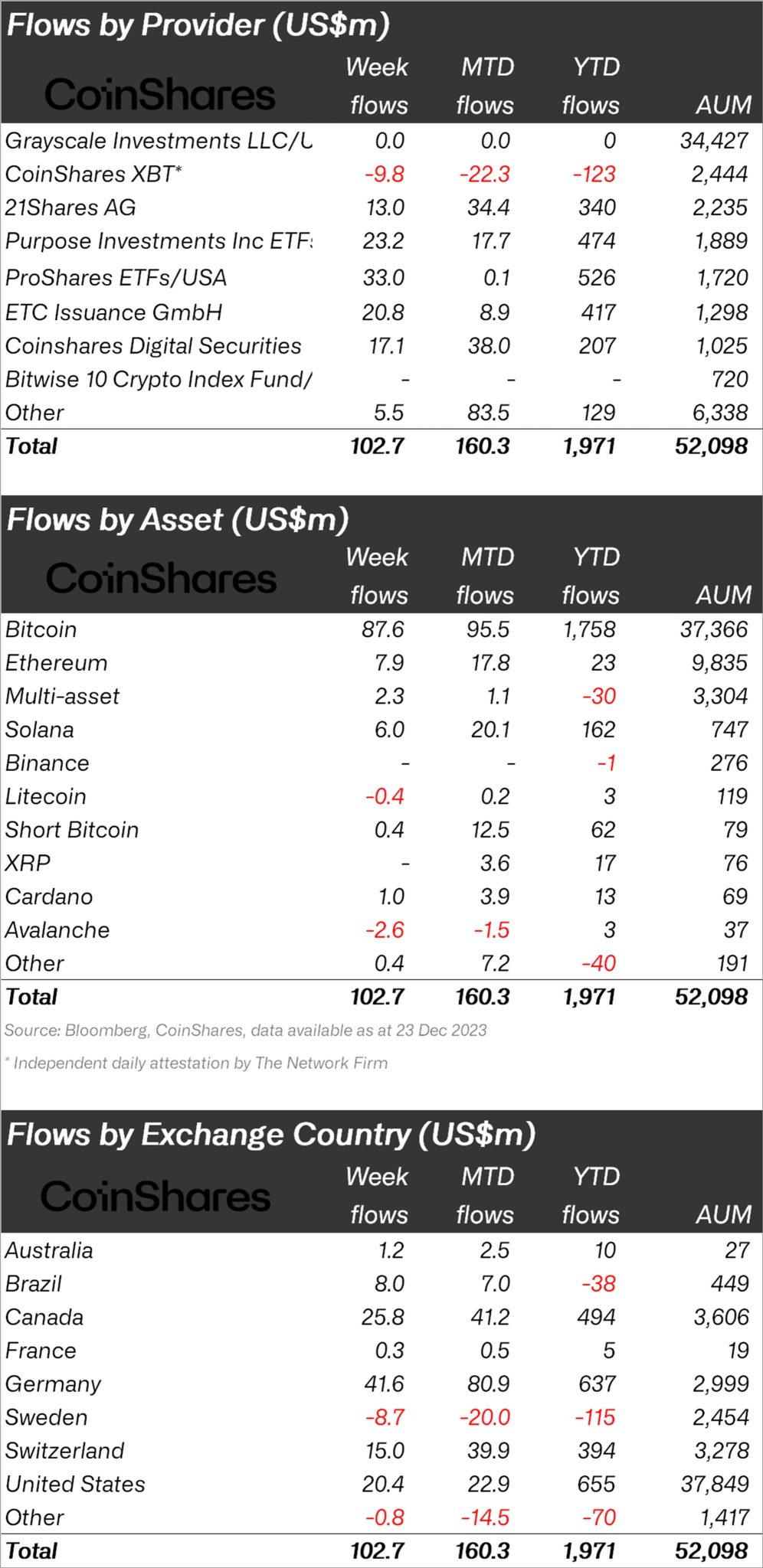

However, Coinshares research head James Butterfill said in his post on his X account that there was an inflow of $103 million into cryptocurrency investment products last week.

“$103 million inflow into digital assets last week, no report on Monday. Merry Christmas!”

US$103m inflows in digital assets last week, no report on Monday. Merry Christmas! pic.twitter.com/xAVzCrPPkQ

— James Butterfill (@jbutterfill) December 23, 2023

When looking at crypto funds individually, it was seen that the majority of fund inflows were in Bitcoin.

While BTC experienced an inflow of $87.6 million last week, the largest altcoin Ethereum (ETH) saw an inflow of $7.9 million.

A small inflow of $0.4 million was seen in the Bitcoin Short fund, which was indexed to the decline of BTC.

When we look at the altcoins, Solana (SOL) continued to inflow, with an inflow of $6 million, Cardano (ADA) an inflow of $1 million, Litecoin (LTC) an outflow of $0.4 million, and Avalanche (AVAX) an outflow of $2.6 million.

When looking at regional fund inflows and outflows, it was seen that Germany ranked first with an inflow of 41.6 million dollars.

Canada ranked second after Germany with 25.8 million dollars; The USA ranked third with 20.4 million dollars.

Against these inflows, Sweden experienced an outflow of 8.7 million dollars.

*This is not investment advice.

Follow our Telegram and Twitter account now for exclusive news, analytics and on-chain data!

Source: https://en.bitcoinsistemi.com/bitcoin-ethereum-and-solana-continue-to-be-the-focus-of-institutional-investors-interest-in-these-two-altcoins-has-decreased/