The U.S. SEC account on X Platform was compromised on Tuesday leading to fake tweets of Bitcoin ETF approval and causing a stir in the BTC price movements. The BTC price surged all the way to $48,000, however, it has dropped to $46,000 as of writing this story.

Bitcoin ETF Approval

In a surprising turn of events, Bitcoin prices surged to a 19-month high, reaching $47,900, only to experience a brief dip to $45,100. The volatility was mainly due to a false announcement posted on a hacked U.S. SEC Twitter account, falsely claiming the approval of a Bitcoin ETF.

Bloomberg ETF analyst Eric Balchunas addressed the situation, anticipating the official SEC announcement of the Bitcoin spot ETF approval between 16:00 and 17:00 ET on Wednesday, with the listing set for Thursday. The incident highlights the impact of misinformation on cryptocurrency markets and the anticipation surrounding potential ETF approvals.

The Bitcoin price has been oscillating around $45,000 over the last week and more amid expectation of the spot Bitcoin ETF approval. Some analysts believe that this could be a sell-the-news event going ahead with Bitcoin likely seeing a pullback to around $40,000.

Also, in a recent analysis by crypto analyst Ali Martinez, Bitcoin (BTC) has solidified a robust support zone at $42,000, underpinned by the presence of 2.48 million addresses collectively holding over 1.12 million BTC.

The on-chain data also indicates that if Bitcoin manages to breach the resistance level at $48,000, a clear path forward may be on the horizon. Notably, there are no significant supply zones in the immediate vicinity, suggesting that BTC could potentially set its sights on $55,000. This analysis provides further insights into the key levels and dynamics shaping Bitcoin’s current price movement.

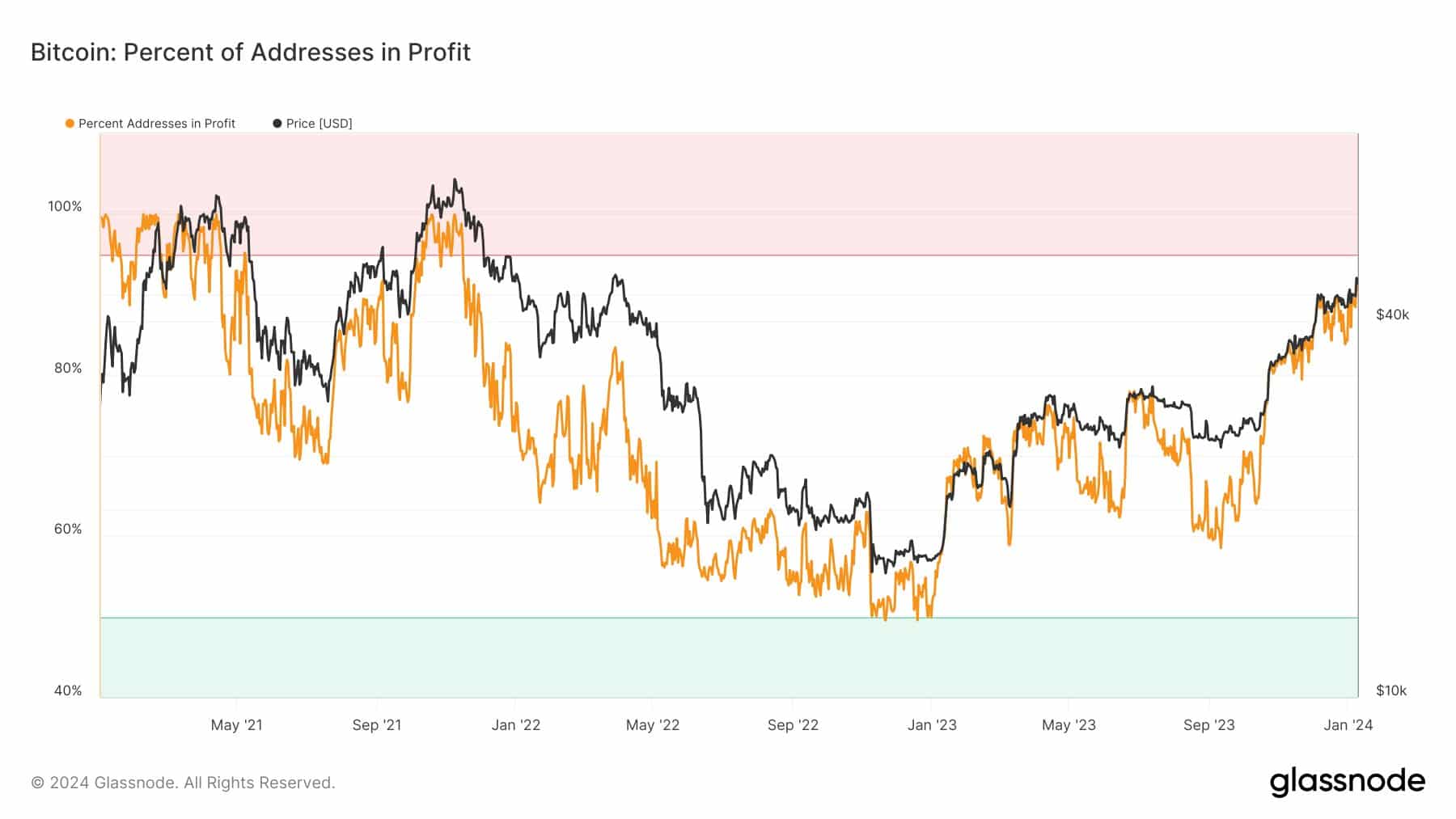

90% of BTC Holders Are In Profit

In a recent report from Glassnode, it has been revealed that with Bitcoin (BTC) surpassing the $46,000 threshold, over 90% of all coin-holding addresses are currently experiencing profit. This marks a significant milestone as it is the first instance of such widespread profitability since November 2021. The question remains whether these addresses will continue to hold or move towards profit booking.

Additionally, the report indicates that approximately 78% of Ethereum (ETH) holding addresses are also currently in a profitable position. The data sheds light on the positive market sentiment and the financial gains realized by a substantial majority of cryptocurrency investors.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/90-of-bitcoin-holders-are-currently-sitting-on-profits-buy-or-sell/

✓ Share: