- Uniswap’s development activity was the highest in October

- Since FTX collapsed, the DEX has seen a surge in user activity

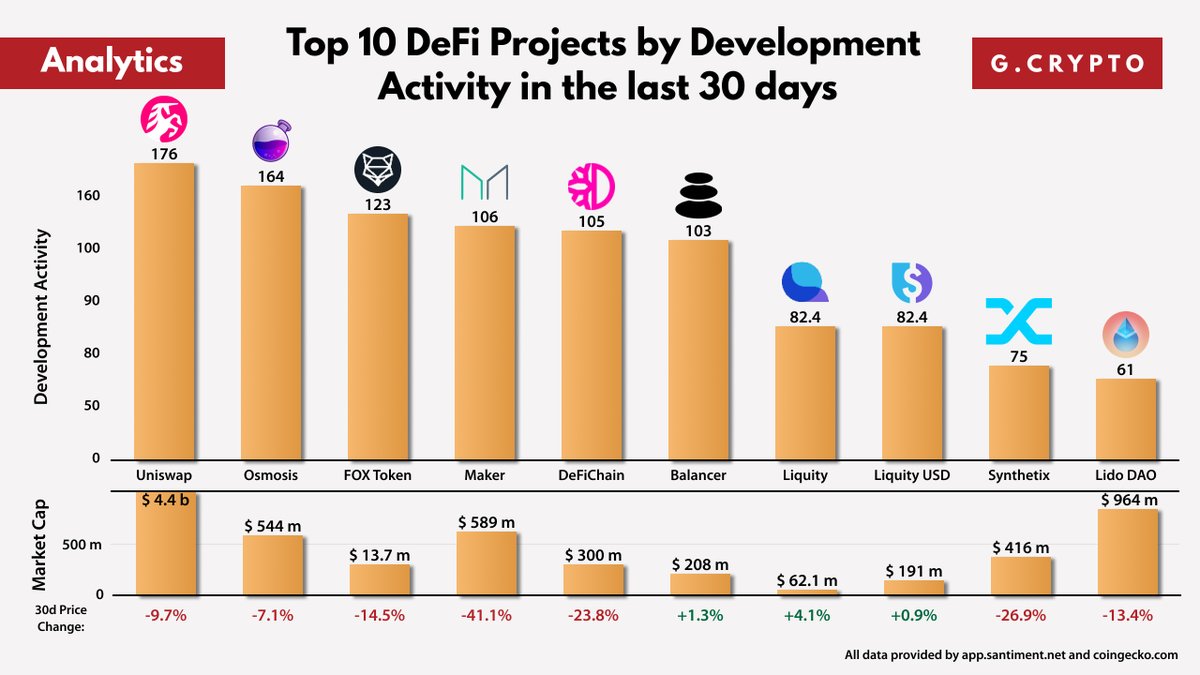

According to data from on-chain analytics platform Santiment, the decentralized finance (DeFi) protocol Uniswap [UNI] had the most development activity in the last month.

Read Uniswap’s [UNI] price prediction 2023-2024

In the last 30 days, Uniswap’s GitHub events totaled 176. It was followed by Osmosis [OSMO] and Fox Token [FOX], which had 164 and 123 GitHub events, respectively.

The month so far has been a particularly interesting one for Uniswap. The sudden fallout of leading exchange FTX led to a decline of trust in centralized exchanges and a migration of users to decentralized exchanges.

According to crypto analyst WuBlockchain, the “loss of trust in CEX” caused a hike in trading volume on Uniswap. This was because Uniswap V2 and V3 burned over 2300 Ethereum [ETH] between 7 and 14 November. This caused the leading altcoin to “fall into deflation.”

Due to the loss of trust in CEX, the trading volume of Uniswap increased, V3 and V2 burned more than 2300 ETH in 7d, which has caused ETH to fall into deflation. MEV robotics activity has recently peaked. The number of addresses trading USDC in DEXs also hit a new high.

— Wu Blockchain (@WuBlockchain) November 14, 2022

A look at UNI

While Uniswap saw growth in user activity and development activity in the last month, courtesy of the collapse of FTX, its native token failed to register the same success.

Per data from CoinMarketCap, UNI had attempted a price rally between 19 October and 6 November, and its price went up by 17% during that period. However, things suddenly turned awry when the FTX revelations came to light on 6 November.

The altcoin’s price has since declined by 24%. At press time, UNI exchanged hands at $5.76.

As users left CEXs to seek solace on DEXs from 6 November, the count of unique addresses that traded UNI went up. However, by 13 November, the token had both crossed its peak and declined. At press time, daily active addresses that traded UNI stood at 1717, dropping by 44% in the last six days.

Following a similar progression, the count of new addresses that joined the UNI network went up on 6 November to peak at 1959 addresses by 13 November. However, it has since gone down by 54%.

On a year-to-date basis, the price per UNI token fell by 66%. Unsurprisingly, UNI holders have held at a loss since the year started. According to on-chain data from Santiment, the alt’s Market Value to Realized Value (MVRV) ratio has been negative since January. Still negative at press time, the MVRV ratio was -57.38%.

Source: https://ambcrypto.com/uniswap-user-and-dev-activity-lack-of-profitability-and-everything-in-between/