- ZK’s market capitalization dropped from $800 million to $648 million

- Bearish sentiment around the token seemed to be rising too

zkSync Era [ZK] recently made headlines with its latest token airdrop. Thanks to the same, the layer-2’s network activity also witnessed growth over the last seven days. However, soon after the airdrop, the token saw a major price correction on the charts.

All about the zkSync Airdrop

zkSync, which last year claimed the title of becoming the first-ever zk-compatible EVM, recently airdropped its newly launched token called ZK. A total of more than 3.6 million tokens were airdropped, which were distributed among 695,000 addresses that met the criteria for interacting with ZKsync Era or its non-EVM-compatible predecessor, ZKsync Lite.

Officials revealed on Monday that more than 45% of the airdropped ZK token supply was claimed by over 225,000 addresses in less than 2 hours.

Initially, during the launch, the token had a value of $0.27 and a market capitalization of $800 million. However, the token saw a major price decline soon after its launch. In the last 24 hours alone, ZK’s price declined by more than 9%. At the time of writing, ZK was trading at $0.1765 with a market cap of over $648 million.

However, investors must not worry, as such price corrections are very common post-airdrops. For reference, Notcoin [NOT], which was airdropped a few weeks ago, also recorded a similar price drop.

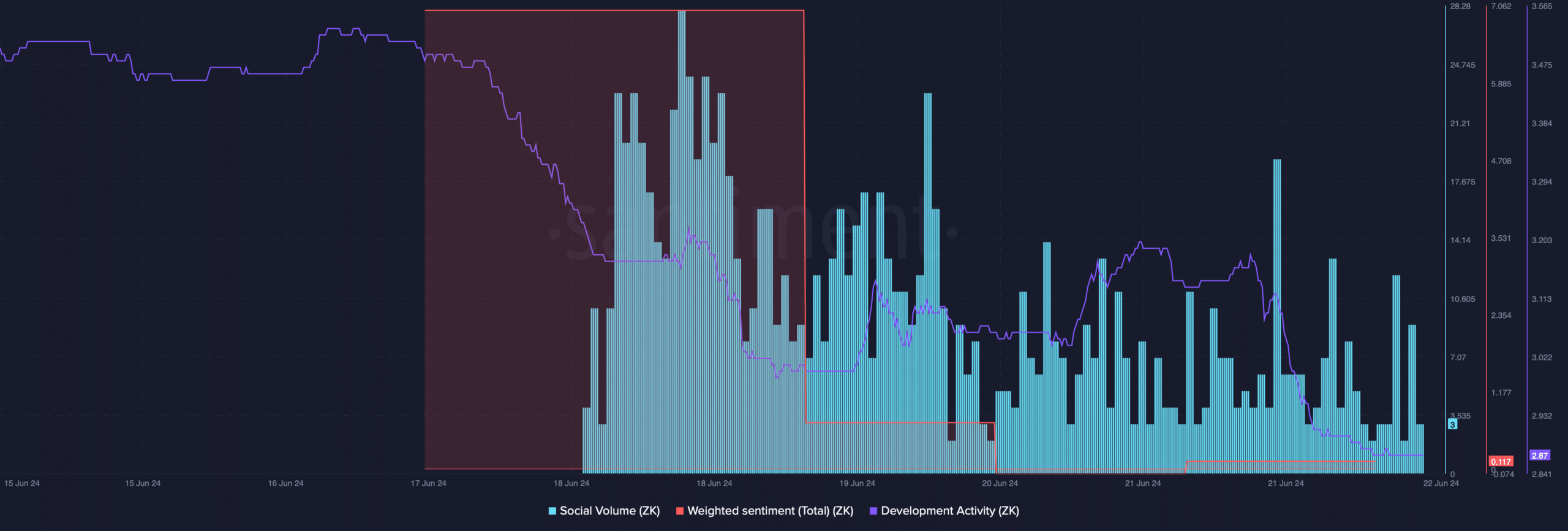

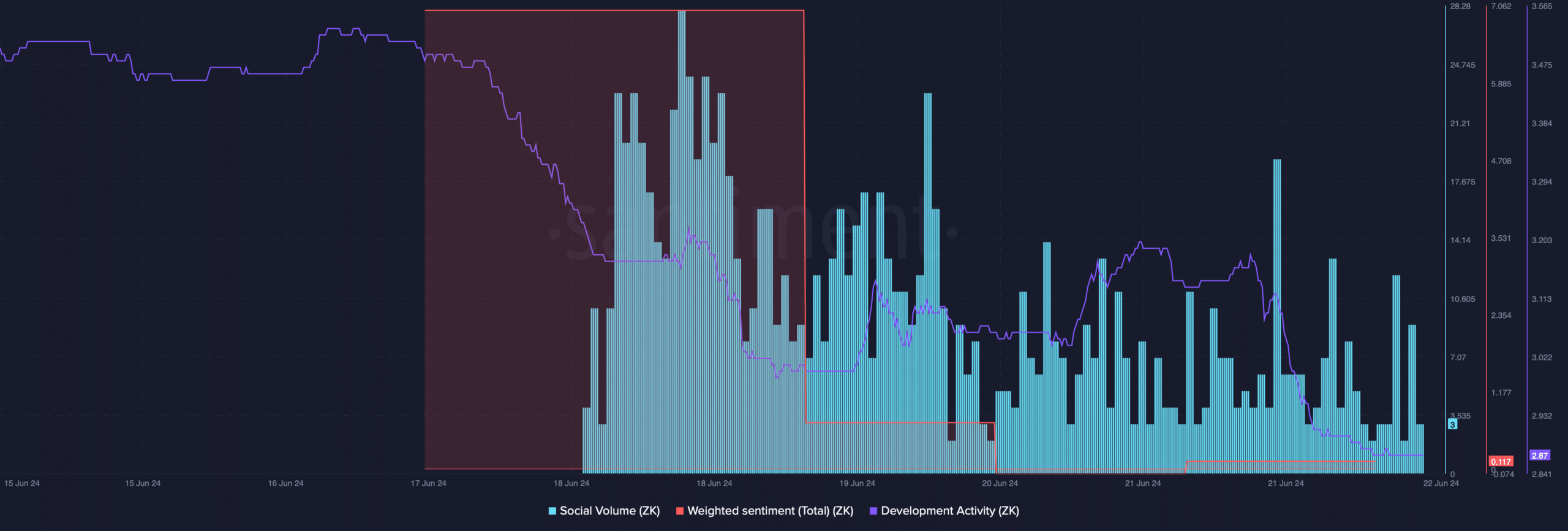

ZK has other reasons to worry though. AMBCrypto’s analysis of Santiment’s data revealed that its social volume dropped, reflecting a decline in its popularity. Its weighted sentiment also dropped, meaning that bearish sentiment around the token rose.

Additionally, its development activity fell, which can be interpreted as a bearish metric.

Source: Santiment

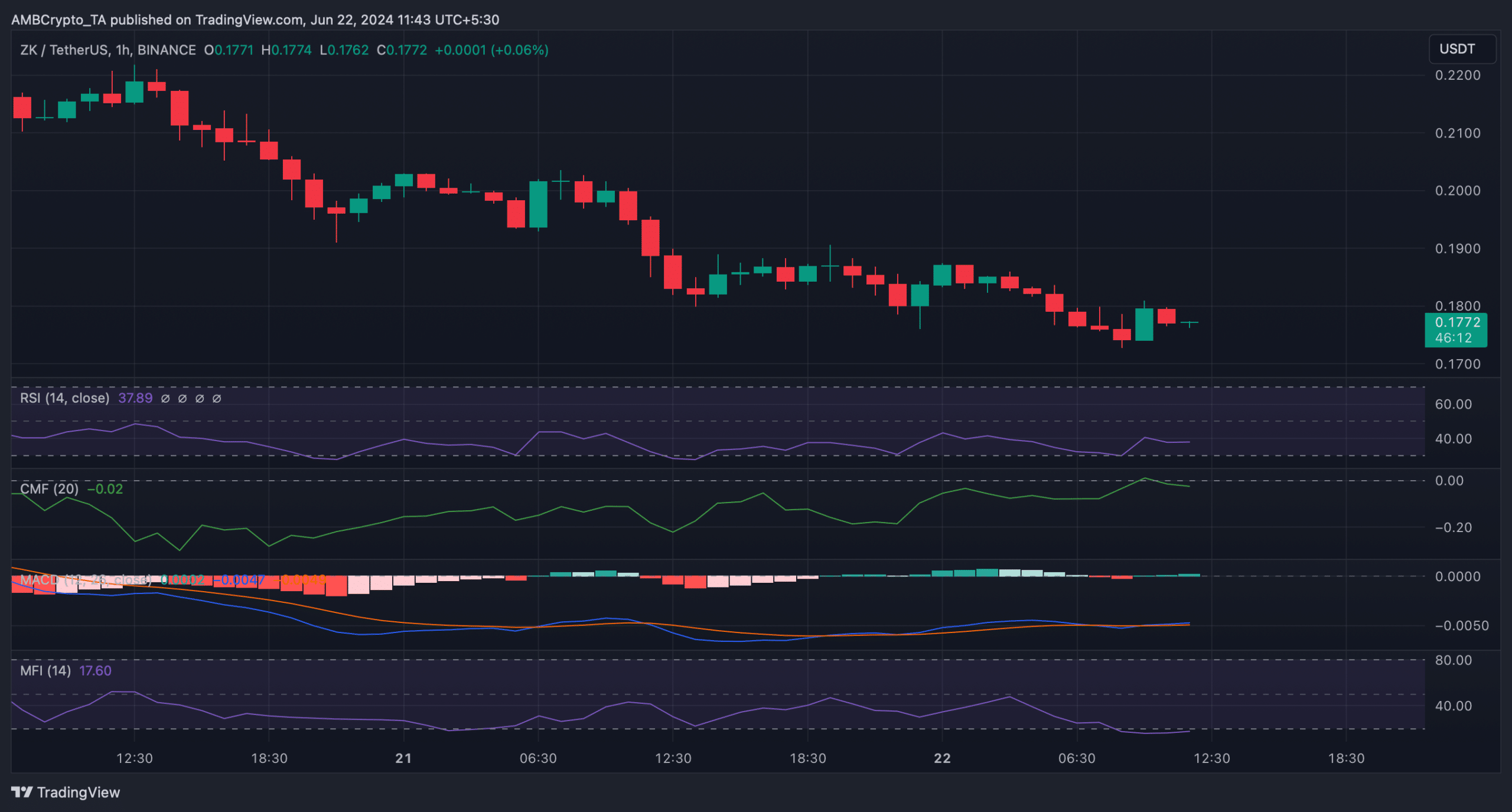

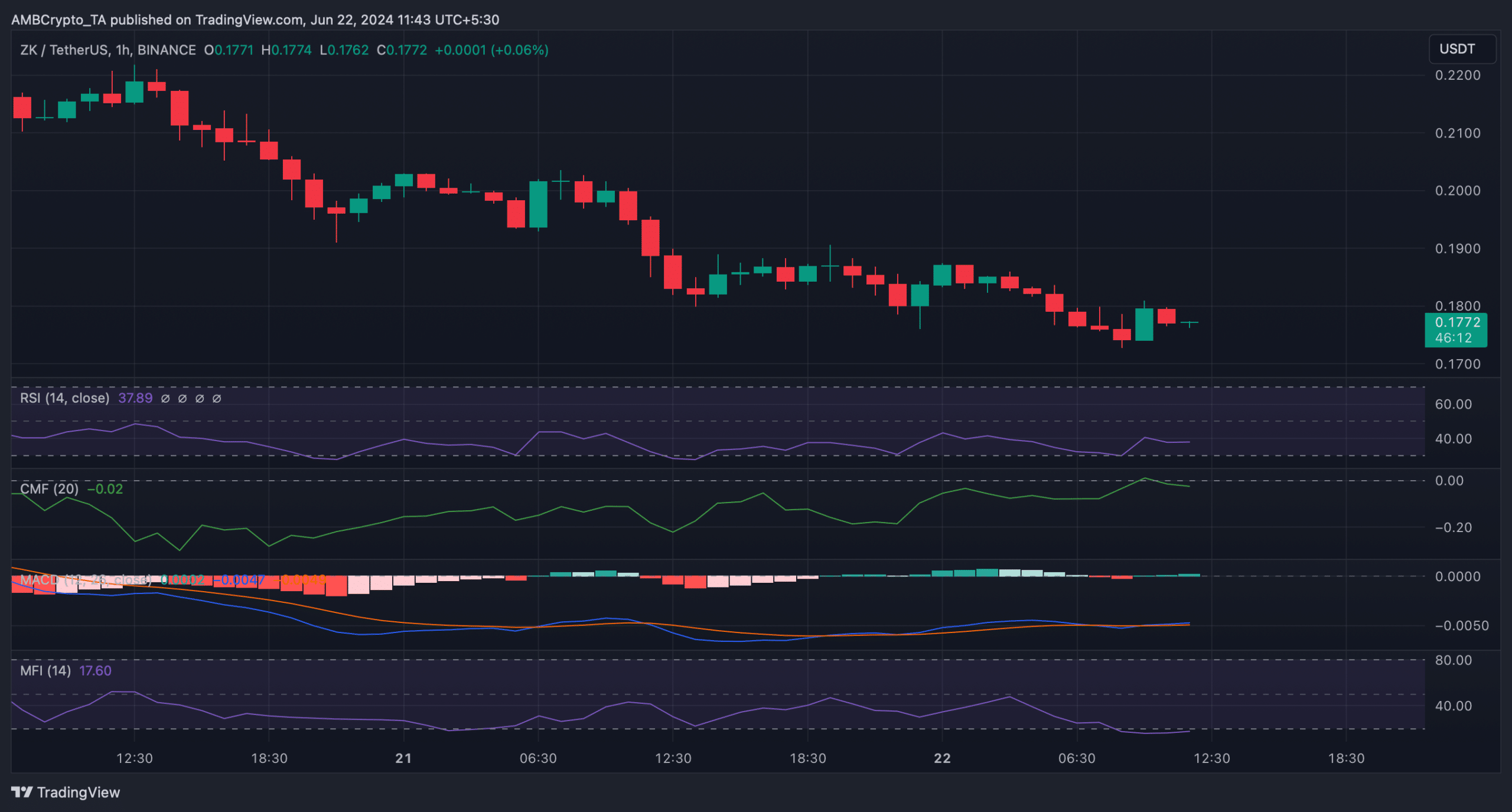

AMBCrypto then planned to have a look at ZK’s hourly chart to better understand whether there were any chances of a price uptick in the short term. We found that both ZK’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) registered sharp downticks, hinting at a sustained price drop.

Nonetheless, the Money Flow Index (MFI) was in the oversold zone, which might exert buying pressure on the token and in turn, list its price. Additionally, the MACD projected a bullish crossover on the charts.

Source: TradingView

Is zkSync’s activity rising?

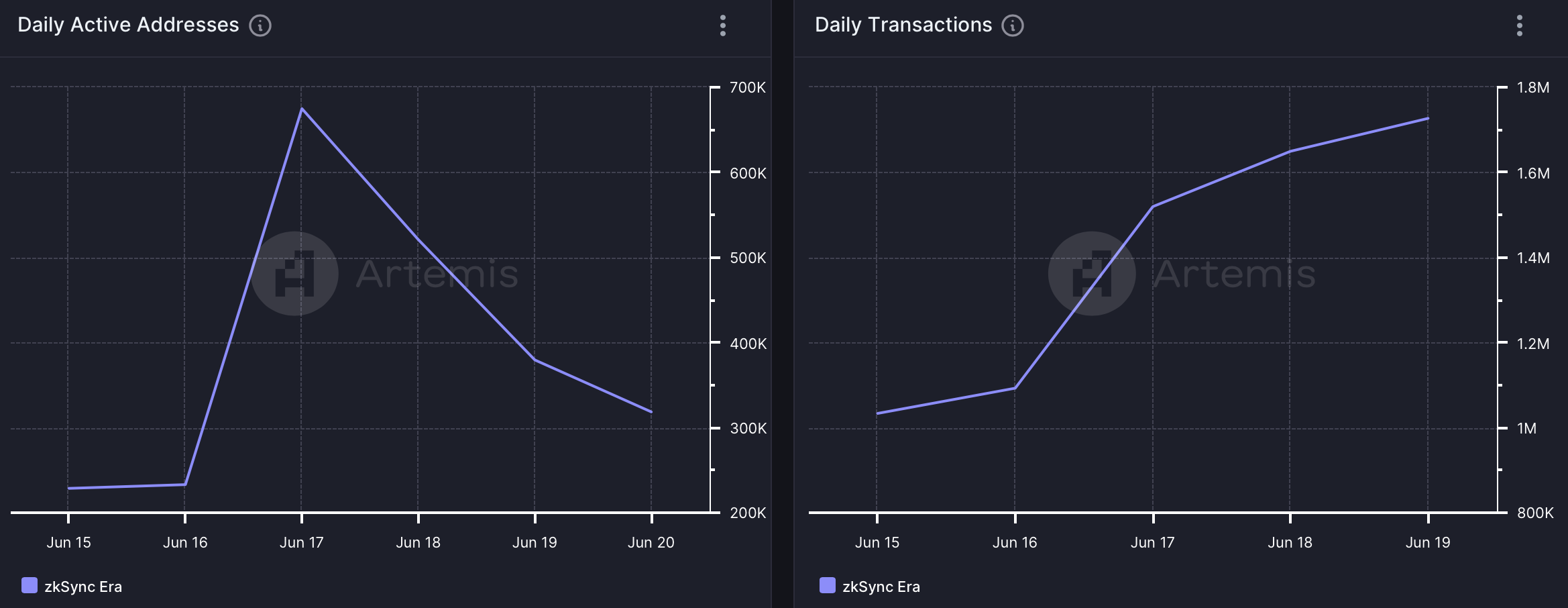

While zkSync airdropped its ZK tokens, the L2’s network activity hiked somewhat. In fact, our analysis of Artemis’ data revealed that zkSync’s daily transactions shot up last week and reached 1.7 million.

Its daily active addresses also registered a sharp uptick on 17 June before declining. However, its fees and revenue fell over the past week.

Source: Artemis

Source: https://ambcrypto.com/zksync-airdrop-challenge-can-it-overcome-a-38-drop/