Key Takeaways

What drove Zcash’s recent surge?

Whale long positions and a 9.7% rise in Open Interest reflected renewed trader confidence and stronger buying pressure.

How could ZEC perform next?

Continued accumulation may lift prices toward $803, though rising leverage could spark corrections near the $480 zone.

After years of tight consolidation, Zcash [ZEC] finally broke out of its range, climbing to a new high of $744.

Since touching that level three days ago, the token has seen sharp volatility—rising above $700, dropping to $488, then rebounding past $600. At press time, ZEC traded at $574.92, down 4.42% over the last 24 hours.

Futures data show buy-side dominance

Since Zcash rebounded a month ago, investors’ participation in the Futures market has skyrocketed. As such, Futures Taker CVD remained green throughout the past 30 days, signaling buyers’ dominance.

Source: CryptoQuant

Thus, most participants in the Futures market were buyers, opening strategic positions, either shorts or longs.

Lookonchain observed such a buyer. According to the on-chain monitor, a whale bought the dip after ZEC dropped to $509.

This whale deposited $6.27 million into Hyperliquid and placed a limit-long order for 20,800 ZEC, worth $12.12 million. After prices moved higher, the whales’ unrealized profit rose to $1.51, but closed late, realizing $1.25 million in profit.

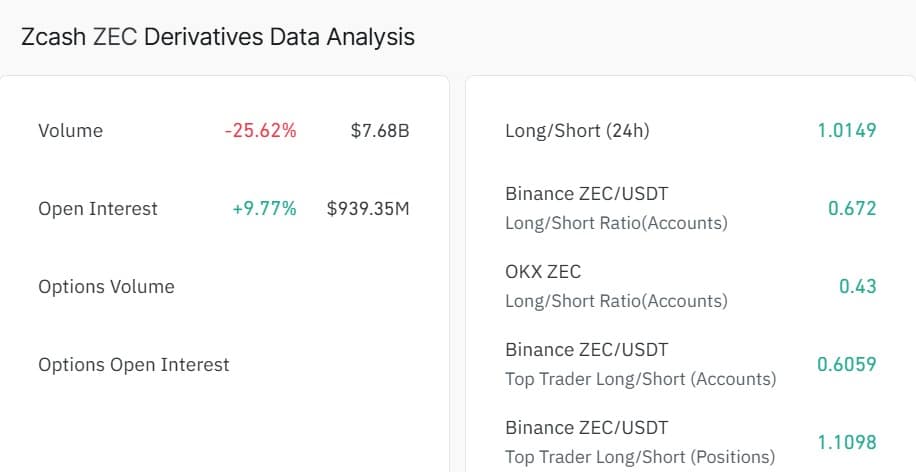

On top of that, investors’ participation in the Futures market has surged significantly. According to CoinGlass, Zcash Open Interest surged 9.77% to $939.31 million, signaling increased capital inflow into futures.

Source: CoinGlass

By contrast, Long/Short Ratios on major exchanges confirmed this bullish lean.

CoinGlass data showed the overall 24-hour Long/Short Ratio at 1.0149, while Binance Top Traders’ Positions hit 1.1098, underscoring growing long exposure.

Spot accumulation strengthens the case

Beyond derivatives, on-chain data revealed rising Spot accumulation.

The Accumulation/Distribution (A/D) Line climbed steadily to 5.33 million, signaling consistent buying pressure. Large volumes were added near daily highs, implying active institutional or whale accumulation.

Source: TradingView

In fact, Sequential Pattern Strength has held positive for three consecutive weeks, supporting the argument that the current rally is demand-driven, not speculative.

If these trends hold, ZEC could retest $698 and push toward $803. However, if excessive leverage triggers liquidations, the token might revisit $480 before finding new support.

Source: https://ambcrypto.com/zec-whales-target-803-why-1-25mln-in-profit-signals-this-new-demand/