- Yellen withholds countries involved in U.S. trade talks.

- Market remains attentive despite no immediate crypto impact.

- Historical patterns show trade secrecy spurs volatility.

Janet Yellen, U.S. Treasury Secretary, declined to disclose potential trade partners this week, citing harm to U.S. interests.

This withholding of information maintains market uncertainty, with crypto markets observing historical precedence of potential volatility but no immediate effects yet noted.

Yellen’s Trade Secrecy Keeps Markets on High Alert

U.S. Treasury Secretary Janet Yellen recently chose not to reveal which countries could be involved in forthcoming trade agreements. Her decision to withhold this information was based on the grounds that disclosure might harm U.S. interests. No verifiable statement was found on her official social media as of May 7, 2025.

This secrecy around international trade discussions perpetuates an environment of economic uncertainty. Investors and market stakeholders remain alert, despite major cryptocurrencies showing no immediate reaction to this development. However, the potential for indirect impacts remains based on historical trends during similar situations.

Janet Yellen, U.S. Treasury Secretary, “Refused to disclose which countries the U.S. could reach a trade agreement with this week, citing potential harm to U.S. interests.” – Bloomberg

Historical Trade Secrecy and Crypto Volatility Correlation

Did you know? Similar instances in the past, such as during the 2018-2019 U.S.-China trade negotiations, led to short-term volatility and pushes toward safe-haven assets like gold and Bitcoin.

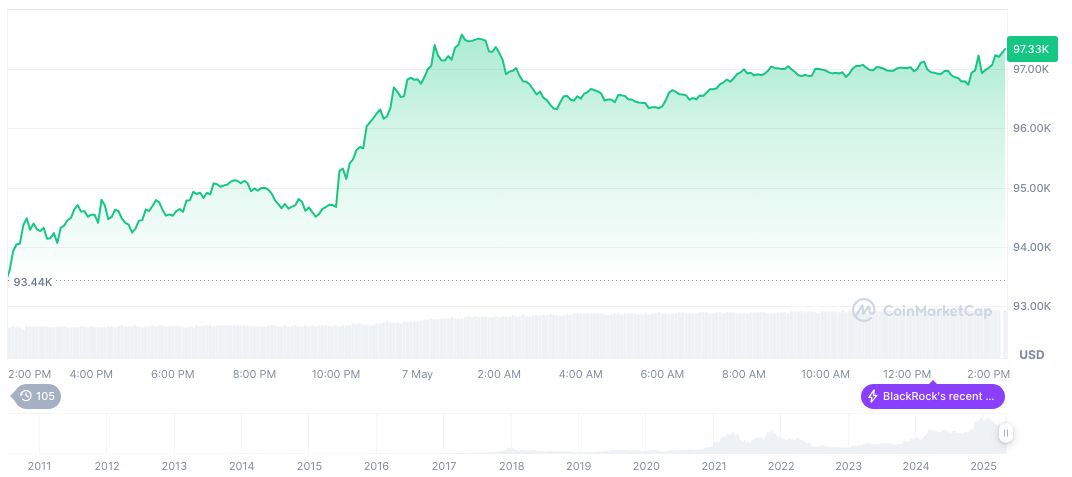

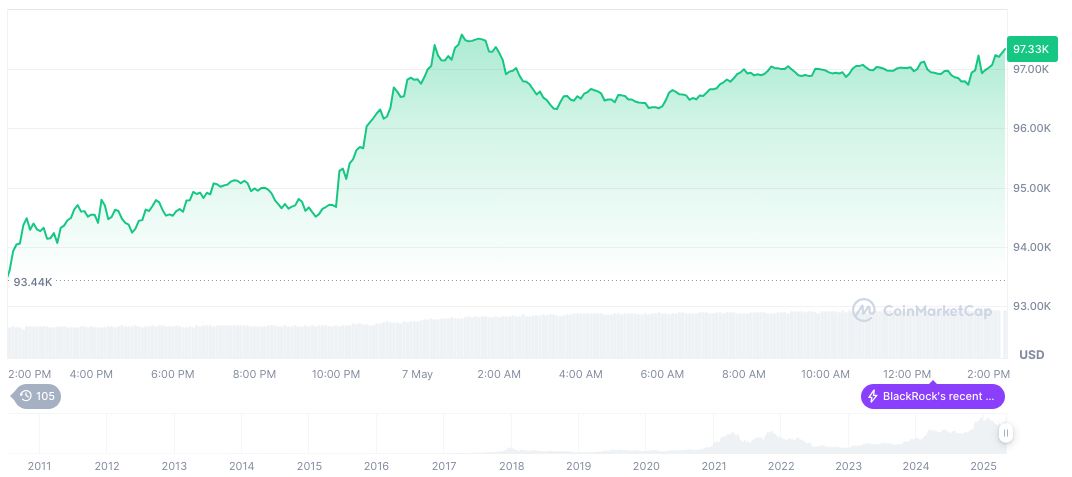

Bitcoin (BTC) currently trades at $96,996.70, with a market cap of [formatted_market_cap]. Over the past 24 hours, it experienced a 2.85% price increase. BTC’s liquidity zone remains a focal point, though Yellen’s withholding of information has not directly impacted its price, according to CoinMarketCap.

Expert insights from Coincu Research suggest a historical correlation between U.S. trade secrecy and macroeconomic volatility. Should Yellen’s comments result in prolonged uncertainty, increased market flows into stablecoins and resilient cryptocurrencies might be expected, tracking past patterns observed during similar geopolitical events.

Source: https://coincu.com/336177-yellen-trade-deal-secrecy-interests/