- Yellen’s statement impacts financial markets, hinting at possible Fed rate cuts.

- Potential September rate cut may be substantial.

- Cryptocurrencies could see volatility amid interest rate shifts.

U.S. Treasury Secretary Janet Yellen highlighted high real interest rates on July 4, indicating potential rate cuts by the Federal Reserve. Discussing rates during an event, Yellen noted the need for possible adjustments as current economic conditions unfold. Concerns about high real interest rates may necessitate larger rate cuts if current conditions persist. (Business Times)

These insights carry weight due to past impacts of rate changes on broad markets, with potential implications including increased demands for riskier assets like cryptocurrencies. As a result, key assets such as Bitcoin and Ethereum could experience heightened volatility.

Yellen’s Remarks and Potential Market Impact

Janet Yellen’s recent commentary about interest rates underscores concerns about current economic conditions. With the U.S. Treasury Secretary’s remarks, there is potential for larger than expected rate cuts in September if rates remain unchanged at upcoming meetings. Concerns about heightened rates are echoed by Federal Reserve officials, including Michelle Bowman and Christopher Waller, who align with Yellen’s views on economic strategy.

If the Federal Reserve acts to lower rates, investor behavior might shift as risk appetite grows. This could affect cryptocurrencies as investors reassess asset allocations. Potential Federal Reserve action could increase the appetite for risk assets like Bitcoin.

Financial markets have responded cautiously, with Yellen emphasizing the need for careful monitoring of economic indicators. The cryptocurrency community, including voices like Arthur Hayes from BitMEX, anticipates shifts, with Hayes seeing current environments favoring risk asset increases.

Cryptocurrency Volatility and Historical Context

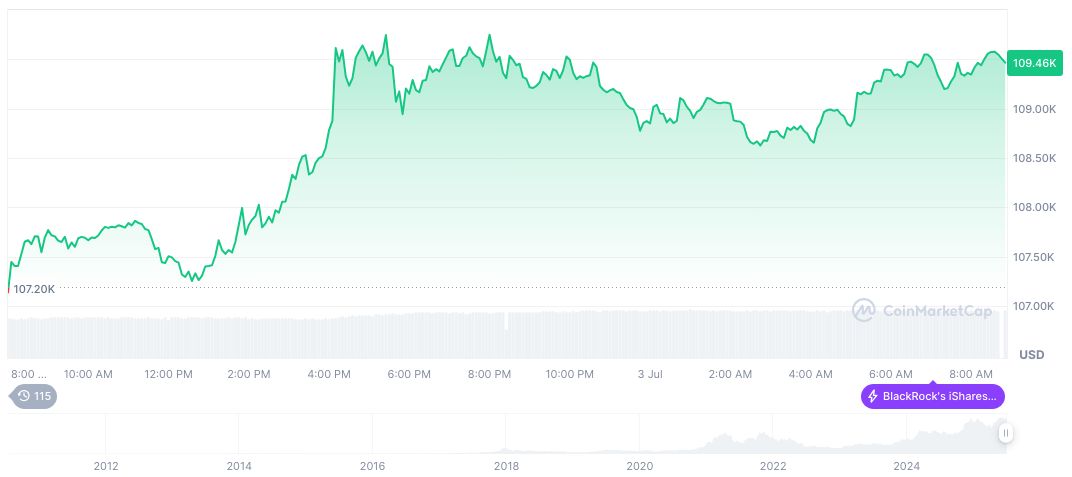

Did you know? Past Federal Reserve rate cuts have often led to marked increases in cryptocurrency investment as investors seek higher returns from volatile assets. Bitcoin (BTC), reporting a market cap of $2.17 trillion as per CoinMarketCap, illustrates fluctuating investor sentiment. Its latest price is $109,168.61, with a trading volume of $58.04 billion in 24 hours, reflecting high market activity. Recent price trends show a slight 0.35% decrease over 24 hours but a significant 31.44% rise in the last 90 days.

Insights from Coincu research highlight potential financial consequences, suggesting careful monitoring of economic indicators is key. A favorable environment for cryptocurrency markets may enhance activity within upcoming months, contingent on Federal Reserve decisions and investor sentiment. Regulatory developments could further shape market pathways for digital assets.

Financial markets have responded cautiously, with Yellen emphasizing the need for careful monitoring of economic indicators. The cryptocurrency community, including voices like Arthur Hayes from BitMEX, anticipates shifts, with Hayes seeing current environments favoring risk asset increases.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346653-yellen-high-interest-rate-cuts/