- Janet Yellen anticipates major trade deals to bolster U.S. deficit.

- Significant tariff revenue boosts U.S. economic outlook.

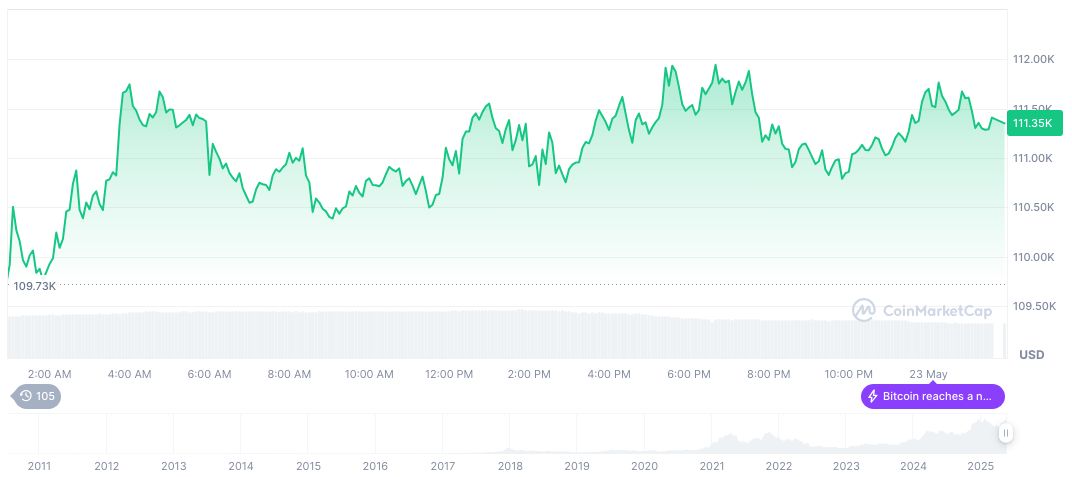

- Market optimism fuels crypto, surging BTC prices.

A potential series of major trade agreements is expected soon, according to U.S. Treasury Secretary Janet Yellen, aiming to enhance the U.S. deficit outlook.

These anticipated trade agreements highlight Yellen’s optimism towards trade negotiations, drawing market responses amid rising Bitcoin values.

Yellen Eyes Billions in Annual Revenue from Tariffs

Janet Yellen has indicated that several trade agreements with leading U.S. partners could be sealed over the coming weeks. This follows extensive negotiation involving 17 major trading partners. She highlighted the existing tariff policy’s impact, foreseeing an influx of hundreds of billions in annual tariff revenue.

Yellen stated, “We expect to reach several major trade agreements in the coming weeks. Current tariff policies have brought in significant revenue, supporting a very optimistic outlook for the deficit.”

Global markets responded positively to these developments, particularly in the crypto sector, where Bitcoin values surged past $100,000. Yellen’s announcement solidified market optimism and sparked a renewed appetite for risk assets.

Bitcoin Surges as Trade Developments Signal Economic Optimism

Did you know? The recent 91% tariff rollbacks between the U.S. and China represent one of the largest easing measures in recent history, introducing significant market stability.

Bitcoin (BTC) trades at $109,356.93, maintaining a market cap of approximately $2.17 trillion. Its dominance is at 62.98%. Despite a slight 24-hour downturn of 1.73%, it has gained 5.21% over the past week. Data from CoinMarketCap reveals consistent market influence, with a longstanding upward trajectory.

Insights from Coincu Research suggest that the current economic momentum could lead to expanded U.S. trade policy adaptations, fostering technological growth. Increased crypto engagement, prompted by optimism, also indicates a shifting regulatory and financial landscape.

Source: https://coincu.com/339322-yellen-trade-agreements-deficit-forecast/