- XRP price consolidates near $2.99 with $2.97 acting as key Fibonacci support against selling pressure.

- ETF speculation sparks bold calls for $10–$25 XRP, though inflows remain modest and momentum uncertain.

- EU regulators push for tighter oversight, adding caution to XRP’s near-term outlook despite bullish narratives.

XRP price today is trading near $2.99, holding just above the $2.97 support zone after cooling from last week’s rally. Sellers are pressing against the 20-day EMA, while buyers continue to defend key Fibonacci levels. With ETF speculation heating up and European regulators pushing for tougher oversight, the market faces a pivotal test.

XRP Price Holds Fibonacci Support But Faces Resistance

The daily chart shows XRP consolidating just above the 0.236 Fibonacci retracement at $2.97, with price recently rejecting the $3.08 resistance aligned with the 0.382 retracement. Immediate support rests near $2.94 and $2.82, while deeper protection sits at $2.57, the 200-day EMA.

Related: Bitcoin (BTC) Price Prediction For September 17

The descending trendline from July’s $3.66 peak continues to cap momentum. A clean breakout above $3.18, where the Parabolic SAR and Fibonacci 0.618 overlap, would flip sentiment bullish. Until then, XRP remains trapped in a contracting structure with risks of another test of the $2.70 base.

Momentum readings highlight caution. The EMA cluster between $2.94 and $2.97 has turned into a battleground, with flattening signals suggesting indecision. A push above $3.08 would invite momentum buyers, but failure to hold $2.97 risks accelerating a breakdown.

ETF Speculation Sparks Bold Predictions

Market attention turned to ETF headlines after Jake Claver told the Paul Barron Show that XRP at $10–$13 is realistic, with $20–$25 possible by year-end. The comments, amplified by analyst John Squire on X, have fueled a wave of speculation about institutional inflows if U.S. regulators clear products tied to XRP.

While many traders see the projections as aggressive, optimism around ETFs is providing a bullish narrative. Historically, similar speculation in Bitcoin and Ethereum led to sustained breakouts once approvals were confirmed, though timing remains uncertain for XRP.

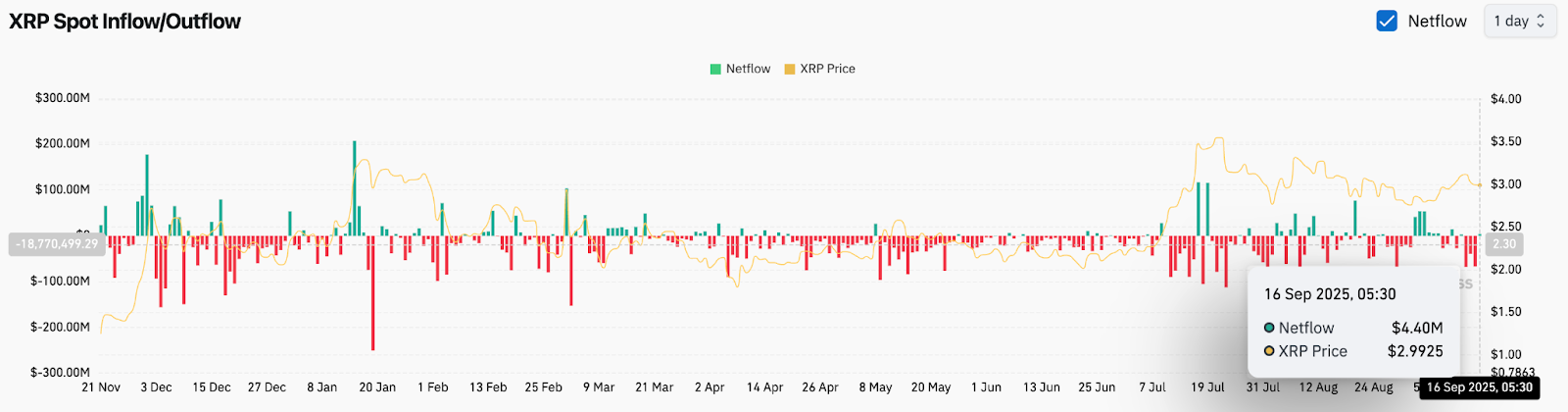

On-Chain Flows Show Modest Inflows

Spot flow data reveals a $4.4 million net inflow into XRP exchanges on September 16. While small compared to historical spikes above $100 million, this shift contrasts with the persistent outflows seen in prior weeks. It suggests cautious positioning by traders preparing for possible ETF developments.

Related: Linea (LINEA) Price Prediction 2025, 2026, 2027, 2028–2030

Participation, however, remains muted. Active address growth has stalled, and futures open interest is subdued. Without stronger and more consistent inflows, XRP may struggle to sustain any breakout above the $3.18–$3.30 zone.

EU Regulators Push For Tighter Oversight

Beyond technicals and ETF hype, regulatory developments add another layer of uncertainty. France, Austria, and Italy have urged the European Union to tighten oversight of crypto markets under MiCA, calling for direct ESMA supervision, mandatory cybersecurity audits, and stricter controls on offshore platforms.

For XRP, which has faced its own legal scrutiny, tougher EU enforcement could limit access for non-EU platforms and dampen liquidity. However, proponents argue that stronger regulation could enhance long-term investor confidence, especially if harmonized across the bloc.

Technical Outlook For XRP Price

Key levels remain well defined. On the upside, clearing $3.08 would target $3.18, followed by $3.30, where the upper Fib levels converge. A breakout there could extend toward $3.46. On the downside, losing $2.97 risks a move to $2.82 and then $2.70. If $2.70 fails, the 200-day EMA at $2.57 becomes the final support.

The balance of risks depends on whether ETF-driven optimism gains traction before technical breakdown pressure overwhelms buyers.

Outlook: Will XRP Go Up?

XRP price today remains at a crossroads, with ETF speculation and modest inflows providing a bullish counterweight to regulatory tightening and trendline resistance. Analysts remain split, with some projecting an aggressive $10–$13 target while others warn that $2.70 must hold for the structure to remain constructive.

Related: Shiba Inu (SHIB) Price Prediction For September 16

As long as XRP stays above $2.97, the bias leans toward consolidation with upside potential. A decisive break above $3.18 would strengthen the bullish case, but failure to defend $2.97 could expose XRP to another round of losses before buyers regroup.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-for-september-17-2025/