XRP price today is trading near $3.08, pulling back slightly after testing the $3.12 resistance zone. The token has been consolidating inside a broader Fibonacci range, with support holding near $2.94 and upside momentum capped by the $3.18–$3.20 region. Traders now weigh technical compression against new adoption news from Chase Bank.

XRP Price Presses Against Key Resistance

The daily chart shows XRP approaching the 0.382 Fibonacci retracement level at $3.08, with sellers defending the descending trendline that has guided price since late July. Immediate resistance sits around $3.18, where the Supertrend indicator also converges. A clean breakout above this threshold could open the path toward $3.19 and $3.30, aligned with the 0.5 and 0.618 Fibonacci levels.

Support remains clustered around the 20-day EMA near $2.97, followed by the $2.81 zone, which coincides with the 50-day EMA. A breakdown below this base would expose deeper risk toward the $2.56 level, where the 200-day EMA offers stronger structural support.

Chase Bank Adoption Boosts Sentiment

Market sentiment improved after Chase Bank confirmed it will now accept payments in XRP. The news has been interpreted as a milestone in institutional adoption, particularly as Chase moves to integrate real-world payment channels with the XRP Ledger.

Alongside this, excitement is building around Real Token, which aims to unlock real estate transactions on the XRP Ledger, highlighting XRP’s broader role in asset tokenization. While these developments do not immediately alter technical structures, they strengthen the long-term case for demand-driven growth.

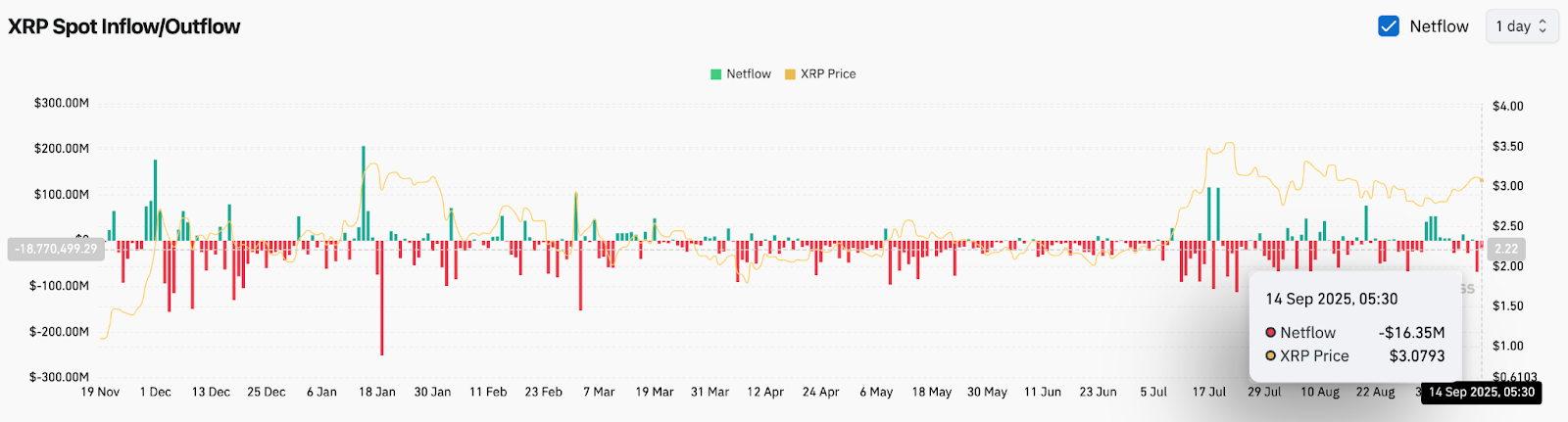

On-Chain Flows Show Outflows Despite News

On-chain data highlights mixed positioning. Spot netflows recorded an outflow of $16.35 million on September 14, showing that traders used recent strength to trim exposure. The negative flow contrasts with the broader bullish narrative, suggesting short-term caution despite the Chase adoption headlines.

Flows over the past month have remained volatile, oscillating between inflows on rallies and sharp outflows during consolidation phases. Analysts argue that a sustained shift to positive net inflows above $50 million would be required to validate the adoption-driven optimism.

Technical Outlook For XRP Price

Key resistance sits at $3.18, a level reinforced by the descending trendline and Supertrend indicator. A decisive break above this zone could confirm bullish continuation, targeting $3.30 as the next upside objective. Clearing $3.46, the 0.786 Fibonacci retracement, would reintroduce the possibility of a retest of the $3.66 peak.

On the downside, failure to hold $2.97 would increase selling pressure, exposing $2.81 as immediate support. A deeper loss of momentum could drag XRP back to $2.56, unwinding much of September’s recovery gains.

Outlook: Will XRP Go Up?

The immediate trajectory for XRP depends on whether adoption headlines can offset the weight of persistent outflows. If buyers manage to defend $2.97 and trigger a breakout above $3.18, the short-term bias tilts bullish toward $3.30–$3.46.

Without stronger on-chain confirmation, however, the risk of another rejection remains. Traders are watching closely as XRP navigates this pivotal zone, where structural compression and fresh adoption narratives collide to define the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-for-september-16-2025/