XRP price today is trading at $2.99, holding just below the psychological $3.00 mark after a sharp rebound from $2.88 support. The token’s range remains capped by a descending trendline, with technical compression converging against rising institutional flows and macro optimism.

XRP Price Retests Key Resistance

The 4-hour chart shows XRP testing the $2.99 ceiling over and over again, while buyers protect the $2.88–$2.90 base. A long-term downward trendline from July is still acting as resistance, but recent bullish candles show that the pressure for a breakout is growing.

Short-term EMAs (20/50/100) have come together around $2.87–$2.92, which is now a strong area for accumulation. Near $2.87, the Parabolic SAR turned bullish, which added to the upside bias. If momentum goes above $2.99, it will open the way to $3.10 and $3.30 in the near future.

Derivatives Data Show Institutional Positioning

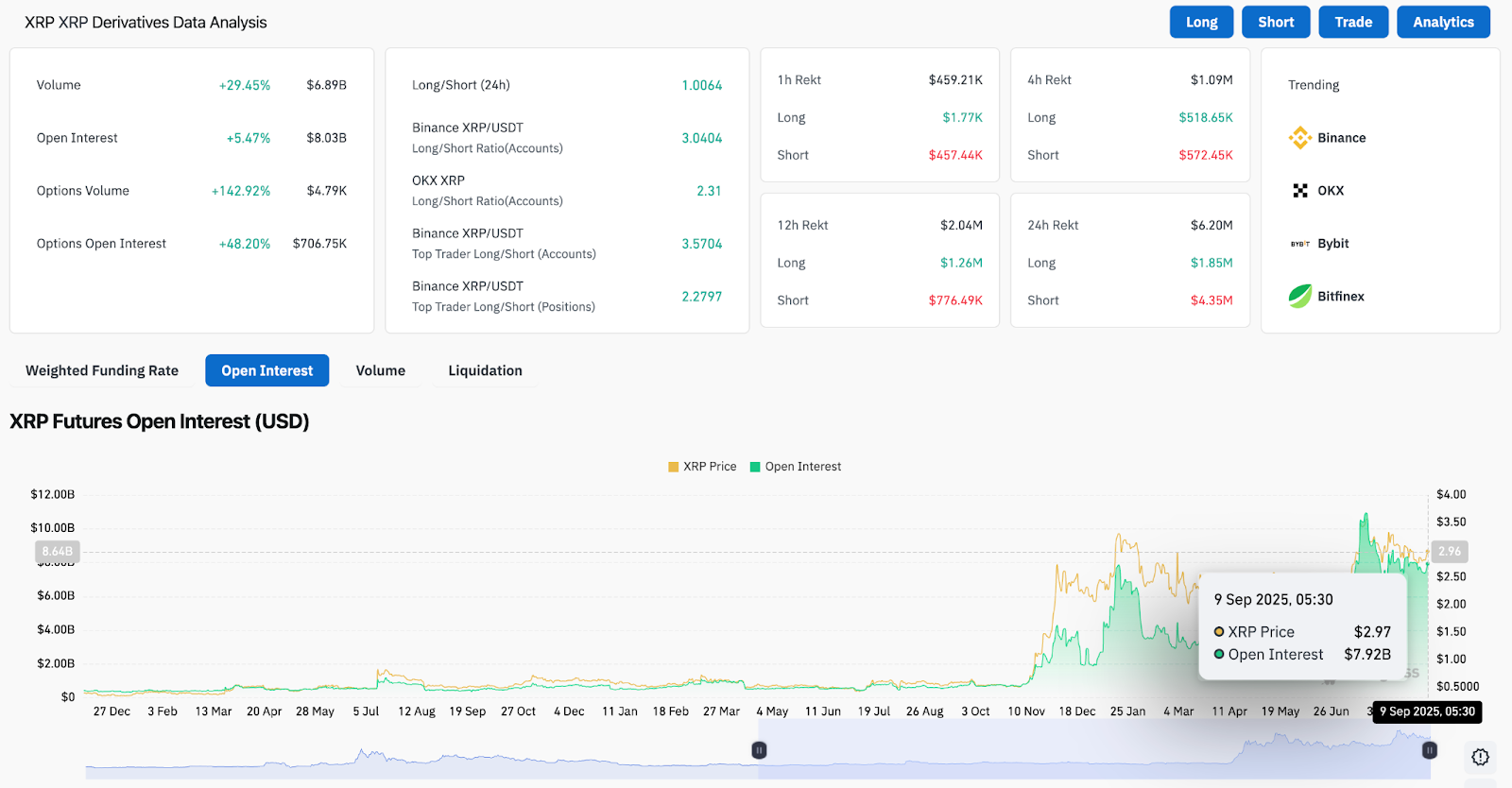

In the last 24 hours, XRP derivatives trading has gone through the roof. Open interest in futures rose 5.4% to $8.03 billion, and trading volume rose 29% to $6.89 billion. Options activity went up even more, with open interest going up by more than 48%.

The long-short ratio across major exchanges is tilted bullish, with Binance top traders showing over three longs for every short. However, liquidation data highlights ongoing two-way volatility, with shorts taking heavier losses during the latest rebound.

This positioning suggests institutions are building leveraged exposure ahead of upcoming macro and regulatory catalysts, keeping XRP price volatility elevated.

Ripple Rewards Event Adds Market Sentiment Boost

Ripple’s announcement of an XRP Rewards Event has injected optimism into the community. The program, involving a 100 million XRP pool, was framed as a gesture of gratitude for long-term holders during challenging periods.

While the event itself has limited impact on circulating supply, it strengthens sentiment at a time when traders are looking for reasons to commit capital. Combined with ETF speculation, the campaign underscores Ripple’s intent to keep engagement high ahead of a decisive quarter.

Macro Catalysts Support The Breakout Case

Beyond technical factors, macro conditions have aligned in XRP’s favor. Fed funds futures now price a 99% probability of a September rate cut, which has weakened the dollar and encouraged flows into risk assets, including crypto.

At the same time, exchange reserves for XRP hit a 12-month peak, signaling potential near-term supply pressure. Yet whale wallets reportedly accumulated over 10 million XRP in a single session, showing divergence between retail profit-taking and institutional build-up.

Traders are also watching the six pending spot XRP ETF applications at the SEC, with decisions expected in October. Approval would provide a structural channel for institutional inflows similar to Bitcoin and Ethereum ETFs earlier this year.

Technical Outlook For XRP Price

XRP’s roadmap remains clear. Immediate resistance sits at $2.99–$3.00. A breakout above this level would target $3.10 and $3.30, with momentum likely accelerating if ETF speculation intensifies. Beyond that, the $3.60 region remains the major upside objective.

On the downside, failure to defend $2.88 risks exposure to $2.77, where buyers last stepped in aggressively. A deeper breakdown could extend to $2.60, the August pivot and 200-day EMA.

Outlook: Will XRP Go Up?

XRP price action is at a pivotal juncture, balancing strong technical resistance against improving macro and derivatives signals. The convergence of Fed easing bets, whale accumulation, and anticipation around ETF decisions provides a constructive backdrop.

As long as XRP holds above $2.88, the bias leans bullish with $3.10–$3.30 as the next upside targets. A sustained breakout above $3.00 could confirm a larger shift in trend, but without follow-through, the risk of another rejection lingers. For now, XRP remains one catalyst away from decisively breaking its consolidation range.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-price-prediction-for-september-10-2025/