- XRP’s $1 billion Open Interest underlined growing market activity, driven by regulatory optimism

- Rising exchange reserves and long liquidations pointed to caution amid bullish momentum

XRP token’s Open Interest has skyrocketed to $1 billion, raising questions about what’s fueling the recent surge. With growing speculation surrounding regulatory clarity and owing to a hike in institutional interest, XRP is now gaining a lot of attention. However, is this enough to spark a bullish breakout?

At press time, XRP was trading at $0.5879, down 6.50% in the last 24 hours. The hike in Open Interest, however, highlighted an increase in activity across the market. By extension, this uptick indicated that traders are now betting on significant future price movements.

This makes it essential to examine what’s driving the altcoin’s momentum. Regulatory developments and institutional investments are likely key factors, but is there something else going on too?

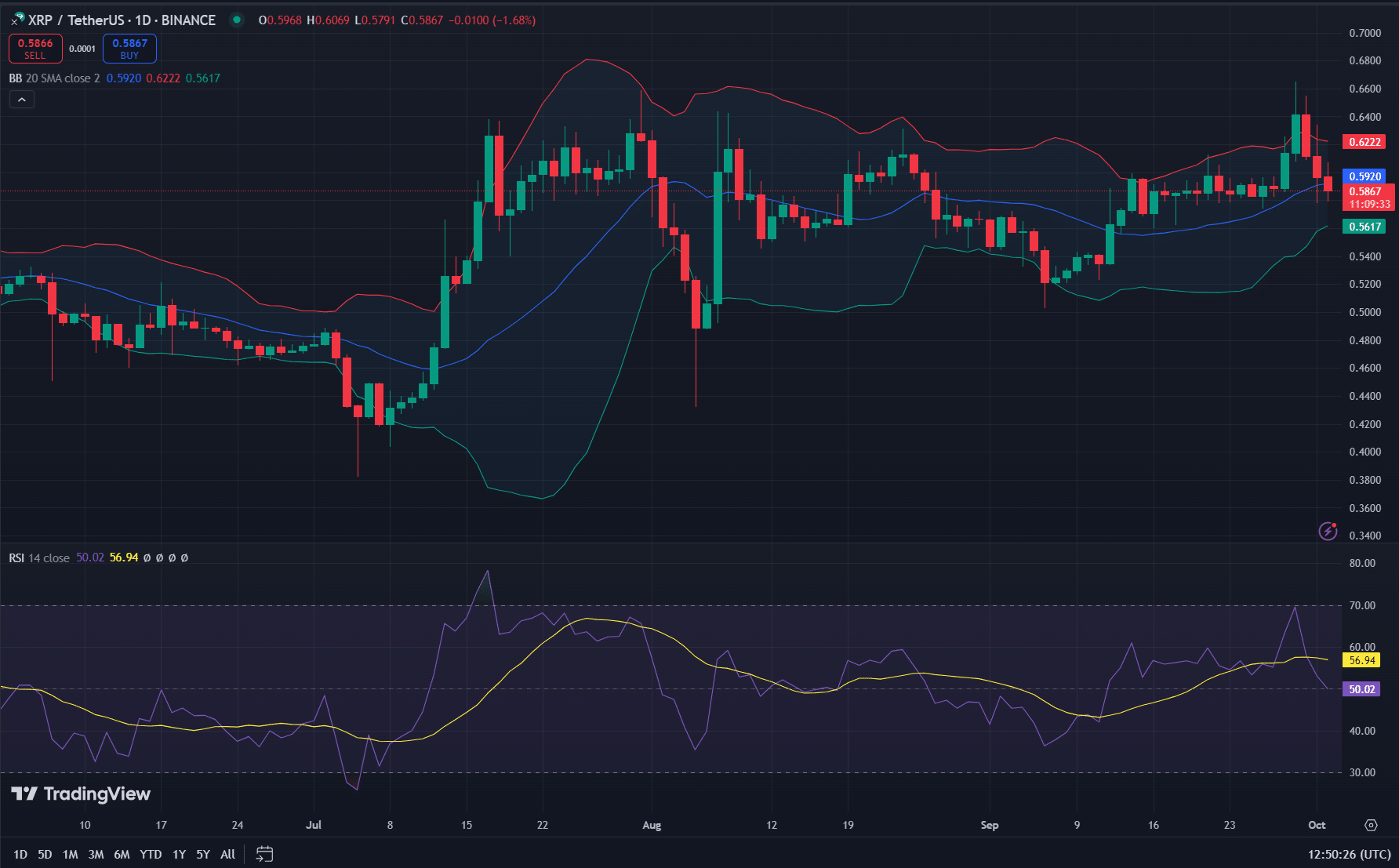

XRP’s price action – Key levels to watch

Looking at the charts, the press time price action showed the token facing stiff resistance at $0.6222. This level has become a critical barrier for any bullish advance. However, a strong support lay at $0.5617, providing a cushion if bearish pressure increases on the charts.

The Bollinger Bands seemed to be tightening, suggesting an imminent price move. Additionally, the RSI at 56.94 highlighted neutral market conditions.

Therefore, traders should watch these levels closely as breaking resistances could trigger a more significant price rally.

Source: TradingView

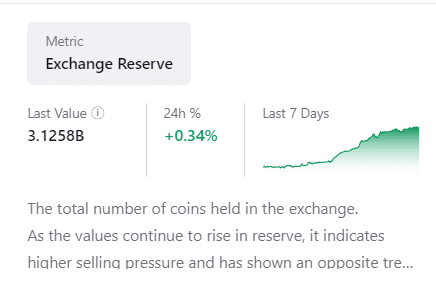

Exchange reserves – Could selling pressure rise?

Here, it’s also worth pointing out that exchange reserves rose by 0.34% to 3.1258 billion tokens in the last 24 hours. Such a hike often points to higher selling pressure, especially as more tokens are transferred to exchanges for potential liquidation.

As a result, investors should be cautious. Although market interest in XRP has risen lately, the uptick in reserves means that some holders may be preparing to sell.

Source: CryptoQuant

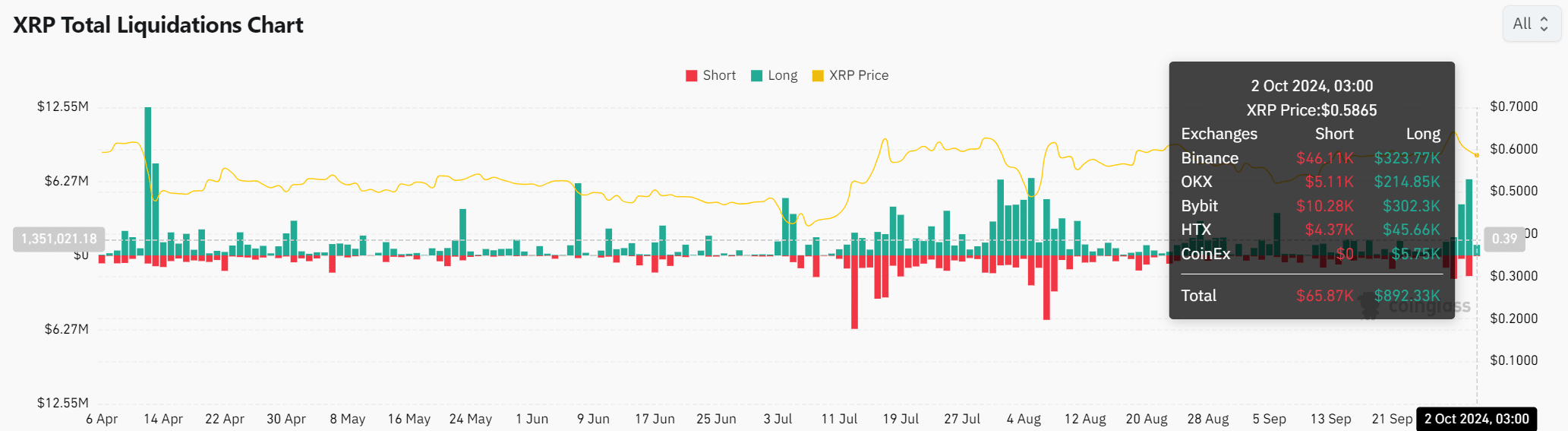

XRP liquidations – Are long positions at risk?

Finally, data on liquidations revealed that over $1.35 million has been liquidated in the last 24 hours, primarily from long positions. On Binance alone, long liquidations totaled $323.77K.

Consequently, while there’s optimism for a breakout, the market’s resistance has led to the unwinding of over-leveraged positions. This highlights the potential risk for bullish traders if the altcoin fails to maintain its momentum.

Source: Coinglass

Read Ripple’s [XRP] Price Prediction 2024-25

Conclusively, the surge in Open Interest, paired with growing institutional and retail involvement, indicates bullish potential.

However, the rise in exchange reserves and long liquidations underlines the need for caution. While breaking above $0.6222 will be key for any sustained rally, traders should prepare for volatility as the altcoin navigates these critical levels.

Source: https://ambcrypto.com/xrp-tokens-1-billion-milestone-heres-what-it-means-for-the-price/