VivoPower expands its XRP treasury strategy by swapping mined tokens, driving a rise in XRP open interest and institutional interest.

XRP’s open interest in futures has surged following a period of decline, driven by VivoPower International’s decision to swap mined tokens for XRP. This move signals a recovery in the token’s market as institutional strategies strengthen.

VivoPower’s Treasury Strategy Expands

VivoPower International has announced its intention to scale up its proof-of-work mining unit, Caret Digital. The company will secure bulk discounts for additional mining rigs and convert mined assets into XRP.

This strategy is a core part of VivoPower’s broader treasury approach, which involves accumulating XRP at a favorable cost basis. In a press release, VivoPower emphasized that it plans to continue leveraging its mining operations to increase XRP exposure.

This move builds on the firm’s earlier initiatives, which include a pledge to dynamically manage asset allocations through direct XRP purchases, mining swaps, and Ripple Labs equity exposure.

By exchanging mined tokens for XRP, VivoPower aims to secure the digital asset at lower average costs, boosting its holdings while increasing exposure to the altcoin.

XRP Open Interest Shows Recovery

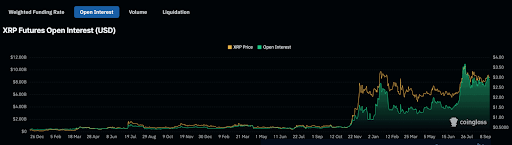

XRP’s futures market has seen a notable increase in open interest, which had fallen sharply last month. According to Coinglass data, open interest dropped by 30% in August, bottoming out at $7.7 billion.

However, it has since risen to $8.45 billion, indicating renewed interest and speculative activity. The rise in open interest suggests that traders are anticipating volatility in the coming months, with many believing that XRP could regain its bullish momentum despite the token’s price remaining below recent highs.

Rising open interest is often considered a sign of stronger conviction in the market. The increase in XRP’s derivatives market comes amid favorable positioning for long positions.

Data reveals that the number of long contracts far outweighs short positions, which historically correlates with potential price recoveries if sustained by volume.

Institutional Activity Fuels XRP Demand

The institutional activity surrounding XRP continues to grow, particularly through VivoPower’s increasing treasury investments.

In addition to the mining strategy, VivoPower recently announced plans to acquire $100 million worth of Ripple shares at a discounted rate of $0.47 per token. This equity investment further solidifies VivoPower’s commitment to XRP as part of its long-term strategy.

Furthermore, VivoPower’s partnership with blockchain firms to unlock yield through decentralized finance (DeFi) protocols is expected to enhance the utility of its growing XRP holdings.

The firm’s partnership with Flare Networks, for instance, involves deploying $100 million worth of XRP onto its layer-1 chain to generate revenue streams through DeFi protocols. This move aligns with VivoPower’s goal to expand its exposure to XRP while simultaneously participating in the wider blockchain ecosystem.