XRP could be on the verge of recovering above the $0.50 threshold as technical indicators, including the Stoch RSI and the CCI, enter oversold regions.

This hope of recovery comes amid a downward trajectory that has plagued XRP since its brief rally on Oct. 3. The rally resulted from the court’s denial of the SEC’s motion to file an interlocutory appeal in the ongoing Ripple vs. SEC legal battle.

Since reaching a high of $0.5480, XRP’s price has experienced a consistent drop, currently 11.4% down from the price top. This descent has brought XRP to its lowest point in a month, shedding the psychological support levels of $0.50 and $0.49.

However, amid this seemingly prolonged decline, there are promising signs that the asset may be gearing up for a reversal in its price trend. This potential reversal could see XRP regain those critical support levels and even push past the $0.50 mark.

– Advertisement –

XRP EMAs

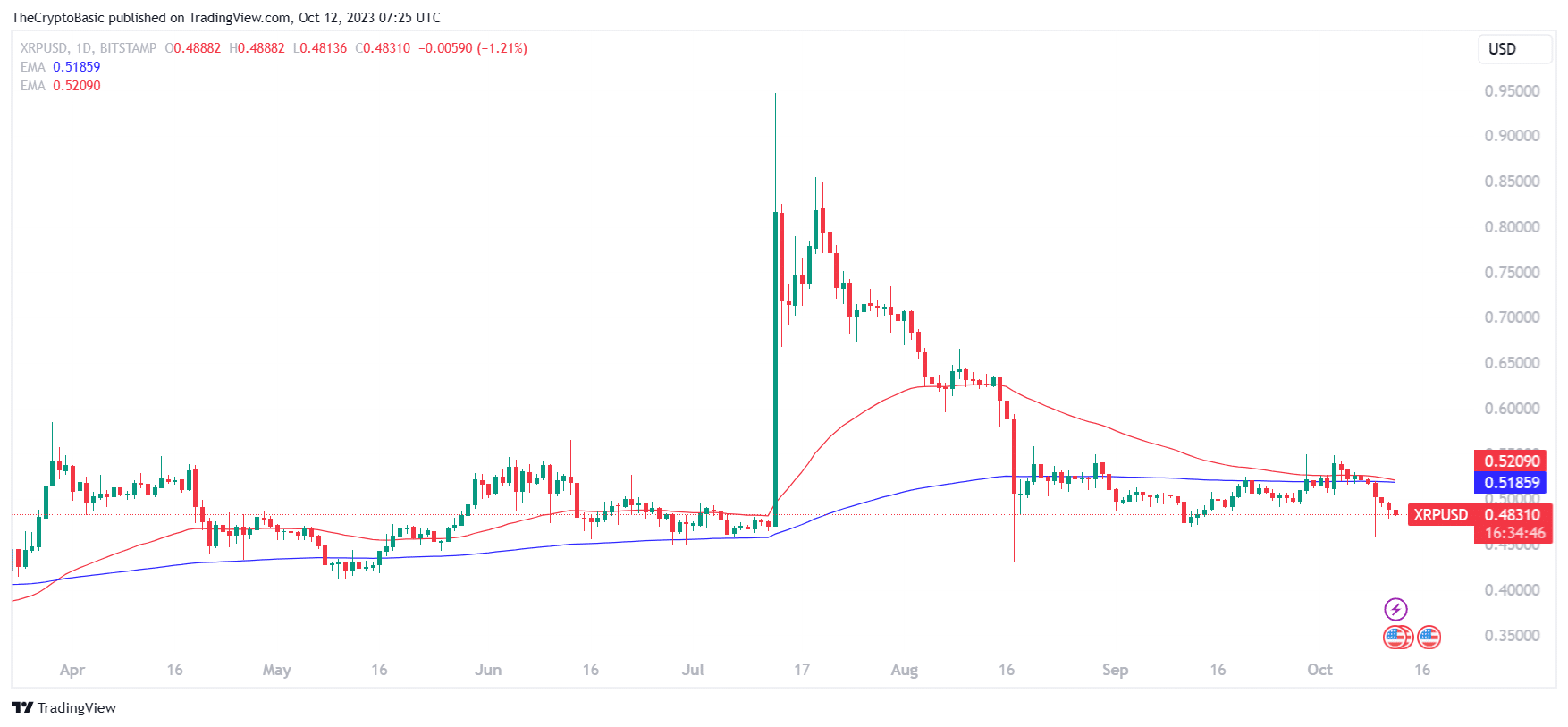

One of the critical indicators hinting at the trend reversal is the convergence of the 50-day and 200-day Exponential Moving Averages (EMAs). XRP has been trading below these EMAs, with the 50-day EMA at $0.51859 and the 200-day EMA at $0.52090.

These values indicate bearish sentiment in both the short and long terms. However, these two moving averages are on the verge of forming a golden cross. The 50-day EMA is gradually approaching a crossover above the 200-day EMA.

The last time such a golden cross formation occurred was in March, followed by a notable XRP price rally, reaching as high as $0.58482. This historical precedent gives XRP proponents hope for a potential recovery.

The Stoch RSI and CCI

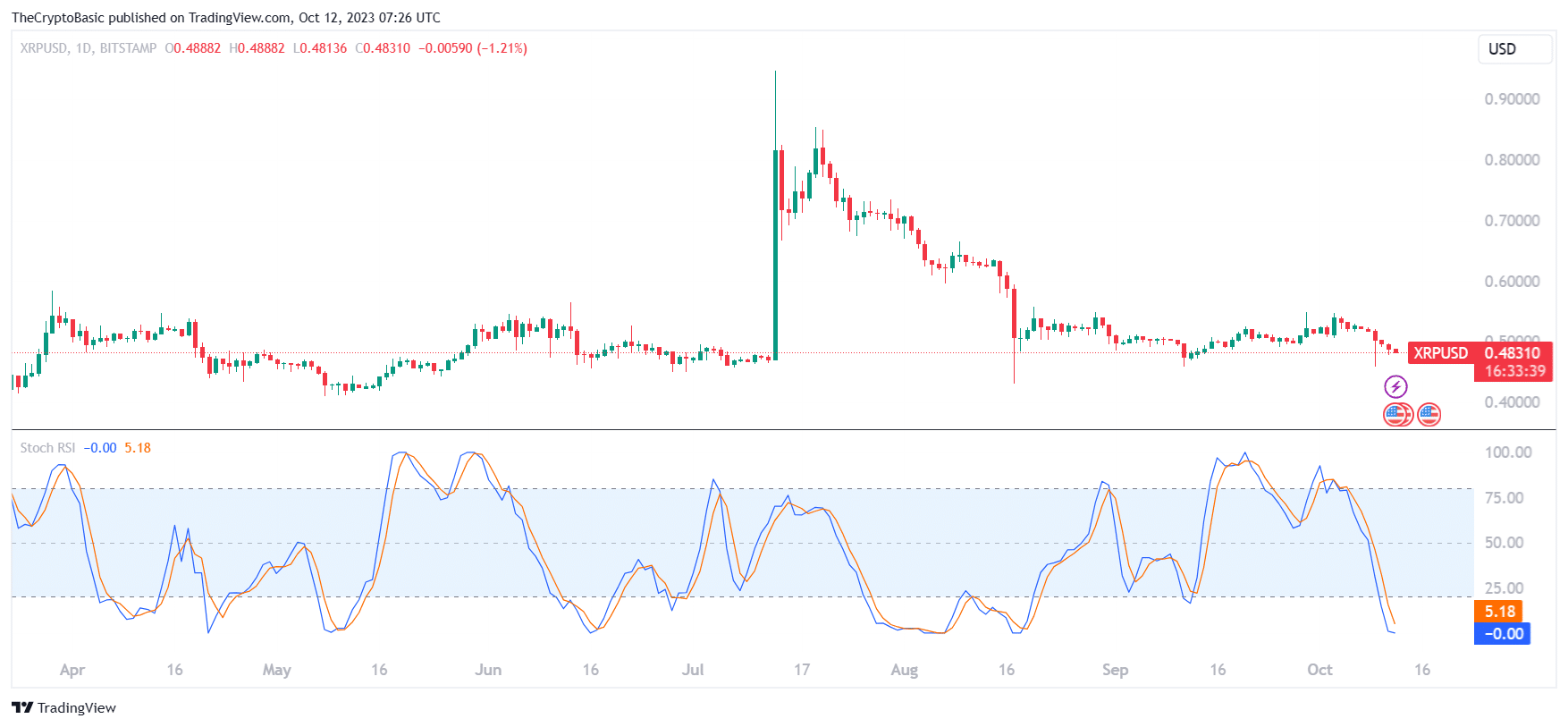

Additionally, technical indicators such as the Stochastic Relative Strength Index (Stoch RSI) and the Commodity Channel Index (CCI) offer further reasons for optimism in the XRP camp.

The Stoch RSI has reached a point where its blue line is perched at -0.00, while the orange stripe has descended to 5.18. These values suggest that the cryptocurrency is now in an oversold condition, indicating that the selling pressure may have become excessive and a price reversal might be looming.

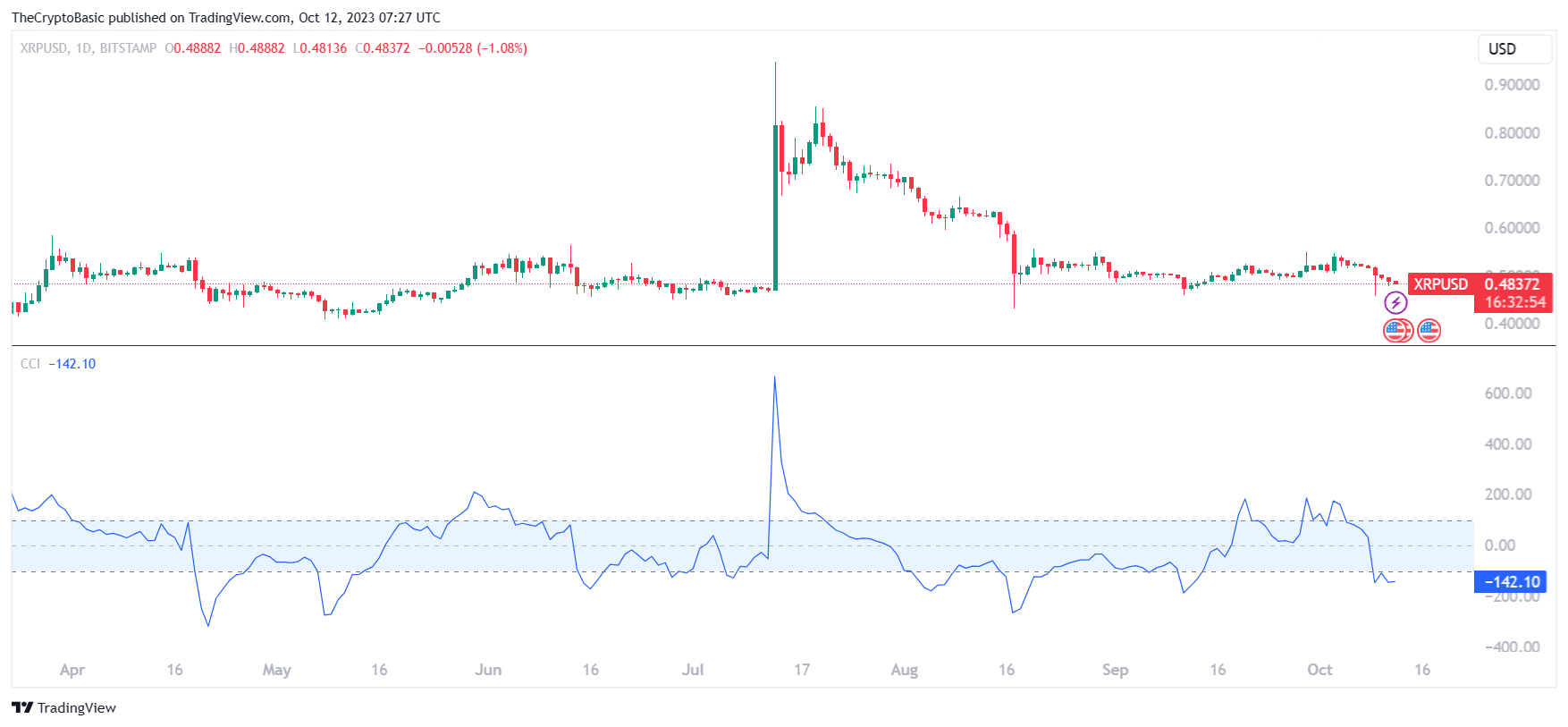

Lastly, the CCI has fallen to a substantial -142.10. The CCI is a bounded oscillator, and a value of -142.10 indicates that XRP’s price is significantly below its typical or average price level, suggesting a strong bearish momentum.

However, this value of -142.10 also signifies an oversold condition. This means that XRP’s price may have dropped too fast, and this extreme downside momentum could lead to a reversal or a bounce in the price.

XRP is changing hands at $0.48310, down 1.21% over the last 24 hours. The asset has plummeted by over 9% in the past week. Notably, the current bearish condition in the broader crypto market has exacerbated XRP’s current downtrend.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

Source: https://thecryptobasic.com/2023/10/12/xrp-gears-for-recovery-above-0-50-as-stoch-rsi-and-cci-enter-oversold-regions/?utm_source=rss&utm_medium=rss&utm_campaign=xrp-gears-for-recovery-above-0-50-as-stoch-rsi-and-cci-enter-oversold-regions