- XRP futures launch at CME; Garlinghouse comments on potential impact.

- Increased institutional interest in XRP futures.

- Ripple’s potential spot ETF opportunity.

Ripple, in collaboration with the Chicago Mercantile Exchange (CME), plans to launch XRP futures at the beginning of May 2025. Ripple’s CEO, Brad Garlinghouse, emphasized the importance of this initiative in increasing cryptocurrency market legitimacy.

This introduction of XRP futures could deepen institutional participation, potentially increasing liquidity and setting the foundation for a spot ETF approval in the future. This aligns with historical patterns seen with other digital assets like Bitcoin.

XRP Futures at CME: A Game Changer for Ripple

Ripple’s collaboration with the CME aims to formalize XRP futures trading, potentially leading to a spot Exchange Traded Fund (ETF). The CME initiative has faced delays, but Garlinghouse maintains that “the launch of XRP futures by the CME is slightly delayed, but it paves the way for the introduction of a spot ETF.”

Market reactions include enthusiasm from traders and institutions as Garlinghouse describes the initiative as a major development. U.S. Senator Cynthia Lummis highlights regulatory battles concerning crypto banking policy, indicating ongoing tension in the financial sector, noting that “[t]he Federal Reserve’s withdrawal of cryptocurrency banking rules is just talk; the fight is far from over.”

Market reactions include enthusiasm from traders and institutions as Garlinghouse describes the initiative as a major development. U.S. Senator Cynthia Lummis highlights regulatory battles concerning crypto banking policy, indicating ongoing tension in the financial sector, noting that “[t]he Federal Reserve’s withdrawal of cryptocurrency banking rules is just talk; the fight is far from over.”

Institutional Interest and Regulatory Outlook for Ripple

Did you know? Previous CME futures for Bitcoin and Ethereum preceded significant institutional engagement and often set the stage for ETF approvals, influencing market liquidity and asset price discovery.

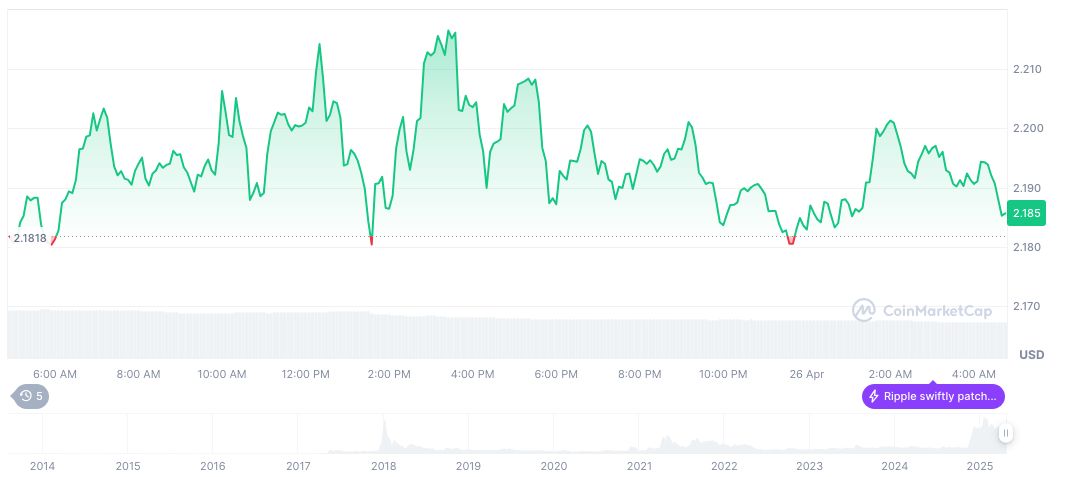

As per CoinMarketCap, XRP presently holds a price point of $2.20 with a market capitalization of $128,575,438,312. It ranks with a market dominance of 4.34% amidst a fully diluted market cap of $220,185,411,680. The 24-hour trading volume stands at $2,677,011,940, reflecting a decrease of 20.73%.

Coincu’s research suggests this move could foster greater institutional involvement in XRP trading, positioning Ripple favorably in regulatory discussions. The growing legitimacy might prompt further adoption, aligning with established trends in cryptocurrency advancements.

Source: https://coincu.com/334479-xrp-futures-cme-ripple-market/