Key Takeaways

What’s driving renewed interest in World Liberty Financial?

WLFI whales accumulated nearly 300 million tokens as the price reclaimed EMA20 and EMA50.

What threatens WLFI’s rebound?

Positive Spot Netflow showed stronger selling, raising the risk of a pullback toward EMA20 support.

The broader market’s multi-week decline eased, and several mid-caps showed early signs of stabilization. World Liberty Financial joined that list after posting its first meaningful recovery structure in weeks.

That shift drew whales back into accumulation as traders attempted to position early for a possible trend reversal.

Whales are aggressively accumulating WLFI

After stepping back from the market, whales have returned to accumulate World Liberty Financial [WLFI]. According to Lookonchain, a newly created wallet, 0xd947, withdrew 47.18 million WLFI, worth $6.95 million, from Binance.

Source: Lookonchain

On top of that, a second whale accumulated 165.79 million WLFI worth $25 million over three days.

In total, these two whales accumulated $31.95 million worth of WLFI. Often, whale accumulation during a period of uncertainty indicates confidence in the asset’s prospects.

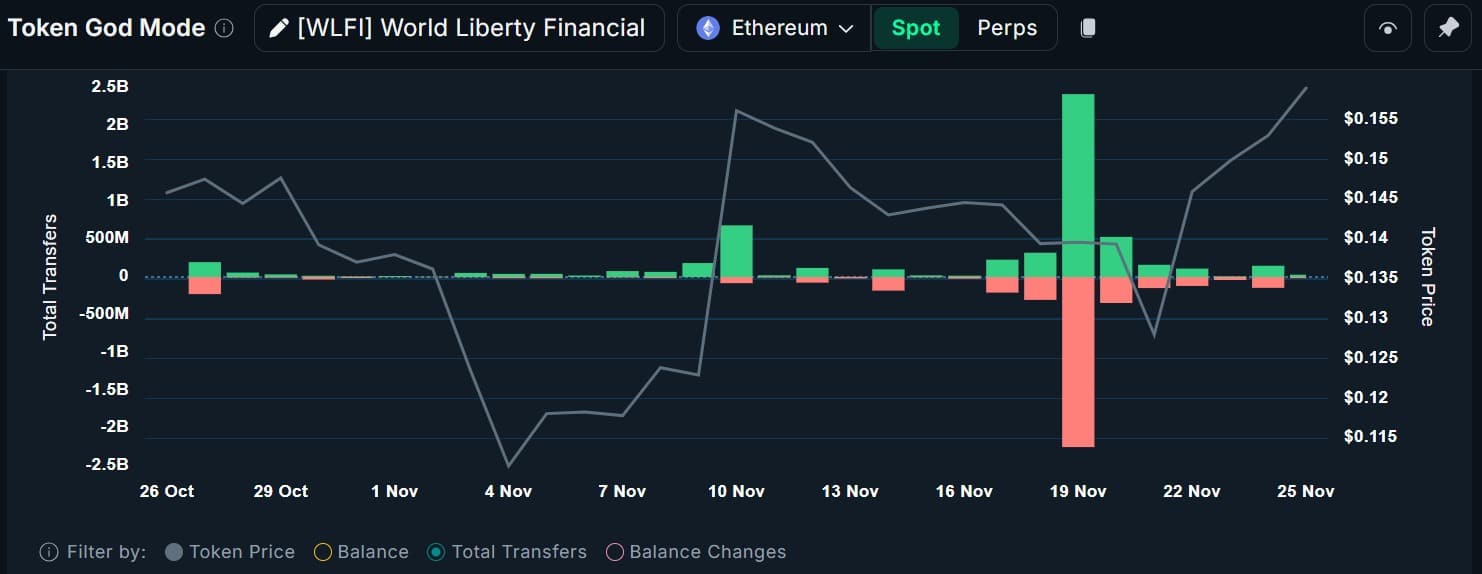

Interestingly, these whale purchases were not an isolated case, as whales significantly increased capital deployment.

Source: Nansen

In fact, Nansen data showed 178 million WLFI added by Top Holders in the past 24 hours. By contrast, the three-day accumulation reached 298 million WLFI, showing sustained appetite during uncertain conditions.

Historically, stronger whale inflows created upward pressure by tightening the circulating supply.

WLFI team sold TRX holdings

Strangely, while whales had been actively accumulating, the World Liberty Financial team reduced exposure to other assets.

According to on-chain data from Onchain Lens, the team deposited 40.59 million TRON [TRX], worth $11.25 million, into HTX. The team bought these tokens for $9.94 million and has now realized a $1.4 million profit.

Source: Onchain Lens

When projects sell secondary assets, it suggests the team is managing liquidity through external assets.

Thus, the team could access external assets for operational funds rather than sell its own tokens. Usually, this is a sign of confidence in the native coin and a neutral-to-bullish signal for WLFI holders.

Price recovery meets resistance tests

WLFI posted four consecutive higher closes after bottoming at $0.11. The token reclaimed the EMA20 and EMA50 at press time, strengthening early momentum.

At press time, WLFI traded at $0.157, up 0.85% daily and 12.3% weekly.

Source: TradingView

The Directional Movement Index showed a bullish crossover on the 24th of November, with the positive index at 20.67 above the negative index at 15.49.

Even so, bulls must protect the structure for continuation.

A daily close above the EMA50 at $0.1524 would keep momentum intact and open the path toward $0.18.

However, Spot Netflow turned positive, signaling rising sell pressure. CoinGlass data showed $1.66 million in positive Netflow, compared with –$500k one day earlier.

If sellers expand, WLFI could revisit the EMA20 near $0.1439.

Source: CoinGlass

Source: https://ambcrypto.com/wlfi-jumps-12-after-whale-inflows-0-18-in-sight-only-if/