Algorithmic crypto trading and market-making firm Wintermute Trading submitted comments to the U.S. SEC Crypto Task Force on tokenized securities regulation. This comes as the SEC seeks to regulate tokenization while companies such as Coinbase, Kraken, and others eye approval for a broker-dealer license.

Wintermute Weighs in on Tokenized Securities with SEC

Wintermute submitted feedback to the SEC‘s Crypto Task Force on tokenized securities, recommending three areas critical for liquidity providers to support the adoption of tokenized securities. The comments came in response to the SEC’s.

The firm asks the SEC to share guidance and rules for crypto brokers and dealers on tokenized securities trading from their accounts. Also, self-custody them with key management and wallet software, and settle tokenized securities on-chain, including with stablecoins and other non-security assets.

Wintermute recommended that the SEC should encourage trading tokenized securities on DeFi, adding tokenized securities to liquidity pools to boost liquidity, and lending tokenized securities directly on DeFi. The firm claimed these activities should not require broker-dealer registration or trigger U.S. jurisdiction.

The firm requested the SEC to clarify that network tokens such as Bitcoin, Ethereum, Solana, XRP, and others are not securities under the Howey Test. As they are critical to decentralized protocols, despite initially distributed in fundraising transactions or traded speculatively.

The firm believes that clear guidance and rules on these will boost RWA tokenization, including tokenized stocks, ETFs, and other traditional financial products.

RWA Tokenization Boost Under Crypto-Friendly SEC

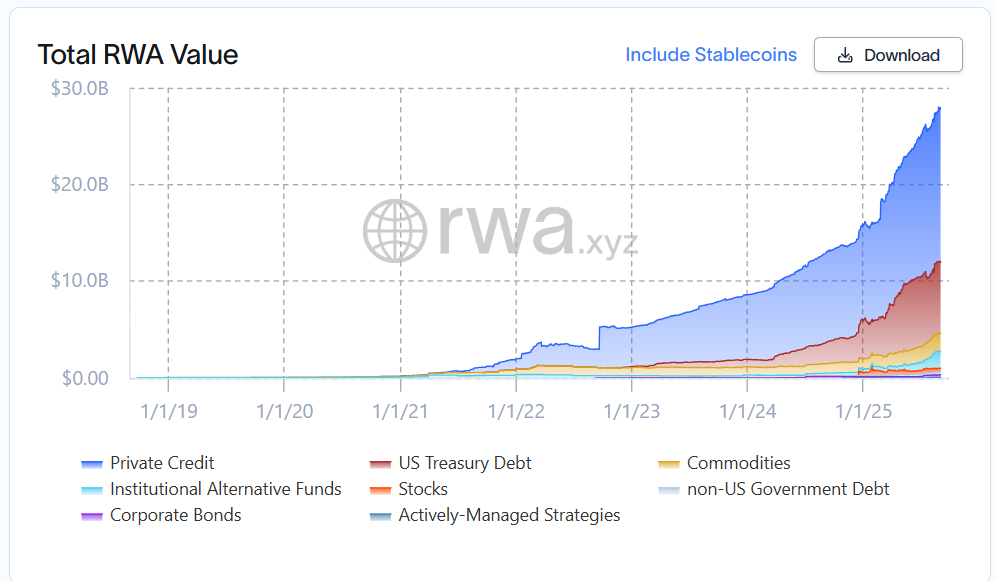

RWA tokenization in the U.S. saw a major boost under the crypto-friendly Trump Administration. The total tokenized RWA market value globally has reached nearly $28 billion, with more than 191.18 million stablecoin holders.

Recently, tokenized stock trading platform Dinari became the first firm to secure a broker-dealer license to offer tokenized securities. Also, Kraken and Coinbase are seeking a broker-dealer license from regulators to offer tokenized securities in the United States.

On September 3, Galaxy Digital became the first company to enable tokenization of its SEC-registered GLXY shares on Solana.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/wintermute-addresses-us-sec-tokenized-securities-coinbase-kraken-seek-license/