- TON registered its highest number of active addresses

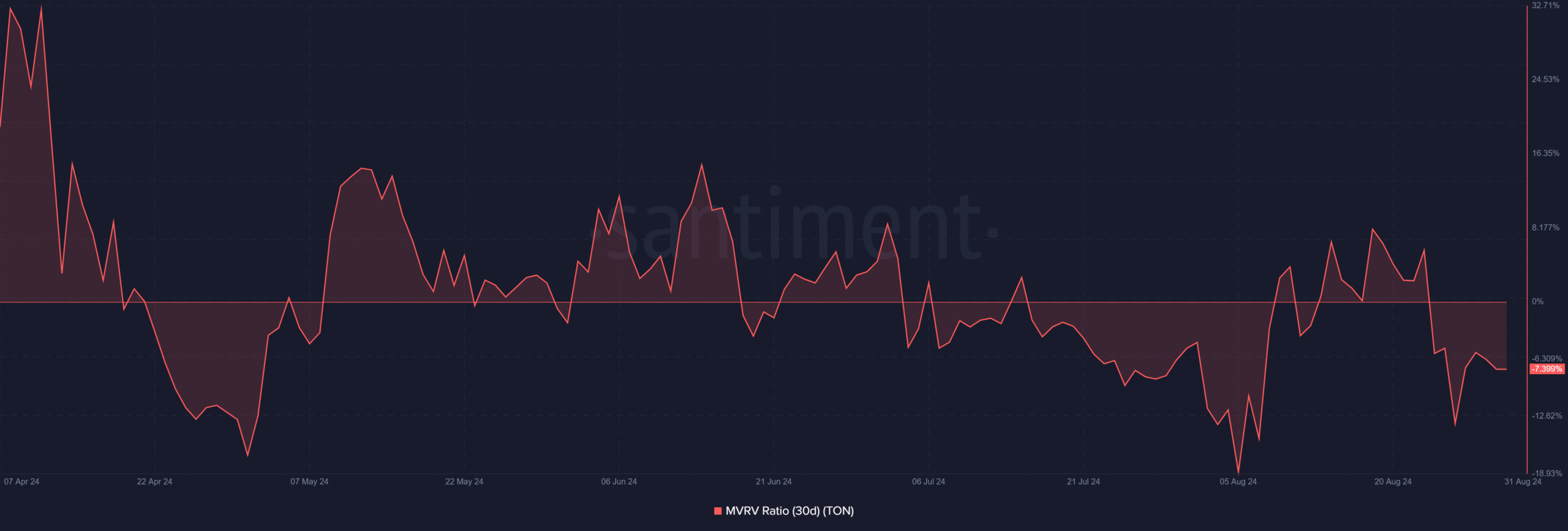

- TON’s MVRV, at press time, was well below zero, underlining losses for some holders

Toncoin (TON) has recently seen notable spikes in key metrics, largely influenced by developments surrounding Telegram’s founder. One significant metric that saw a spike was the number of active addresses on the Toncoin network.

At press time, data indicated that the number of active addresses has remained high. On the contrary, the overall trend for Toncoin (TON) has remained bearish.

A historical number of active addresses

According to data from CryptoRank, Toncoin (TON) saw a significant spike in active addresses on 26 August. This surge in activity was so significant that the number of active addresses surpassed the combined active addresses of Bitcoin and Ethereum on that day. The spike was primarily triggered by the arrest of Telegram’s founder, with the same causing panic and heightened market activity within Toncoin’s community.

Further analysis using data from IntoTheBlock confirmed this spike, highlighting that the number of active addresses on Toncoin’s network climbed to over 440,000 on 26 August. The heightened activity did not immediately subside though. Instead, it continued to climb.

And by 29 August, the number of active addresses had surpassed 600,000. This marked the highest level of active addresses in Toncoin’s history.

Also, according to CryptoRank, the seven-day active addresses on the network crossed 3 million. This number was more than Ethereum’s, with only Bitcoin surpassing it with 3.7 million.

TON’s price struggles continue

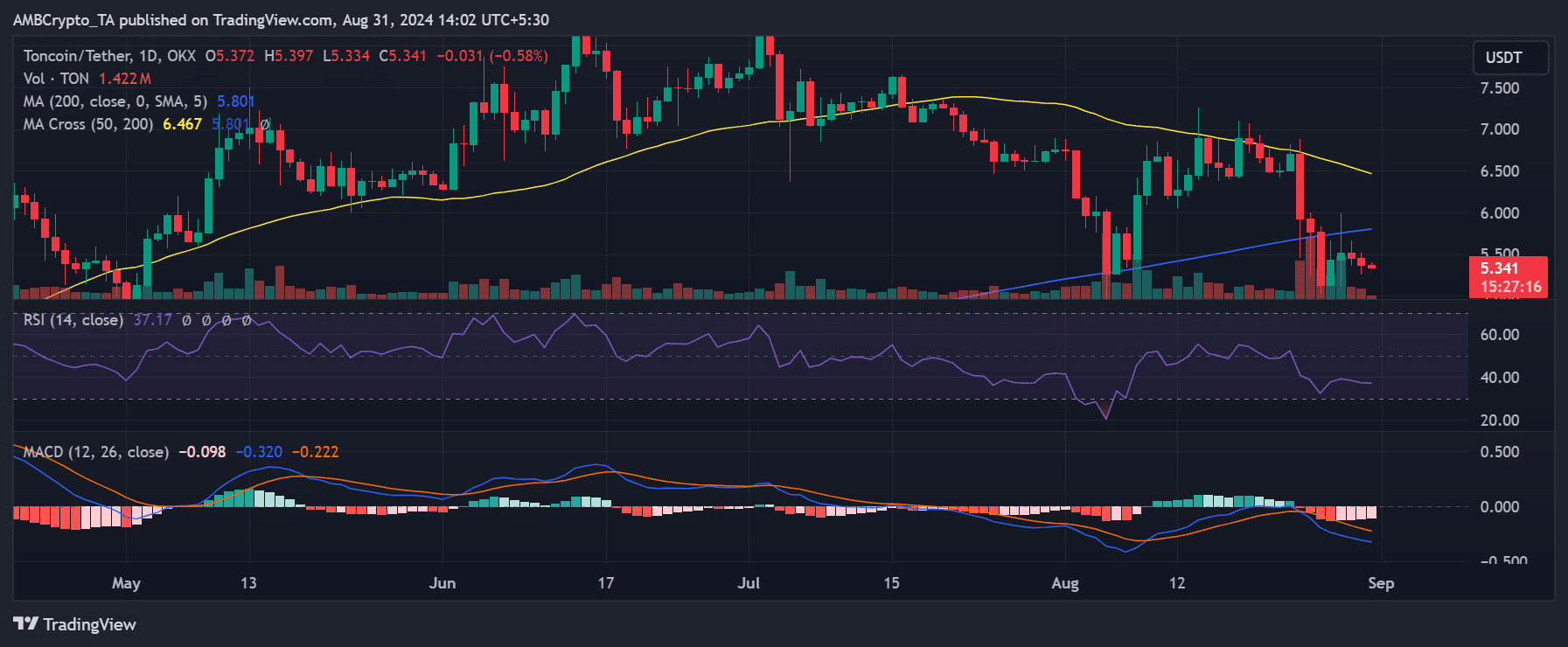

A recent analysis of Toncoin’s (TON) price trend indicated that the cryptocurrency has struggled to recover from the decline it saw. In fact, despite some brief uptrends on 27 and 28 August, TON has been unable to sustain this momentum. This has led to consecutive declines in subsequent trading sessions.

AMBCrypto’s analysis revealed that Toncoin ended its last trading session with a decline of over 1%, with this downtrend persisting at press time too.

Source: TradingView

The Relative Strength Index (RSI) for Toncoin was around 40 – A sign of the asset being in a bearish phase.

Here, it’s worth noting that the prevailing price level might present a buying opportunity for some traders. Especially since Toncoin had previously established strong support around the $6-mark.

Toncoin holders go underwater

An analysis of Toncoin’s 30-day Market Value to Realized Value (MVRV) ratio can be used to highlight the current state of holders. At press time, the MVRV ratio for Toncoin was around -7.3%, indicating that holders were underwater.

This suggested that they have been holding at a loss, relative to their purchase prices.

Earlier in the month, Toncoin’s MVRV climbed into positive territory, allowing holders to realize profits after a prolonged period below zero. However, the ratio has since fallen below zero – A sign that the asset may be undervalued.

Source: Santiment

– Realistic or not, here’s TON market cap in BTC’s terms

An MVRV ratio below zero generally means that the asset is undervalued, as the market value is less than the realized value. This indicates that many holders are at a loss.

This situation often presents a buying opportunity, as it points to the potential for a price rebound.

Source: https://ambcrypto.com/will-toncoins-latest-record-make-any-difference-to-its-price-trend/