ADA price is at a crossroads. With the Chang hard fork up ahead and a thin slice of support holding the price up, it is difficult to predict what will happen next. While on-chain metrics hint the market sentiment may be more bullish than bearish, analysis of traders’ behaviors shows they are bearish on the asset. Will ADA price survive the mixed sentiment in the market?

Onchain Metrics Reveal ADA Price Potential Rally

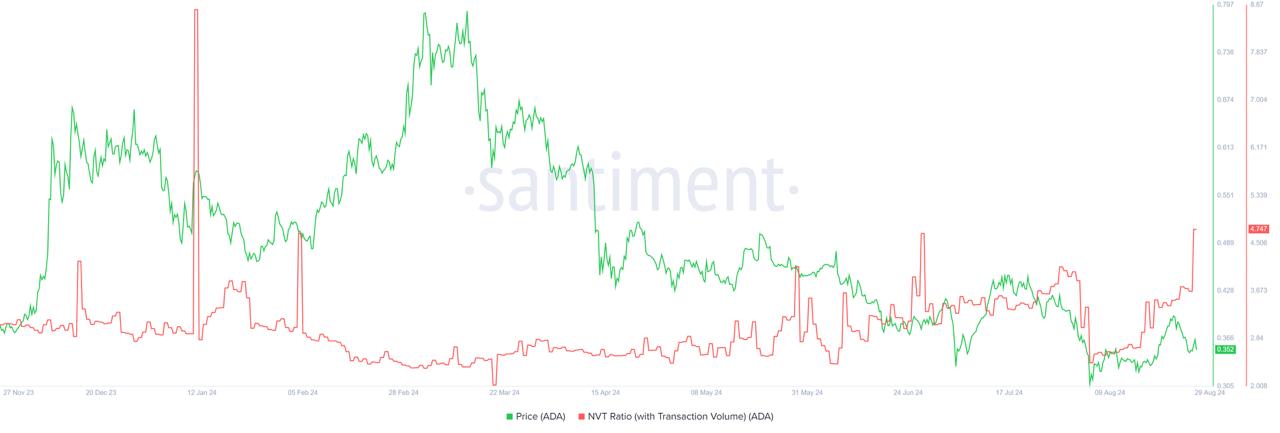

Data from Santiment shows that the Cardano Network Value to Transactions (NVT) ratio hit a 7-month high, but the price has dropped for the last five days. When the NVT ratio spikes while the price decreases, it generally indicates a bearish signal for the crypto asset.

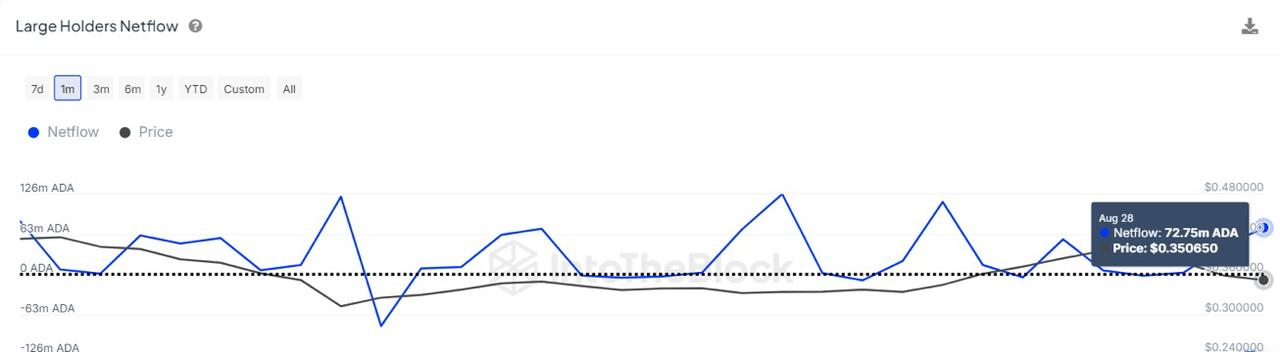

The buying activity from large holders can signal their confidence in the asset’s long-term potential, even if the short-term price action is negative. Coupled with the spike in the NVT ratio, this positive investor sentiment may signal they are pricing Cardano at a premium, possibly due to speculative interest or future growth expectations.

ADA Technical Analysis: Temporary Support or Launch Pad?

The Cardano price tried to stay above the 50-day exponential moving average, but the selling pressure was too high. The price dropped below the 50 EMA (indicated by the green line), suggesting that a bearish momentum is dominant.

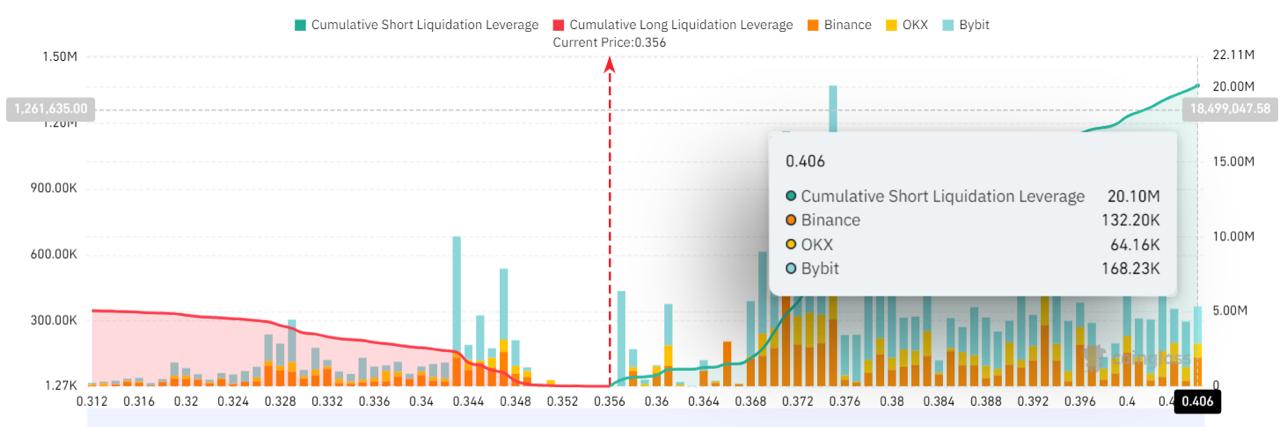

ADA price found support around $0.3550, where most of the whales seem to be building a buy wall. The candlestick analysis at this level shows small-bodied candles with wicks on both sides, indicating indecision in the market.

However, data from the Coinglass 7-day Liquidation Map shows a huge sell wall between $0.372 and $0.4. This means it will take a great effort to push the price beyond this price to the upside.

Will Cardano Price Crash 10%?

ADA price remains overall bearish unless the price breaks above the previous high at $0.4. Positive investor sentiment can sustain the price up, but eventually, the profit-driven Futures traders have more power as they don’t have an actual stake in the asset – only leverage. The successful launch of Chang hard fork will go a long way in helping Cardano price decide the next course of direction.

Frequently Asked Questions (FAQs)

The NVT ratio for Cardano has recently reached a 7-month high, suggesting that the network may be overvalued.

Data from IntoTheBlock shows that large holders have increased their netflow from August 25 to August 28, even as the price of ADA dropped.

Yes, there is a risk. If the price fails to break above $0.4 and the Chang hard fork launch is problematic, ADA could face a 10% price drop.

Related Articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/ada-price-faces-crossroads-will-the-7-month-high-nvt-ratio-lead-to-a-crash/

✓ Share: