- The SUI circulating supply is set to increase by over 2%.

- The funding rate remains positive despite the upcoming unlock event.

This week, SUI is set to release 64.19 million tokens, valued at over $100 million, as part of a scheduled token unlock. This influx represents 2.32% of SUI’s circulating supply, sparking speculation on how this event may impact the token’s price.

With a current market cap of approximately $4.6 billion and a circulating supply of 2.76 billion tokens, it stands at a critical juncture as it prepares to navigate the effects of this release.

Unlock could increase selling pressure on SUI

As the 64.19 million SUI tokens become liquid, there is potential for increased selling pressure. This is common during token unlocks when early investors and team members gain access to previously locked assets.

Given that this unlock represents over 2% of the circulating supply, a substantial number of these tokens entering the open market could exert downward pressure on SUI’s price if holders decide to sell.

SUI was trading around $1.69 at press time, showing signs of weakness from recent highs. The Relative Strength Index (RSI) reflects this, standing at 41.96 and indicating a leaning towards bearish sentiment.

This sentiment could deepen if selling activity ramps up, pushing SUI’s price to test support levels.

Key SUI support levels to monitor

In the event of a selloff due to the unlock, SUI’s price may test critical support levels. The 50-day moving average at $1.69 serves as the immediate support level.

If breached, it could lead to further declines toward the $1.50 mark, where buyer interest might strengthen.

Source: TradingView

Historical patterns from previous unlocks indicate that such events can heighten market volatility as traders react to the sudden increase in supply.

If it fails to maintain its current price levels, it may experience a short-term struggle for recovery. Conversely, if it can remain above the 50-day moving average, this could encourage buyers to reenter the market.

Long-term holders may find opportunity despite short-term volatility

Although the token unlock presents immediate risks, long-term holders may view this as a temporary disruption rather than a long-term setback.

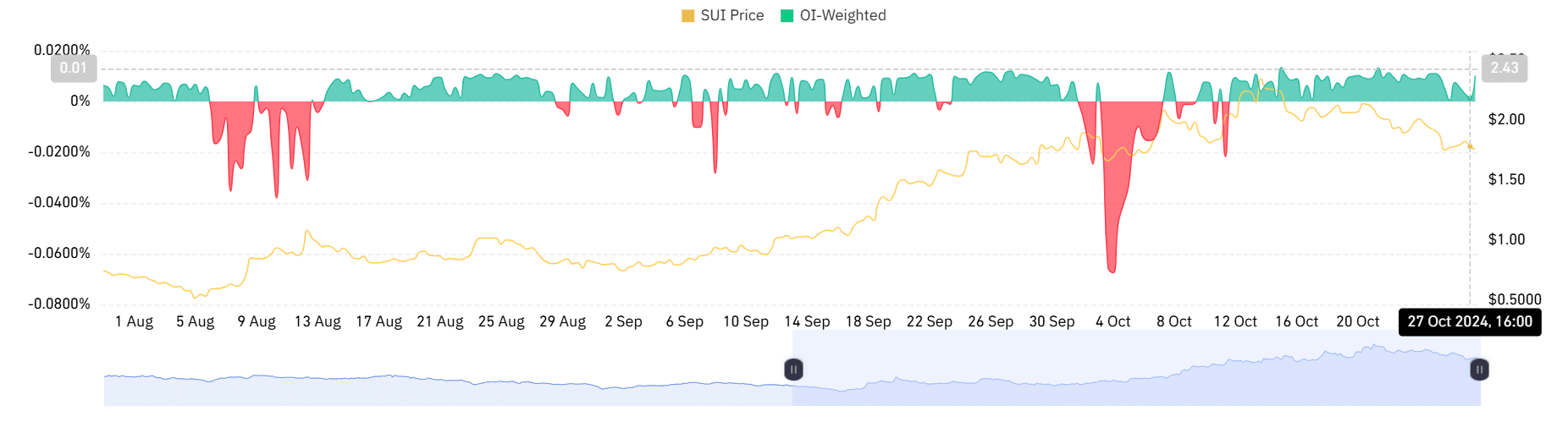

According to data from Coinglass, the funding rate has remained positive. This means there are more buyers than sellers in the market, meaning more long positions.

Source: Coinglass

Is your portfolio green? Check out the SUI Profit Calculator

Ultimately, the impact of this token unlock will largely depend on how holders react. A quick market recovery following the unlock could signal that SUI has efficiently absorbed the increased supply, stabilizing its market position.

However, if significant selling ensues, SUI’s price may face short-term challenges, testing the resilience of both the asset and its investor base.

Source: https://ambcrypto.com/will-sui-hold-steady-over-64m-new-tokens-to-hit-the-market/